BP 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP ANNUAL REPORT AND ACCOUNTS 2007 53

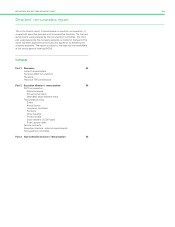

Environmental expenditure

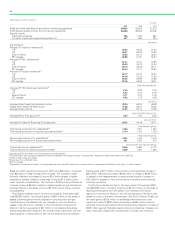

$million

------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------

Operating expenditure 662 596 494

Clean-ups 62 59 43

Capital expenditure 1,033 806 789

Additions to environmental

remediation provision 373 423 565

Additions to decommissioning

provision 1,163 2,142 1,023

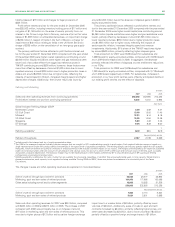

Operating and capital expenditure on the prevention, control, abatement

or elimination of air, water and solid waste pollution is often not incurred

as a separately identifiable transaction. Instead, it forms part of a larger

transaction that includes, for example, normal maintenance expenditure.

The figures for environmental operating and capital expenditure in the

table are therefore estimates, based on the definitions and guidelines of

the American Petroleum Institute.

The increase in environmental operating expenditure in 2007

compared with 2006 is primarily due to increased integrity management

activity and activity associated with the implementation of the Baker

Panel recommendations. The increase in environmental operating

expenditure in 2006 compared with 2005 is largely related to expenditure

incurred on reducing air emissions at US refineries. Similar levels of

operating and capital expenditures are expected in the foreseeable

future. In addition to operating and capital expenditures, we also create

provisions for future environmental remediation. Expenditure against

such provisions is normally in subsequent periods and is not included in

environmental operating expenditure reported for such periods. The

charge for environmental remediation provisions in 2007 includes

$339 million resulting from a reassessment of existing site obligations

and $34 million in respect of provisions for new sites.

Provisions for environmental remediation are made when a clean-up is

probable and the amount reasonably determinable. Generally, their timing

coincides with commitment to a formal plan of action or, if earlier, on

divestment or on closure of inactive sites.

The extent and cost of future remediation programmes are inherently

difficult to estimate. They depend on the scale of any possible

contamination, the timing and extent of corrective actions and also the

group’s share of liability. Although the cost of any future remediation

could be significant and may be material to the result of operations in the

period in which it is recognized, we do not expect that such costs will

have a material effect on the group’s financial position or liquidity. We

believe our provisions are sufficient for known requirements; we do not

believe that our costs will differ significantly from those of other

companies engaged in similar industries, or that our competitive position

will be adversely affected as a result.

In addition, we make provisions on installation of our oil- and gas-

producing assets and related pipelines to meet the cost of eventual

decommissioning. On installation of an oil or natural gas production

facility a provision is established that represents the discounted value of

the expected future cost of decommissioning the asset. Additionally, we

undertake periodic reviews of existing provisions. These reviews take

account of revised cost assumptions, changes in decommissioning

requirements and any technological developments. The level of increase

in the decommissioning provision varies with the number of new fields

coming onstream in a particular year and the outcome of the periodic

reviews.

Provisions for environmental remediation and decommissioning are

usually set up on a discounted basis, as required by IAS 37 ‘Provisions,

Contingent Liabilities and Contingent Assets’.

Further details of decommissioning and environmental provisions

appear in Financial statements – Note 37 on page 151. See also

Environment on page 41.

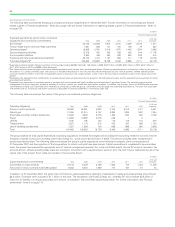

Suppliers and contractors

Our processes are designed to enable us to choose suppliers carefully

on merit, avoiding conflicts of interest and inappropriate gifts and

entertainment. We expect suppliers to comply with legal requirements

and we seek to do business with suppliers who act in line with BP’s

commitments to compliance and ethics, as outlined in the code of

conduct. We engage with suppliers in a variety of ways, including

performance review meetings to identify mutually advantageous

ways to improve performance.

Creditor payment policy and practice

Statutory regulations issued under the UK Companies Act 1985 require

companies to make a statement of their policy and practice in respect of

the payment of trade creditors. In view of the international nature of the

group’s operations there is no specific group-wide policy in respect of

payments to suppliers. Relationships with suppliers are, however,

governed by the group’s policy commitment to long-term relationships

founded on trust and mutual advantage. Within this overall policy,

individual operating companies are responsible for agreeing terms and

conditions for their business transactions and ensuring that suppliers are

awareofthetermsofpayment.

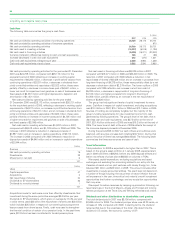

Contributing to communities

We make direct contributions to communities through community

programmes. Our total contribution in 2007 was $135.8 million. This

includes $0.7 million contributed by BP to UK charities. The growing

focus of this is on education, the development of local enterprise and

providing access to energy in remote locations.

In 2007, we spent $77.7 million promoting education, with investment

in three broad areas: energy and the environment; business leadership

skills; and basic education in developing countries where we operate

large projects.