Allegheny Power 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Allegheny Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015

ANNUAL REPORT

Table of contents

-

Page 1

A N N U A L 2015 R E P O R T -

Page 2

... across our company • Socurod a 20-yoar liconso oxtonsion from tho Nucloar Rogulatory Commission for tho Davis-Bosso Nucloar Powor Station • Enhancod transmission and distribution systom roliability F I N A N C I A L S AT A G L A N C E (dollars in millions, oxcopt por sharo amounts) 2015 TOTAL... -

Page 3

...-looking rato filing for our Amorican Transmission Systoms, Inc. (ATSI) transmission company, which will allow moro offoctivo and timoly rocovory of its systom invostmonts. Six of our rogulatod utilitios rocoivod approval of sottlomonts in distribution rato casos in 2015, and our rato caso in Now... -

Page 4

...,000 customors in tho northorn portion of Wost Virginia. Givon that our rogulatod footprint is alignod with somo of tho nation's richost shalo fiolds, wo'ro making invostmonts through 2020 to support growth in midstroam shalo gas oporations throughout our sorvico aroa, including plannod oxpansions... -

Page 5

...thoso costs. In fact, as part of our proposod ESP, wo filod a plan to ovaluato smart motor and smart grid tochnologios across our Ohio sorvico aroa, subjoct to PUCO considoration and approval. NEARLY 32 MILLION MEGAWATT-HOURS OF CARBON-FREE ELECTRICITY GENERATED BY OUR THREE NUCLEAR POWER STATIONS... -

Page 6

... offoctivoly financo and build transmission facilitios within our Mot-Ed, Ponoloc and JCP&L sorvico aroas whilo providing strongor support to our Enorgizing tho Futuro initiativo as it oxpands oastward. Although tho Now Jorsoy Board of Public Utilitios (BPU) rojoctod ono of tho plan's provisions, it... -

Page 7

LOWERING RISK IN OUR MEETING OUR ENVIRONMENTAL COMPETITIVE BUSINESS Wo continuo to oxocuto a consorvativo salos and gonoration stratogy that offors loss risk to tho company. To achiovo this goal, our FirstEnorgy Solutions subsidiary continuod to rostructuro its salos portfolio to roduco our ... -

Page 8

...transition to a cloanor onorgy futuro. $ 4.2 BILLION IN PLANNED TRANSMISSION INVESTMENTS FROM 2014 THROUGH 2017 SETTING A COURSE FOR THE ... pursuing tho right stratogy for your company. By achioving solid porformanco across our throo businoss soctors - distribution, transmission and gonoration... -

Page 9

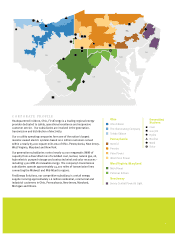

..., Maryland, Michigan and Illinois. Ohio Ohio Edison Tho Illuminating Company Tolodo Edison Generating Stations Coal Gas/Oil Hydro Nucloar Wind Solar Pennsylvania Mot-Ed Ponoloc Ponn Powor Wost Ponn Powor West Virginia/Maryland Mon Powor Potomac Edison New Jersey Jorsoy Contral Powor & Light 7 -

Page 10

... thoir offorts to achiovo customor-focusod growth in tho company's rogulatod utility oporations, manago risk in its compotitivo businoss, and roduco oxponsos. Your Board providod an annual dividond rato of $1.44 por sharo in 2015. As FirstEnorgy addrossos futuro opportunitios and challongos, wo will... -

Page 11

... 1 ...Selected Financial Data 3...Management's Discussion and Analgsis 61 ...Management Reports 62...Report of Independent Registered Public Accounting Firm 63...Consolidated Statements of Income 64...Consolidated Statements of Comprehensive Income 65...Consolidated Balance Sheets 66...Consolidated... -

