BP 2007 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP ANNUAL REPORT AND ACCOUNTS 2007 143

34 Derivative financial instruments

An outline of the group’s financial risks and the objectives and policies pursued in relation to those risks is set out in Note 28.

IAS 39 prescribes strict criteria for hedge accounting, whether as a cash flow or fair value hedge or a hedge of a net investment in a foreign

operation, and requires that any derivative that does not meet these criteria should be classified as held for trading and fair valued, with gains and

losses recognized in profit or loss.

In the normal course of business the group enters into derivative financial instruments (derivatives) to manage its normal business exposures in

relation to commodity prices, foreign currency exchange rates and interest rates, including management of the balance between floating rate and fixed

rate debt, consistent with risk management policies and objectives. Additionally, the group has a well-established entrepreneurial trading operation that

is undertaken in conjunction with these activities using a similar range of contracts.

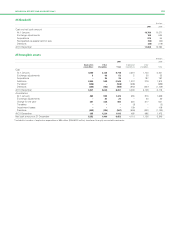

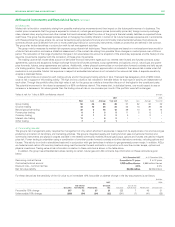

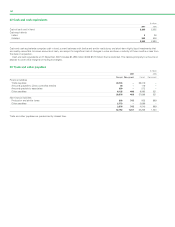

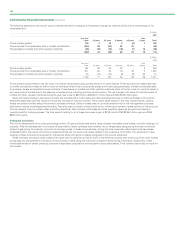

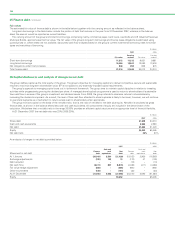

The fair values of derivative financial instruments at 31 December are set out below.

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Fair Fair Fair Fair

value value value value

asset liability asset liability

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Derivatives held for trading

Currency derivatives 147 (317) 137 (32)

Oil price derivatives 3,214 (3,432) 2,664 (2,368)

Natural gas price derivatives 4,388 (4,022) 6,558 (5,703)

Power price derivatives 1,121 (1,140) 3,232 (3,190)

Other derivatives 30 – 113 –

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

8,900 (8,911) 12,704 (11,293)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Embedded derivatives

Natural gas and LNG contracts 255 (2,340) 107 (2,171)

Interest rate contracts – (33) –(26

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

255 (2,373) 107 (2,197)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Cash flow hedges 348 (97) 219 (33)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Fair value hedges

Currency forwards, futures and swaps 430 (9) 228 (13)

Interest rate swaps 89 (17) 33 (91)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

519 (26) 261 (104)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Hedges of net investments in foreign operations 40 – 107 –

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

10,062 (11,407) 13,398 (13,627)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Of which – current 6,321 (6,405) 10,373 (9,424)

–non-current 3,741 (5,002) 3,025 (4,203)

)