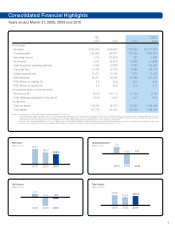

Alpine 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Alpine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

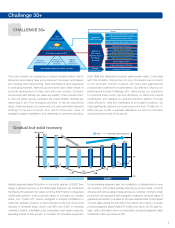

CHALLENGE 30+

Gradual but solid recovery

5

Challenge 30+

The auto industry is undergoing a radical transformation. North

American automakers have gone bankrupt. European automakers

are merging and restructuring. New automakers have appeared

in emerging markets. National governments have taken steps to

promote replacement of older cars with new models. Compact

and environment-friendly car sales are healthy. China became No.1

in new car sales, having overtaken the United States; markets are

expanding in all of the emerging countries. In the car electronics

sector, there are signs of a turnaround, but with automotive demand

shifting to low-end compact cars, which have lower rates of

navigation system installation, and weakness in personal spending,

both OEM and aftermarket product sales remain weak. Confronted

with this situation, Alpine has not only introduced new products

in our domestic market in Japan. We have also aggressively

pursued new business from automakers. Our efforts to improve our

performance include Challenge 30+, restructuring our operations

to minimize fixed costs, improve efficiency on R&D and capital

investments, and reshape our global production system. Through

these efforts to meet the challenges of prolonged recession, we

have signifi cantly reduced our break-even point from 14 billion to 13

billion yen per month, a success refl ected in our return to the black

during the second half of this period.

Alpine’s quarterly sales hit bottom in the fourth quarter of 2008, then

began a gradual recovery. In the aftermarket segment, we introduced

the Bluetooth-enabled CD player and the X08 Premium integrated

multimedia system, both proactive steps to increase our market

share. Our “Perfect Fit” series, designed to simplify installation in

customer vehicles, became a new business model and drove solid

recovery in domestic sales, which rose 88% over 2008. In overseas

markets, however, intensifi ed price competition and weak consumer

spending limited further growth. In contrast, the standard equipment

for automakers segment saw the completion of adjustments in new

car inventory, with orders partially returning to proper levels. In North

America and China, sales of large and luxury vehicles, of which a high

proportion are equipped with navigation systems, showed signs of

gradual improvement, but sales for the year declined due to the impact

of lower sales during the fi rst half of the period. As a result, our audio

products segment sales totaled 70.4 billion yen (down 20.3% year-on-

year), while information and communication products segment sales

totaled 98.1 billion yen (down 9.4%).

0

200

-100

100

400

600

(100 million yen)

2008FY 2009FY

632

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q

Sales Operating income (right axis)

607

405

322 360 404 440 481

34

24

7

△39 △72 △48

△8

3

360

2010

Profit Growth

Growth Strategies

¥13 billion monthly B.E.P.

Improve

development

efficiency

Reduce

product costs

Improve

indirect

productivity

Aggressive

Growth Strategy

Defensive

30% Lower

Monthly B.E.P.

¥13 Billion

Structure

New Customer Business Model

Products Matched to Market Changes

Issues

Stronger Order-generating Capability (CTB, GTB)

Lower Product Costs

Improved Development Efficiency

Rethink global staffing

Lower salaries and bonuses

50% lower facilities investments

40% lower running costs

Improved Indirect Productivity

Integrated Organization

Heightened awareness, faster, slimmer

Stronger

Corporate Culture