Page 12

... energy-Ârelated products and services in April 2012, which owns and operates transmission facilities FirstEnergy Corp., a public utility holding company Buchanan Generation, LLC, a joint venture between AE Supply and CNX Gas Corporation FirstEnergy Nuclear Operating... -

Page 13

... Charge Default Service Plan Electric Distribution Company Executive Deferred Compensation Plan Energy Efficiency and Conservation Electric Generation Supplier Environmental Law & Policy Center Eastern Mid-ÂAtlantic Area Council of PJM EmPOWER Maryland Energy... -

Page 14

... Utilities Non-ÂMarket Based Net Operating Loss Notice of Violation Nitrogen Oxide National Pollutant Discharge Elimination System Normal Purchases and Normal Sales Nuclear Regulatory Commission NRG Energy, Inc. New Source Review Non-ÂUtility Generation... -

Page 15

... Transmission Tariff Particulate Matter Provider of Last Resort Purchase of Receivables Purchase Power Agreement Parts per Billion Pennsylvania Public Utility Commission Power Supply Agreement Prevention of Significant Deterioration Price-Âto-ÂCompare Public... -

Page 16

... the District of Columbia Circuit Utility Workers Union of America Variable Interest Entity Variable Resource Requirement Virginia State Corporation Commission West Virginia Department of Environmental Protection Public Service Commission of West Virginia v -

Page 17

...from current assets to non-Âcurrent liabilities. PRICE RANGE OF COMMON STOCK The common stock of FirstEnergy Corp. is listed on the New York Stock Exchange under the symbol "FE" and is traded on other registered exchanges. 2015 High First Quarter Second... -

Page 18

...-ÂOwned Electric Utility Companies and the S&P 500. HOLDERS OF COMMON STOCK There were 90,633 and 90,346 holders of 423,560,397 and 423,650,645 shares of FirstEnergy's common stock as of December 31, 2015 and January 31, 2016, respectively. Information... -

Page 19

...regulated utilities to recover their costs. Costs being higher than anticipated and the success of our policies to control costs and to mitigate low energy, capacity and market prices. Other legislative and regulatory changes, and revised environmental requirements... -

Page 20

... us, our subsidiaries and/or our major industrial and commercial customers, and other counterparties with which we do business, including fuel suppliers. The impact of any changes in tax laws or regulations or adverse tax audit results or rulings... -

Page 21

..., West Virginia, Maryland, New Jersey and New York, and purchases power for its POLR, SOS, SSO and default service requirements in Ohio, Pennsylvania, New Jersey and Maryland. This segment also includes regulated electric generation facilities located primarily... -

Page 22

... in operating improvements and environmental compliance at MP's and PE's regulated coal-Âfired power plants in West Virginia. MP and PE also received orders in December 2015 in their ENEC case and their biennial vegetation management program surcharge... -

Page 23

... of electricity annually, with up to an additional 5 million MWHs available from purchased power agreements for wind, solar and its entitlement from OVEC. In 2015, CES sold approximately 75 million MWHs of which 68 million MWHs were through contract sales... -

Page 24

... to closely monitor sales trends across its utility footprint. Within its Regulated Distribution segment, FirstEnergy continues to be impacted by lower customer usage as a result of energy efficiency mandates and products. During 2015, electric distribution... -

Page 25

... a power price recovery may occur, FirstEnergy believes it has taken appropriate action over the last several years to reposition this business for such a recovery. CES uses a conservative hedging strategy, and expects to sell its annual generation resources... -

Page 26

...auction prices. • The increase in revenue at Regulated Distribution resulted from the implementation of new rates at certain operating companies as well as a year-Âover-Âyear increase in retail generation revenue, resulting from a lower number... -

Page 27

...MP acquired 1,476 MWs of generation from AE Supply. • The increase at Regulated Transmission primarily reflected a higher rate base and recovery of incremental operating expenses. • The decrease at CES resulted from lower contract sales as in 2014, CES... -

Page 28

... as follows: Increase (Decrease) 2015 Net Income (Loss) By Business Segment: Regulated Distribution Regulated Transmission Competitive Energy Services Corporate/Other Net Income Basic Earnings Per Share: Continuing operations Discontinued operations (Note... -

Page 29

Summary of Results of Operations - 2015 Compared with 2014 Financial results for FirstEnergy's business segments in 2015 and 2014 were as follows: Regulated Distribution Regulated Transmission Competitive Energy Services (In millions) Revenues: ... -

Page 30

...Income Taxes (Benefits) Income taxes (benefits) Income (Loss) From Continuing Operations Discontinued Operations, net of tax Net Income (Loss) $ $ Regulated Distribution Regulated Transmission Competitive Energy Services (In millions) Corporate/Other... -

Page 31

...Before Income Taxes (Benefits) Income taxes (benefits) Income (Loss) From Continuing Operations Discontinued Operations, net of tax Net Income (Loss) Regulated Distribution Regulated Transmission Competitive Energy Services (In millions) Corporate/Other... -

Page 32

...NUG costs and certain energy efficiency programs for the Pennsylvania Companies, which was impacted by a rate increase in 2015. Partially offsetting these items were the impacts of lower residential and industrial customer usage as described below. Distribution... -

Page 33

...low spot market energy prices Purchased power costs were $163 million higher in 2015 primarily due to increased volumes reflecting lower customer shopping as described above, higher unit costs related to higher default service auction results, and... -

Page 34

...earnings Increased regulated generation operating and maintenance expenses of $7 million, reflecting higher planned outage expenses in 2015 compared to 2014 Higher retirement benefit costs of $22 million, reflecting higher net benefit costs before the pension and... -

Page 35

... events and unplanned outages in 2014 that resulted in higher purchased power and transmission costs, partially offset by lower contract sales volumes. Additionally, changes in year-Âover-Âyear operating results were impacted by lower Pension and OPEB mark... -

Page 36

... the price and volume factors contributing to changes in revenues: Source of Change in Revenues Increase (Decrease) Sales Volumes $ (1,095 ) (249 ) (193 ) (216 ) 3 197 $ Gain on Settled Contracts (In millions) Direct Governmental... -

Page 37

... sales obligations Nuclear operating costs increased $84 million as a result of higher planned outage costs and higher employee benefit expenses. There were three planned refueling outages in 2015 as compared to two planned outages in 2014. Transmission... -

Page 38

... in Global Holding, higher costs associated with environmental remediation at legacy plants, higher interest expense and a higher effective tax rate. During 2015, based on the significant decline in coal pricing and the current outlook for... -

Page 39

... results for FirstEnergy's business segments in 2014 and 2013 were as follows: Competitive Energy Services (In millions) Revenues: External Electric Other Internal Total Revenues Operating Expenses: Fuel Purchased power Other operating expenses Pension... -

Page 40

...Before Income Taxes (Benefits) Income taxes (benefits) Income From Continuing Operations Discontinued Operations, net of tax Net Income (Loss) $ $ Regulated Distribution Regulated Transmission Competitive Energy Services (In millions) Corporate/Other... -

Page 41

... Financial Results Changes Between 2014 and 2013 Financial Results Regulated Regulated Regulated Regulated Increase (Decrease) Increase (Decrease) Distribution Distribution Transmission Transmission Revenues: Revenues: External External Electric Electric... -

Page 42

... other customer program costs for the Pennsylvania Companies. This was partially offset by higher electric distribution MWH deliveries of 1.1% as described below, rate increases for the Ohio Companies associated with energy efficiency performance shared savings... -

Page 43

... related to increased generation as a result of the October 2013 Harrison/Pleasants asset transfer Purchased power costs were $77 million higher in 2014 primarily due to increased unit prices and capacity expense reflecting higher auction... -

Page 44

...million Lower default generation service and NUG costs recovery in Pennsylvania ($48 million Increased deferral of West Virginia vegetation management expenses ($33 million) and customer refunds associated with the gain on the Pleasants plant resulting... -

Page 45

... to lower retail-Ârelated costs, lower generation costs resulting from plant deactivations and asset transfers, and higher capacity revenues from higher auction prices. Additionally, operating results were impacted by a $78 million after-Âtax gain on the sale... -

Page 46

...prices as a result of increased channel pricing and higher capacity revenues, as described below. The decrease in total revenues resulted from the following sources: For the Years Ended December 31, Revenues by Type of Service Contract Sales: Direct... -

Page 47

...available generation due to outages, the October 2013 Harrison/Pleasants asset transfer and the deactivation of certain power plants in 2013, partially offset by lower contract sales as described above. The increase in unit prices was primarily a result... -

Page 48

... resulted in a lower tax benefit on pre-Âtax losses, primarily resulted from changes in state apportionment factors and higher valuation allowances on certain NOL carryforwards. Discontinued Operations - Discontinued operations increased... -

Page 49

... damage costs began earning a return on April 1, 2015. Effective with the approved settlement on April 9, 2015, associated with their general base rate case, the Pennsylvania Companies transferred the net book value of legacy meters from plant-Âin-Âservice... -

Page 50

... position. Specifically, at the regulated businesses, authority has been obtained for various regulated distribution and transmission subsidiaries to issue and/or refinance debt. As part of an ongoing effort to manage costs, FirstEnergy identified both immediate... -

Page 51

... to borrow or accelerate payment of outstanding advances in the event of any change in credit ratings of the borrowers. Pricing is defined in "pricing grids," whereby the cost of funds borrowed under the Facilities is related to the credit ratings of the... -

Page 52

...prior to maturity with the purchase price payable from remarketing proceeds or, if the PCRBs are not successfully remarketed, by drawings on the irrevocable direct pay LOCs. The subsidiary obligor is required to reimburse the applicable LOC bank for any such... -

Page 53

... and the sale of energy and related products and services by its unregulated competitive subsidiaries. The most significant use of cash from operating activities is to buy electricity in the wholesale market and pay fuel suppliers, interest, employees, tax... -

Page 54

...31, Cash Used for Investing Activities Property Additions: Regulated distribution Regulated transmission Competitive energy services Other and reconciling adjustments Nuclear fuel Proceeds from asset sales Investments Asset removal costs Other $ $ 1,108... -

Page 55

... cash payments for income taxes are determined based primarily on taxable income for each applicable fiscal year. NUCLEAR INSURANCE The Price-ÂAnderson Act limits the public liability which can be assessed with respect to a nuclear power plant... -

Page 56

... costs. The NRC requires nuclear power plant licensees to obtain minimum property insurance coverage of $1.06 billion or the amount generally available from private sources, whichever is less. The proceeds of this insurance are required to be used first... -

Page 57

...Supply has posted no collateral. The Regulated Distribution segment has posted collateral of $1 million. These credit-Ârisk-Ârelated contingent features stipulate that if the subsidiary were to be downgraded or lose its investment grade credit rating (based... -

Page 58

...based information. The model provides estimates of future regional prices for electricity and an estimate of related price volatility. FirstEnergy uses these results to develop estimates of fair value for financial reporting purposes and for internal management... -

Page 59

... and industrial companies. Retail credit risk results when customers default on contractual obligations or fail to pay for service rendered. This risk represents the loss that may be incurred due to the nonpayment of customer accounts receivable balances, as... -

Page 60

..., Pennsylvania, Illinois, Michigan, New Jersey and Maryland, FES and AE Supply are subject to state laws applicable to competitive electric suppliers in those states, including affiliate codes of conduct that apply to FES, AE Supply and their public utility... -

Page 61

...fixed price service and is intended for smaller commercial and residential customers. All New Jersey EDCs participate in this competitive BGS procurement process and recover BGS costs directly from customers as a charge separate from base rates... -

Page 62

... the PUCO's termination of Rider RRS charges/credits associated with any plants or units that may be sold or transferred Continuing to provide power to non-Âshopping customers at a market-Âbased price set through an auction process Continuing Rider DCR with... -

Page 63

.... On December 18, 2015, FES filed an Application for Rehearing seeking to change the ruling or have it only apply to residential and small commercial customers. PENNSYLVANIA The Pennsylvania Companies currently operate under DSPs that expire... -

Page 64

... for: a $15 million increase in annual base rate revenues effective February 25, 2015;; the implementation of a Vegetation Management Surcharge to recover all costs related to both new and existing vegetation maintenance programs;; authority to establish... -

Page 65

...to allocate costs for new transmission facilities. While FirstEnergy and other parties advocate for a traditional "beneficiary pays" (or usage based) approach, others advocate for "socializing" the costs on a load-Âratio share basis, where each customer in the... -

Page 66

... the functional control of PJM, and PJM will provide transmission service using these facilities under the PJM Tariff. During the third quarter of 2015, FirstEnergy responded to FERC Staff's request for additional information regarding the application. FERC... -

Page 67

... on the authorized ROE of our FERC-Âregulated transmission utilities and the cost-Âof-Âservice wholesale power generation transactions of MP. MISO Capacity Portability On June 11, 2012, in response to certain arguments advanced by MISO, FERC requested... -

Page 68

...-Âsulfur fuel, utilizing combustion controls and post-Âcombustion controls, generating more electricity from lower or non-Âemitting plants and/or using emission allowances. CSAPR requires reductions of NOx and SO2 emissions in two phases (2015 and 2017... -

Page 69

... plants in Pennsylvania and the coal-Âfired Fort Martin and Willow Island plants in West Virginia. The EPA's NOV alleges equipment replacements during maintenance outages triggered the pre-Â construction permitting requirements under the NSR and PSD programs... -

Page 70

..., 2014 EPA Report. Due to plant deactivations and increased efficiencies, FirstEnergy anticipates its CO2 emissions will be reduced 25% below 2005 levels by 2015, exceeding the President's Climate Action Plan goals both in terms of timing and reduction... -

Page 71

... protection procedures and other operational and reporting procedures to assure the safe disposal of CCRs from electric generating plants. Based on an assessment of the finalized regulations, the future cost of compliance and expected timing of spend had no... -

Page 72

... revenues requires management to make estimates regarding electricity available for retail load, transmission and distribution line losses, demand by customer class, applicable billing demands, weather-Ârelated impacts, number of days unbilled and tariff rates in... -

Page 73

... scale SS2014INT was utilized to determine the 2015 benefit cost and obligation as of December 31, 2015 for the FirstEnergy pension and OPEB plans. The impact of using the RP2014 mortality table and projection scale SS2014INT resulted in an increase in the... -

Page 74

...when utilized, are being amortized over the recovery period of the related property. Deferred income tax liabilities related to temporary tax and accounting basis differences and tax credit carryforward items are recognized at the statutory income tax rates in... -

Page 75

...discounted cash flow analysis requiring significant management judgment included the following: • Future Energy and Capacity Prices: FirstEnergy used observable market information for near term forward power prices, PJM auction results for near term capacity... -

Page 76

... presenting debt issuance costs relating to its revolving credit facilities as an asset. In August 2015, the FASB issued ASU 2015 -Â13, "Application of the NPNS Scope Exception to Certain Electricity Contracts within Nodal Energy Markets", which... -

Page 77

... complaints received by the Company regarding accounting, internal accounting controls, or auditing matters and allows for the confidential, anonymous submission of concerns by employees. The Audit Committee held eight meetings in 2015. Management's Report on... -

Page 78

... schedule, and on the Company's internal control over financial reporting based on our integrated audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require... -

Page 79

...REVENUES: Electric utilities Unregulated businesses Total revenues* OPERATING EXPENSES: Fuel Purchased power Other operating expenses Pension and OPEB mark-Âto-Âmarket adjustment Provision for depreciation Amortization of regulatory assets, net General taxes... -

Page 80

...): Pension and OPEB prior service costs Amortized gains (losses) on derivative hedges Change in unrealized gain on available-Âfor-Âsale securities Other comprehensive loss Income tax benefits on other comprehensive loss Other comprehensive loss, net of tax... -

Page 81

...accounts of $5 in 2015 and 2014 Materials and supplies, at average cost Prepaid taxes Derivatives Collateral Other PROPERTY, PLANT AND EQUIPMENT: In service Less - Accumulated provision for depreciation Construction work in progress INVESTMENTS: Nuclear... -

Page 82

... income tax benefits (Note 3) Stock-Âbased compensation Cash dividends declared on common stock Stock issuance -Â employee benefits Balance, December 31, 2014 Net income Amortized gains on derivative hedges, net of $1 million of income taxes Change in... -

Page 83

... income taxes and investment tax credits, net Deferred costs on sale leaseback transaction, net Deferred purchased power and other costs Asset removal costs charged to income Retirement benefits Commodity derivative transactions, net (Note 10) Pension trust... -

Page 84

...Other Postemployment Benefits ... Stock-ÂBased Compensation Plans ... Taxes ... Leases ... Intangible Assets ... Variable Interest Entities ... Fair Value Measurements... Derivative Instruments ... Capitalization ... Short-ÂTerm Borrowings and Bank Lines of Credit... -

Page 85

... through the application of regulatory accounting to the Utilities, AGC, ATSI, PATH and TrAIL since their rates are established by a third-Âparty regulator with the authority to set rates that bind customers, are cost-Âbased and can be charged to and... -

Page 86

...providing electric service to customers in Ohio, Pennsylvania, West Virginia, New Jersey and Maryland. FES' principal business is supplying electric power to end-Âuse customers through retail and wholesale arrangements, including affiliated company power sales to... -

Page 87

.... TT he he cost cost of on f uclear nuclear fuel fuel included included in in CC ES' ES' net net plant plant as as of December 31, 2015 was $418 million. Net plant in service balances by segment as of December 31, 2015 and 2014 were... -

Page 88

...hydroelectric station in Bath County, Virginia, operated by the 60% owner, Virginia Electric and Power Company, a non-Âaffiliated utility. Net Property, plant and equipment includes $666 million representing AGC's share in this facility as of December 31, 2015... -

Page 89

...gas pricing. Retail Sales and Margin: FirstEnergy used CES' current retail targeted portfolio to estimate future retail sales volume as well as historical financial results to estimate retail margins. 73 Regulated Transmission Competitive Energy Services... -

Page 90

...Materials and supplies inventory includes fuel inventory and the distribution, transmission and generation plant materials, net of reserve for excess and obsolete inventory. Materials are generally charged to inventory at weighted average cost when purchased and... -

Page 91

...presenting debt issuance costs relating to its revolving credit facilities as an asset. In August 2015, the FASB issued ASU 2015 -Â13, "Application of the NPNS Scope Exception to Certain Electricity Contracts within Nodal Energy Markets", which confirmed... -

Page 92

...) Other comprehensive income (loss), net of tax AOCI Balance, December 31, 2015 38 3 3 1 2 (36 2 ) (2 ) (1 ) (1 ) (37 5 5 1 4 (33 ) $ Unrealized Gains on AFS Securities Defined Benefit Pension & OPEB Plans 408 $ 35 (195... -

Page 93

... Realized gains on sales of securities $ $ Defined benefit pension and OPEB plans Prior-Âservice costs $ $ (1) (2) Year Ended December 31, 2015 2014 (In millions) (10 ) $ 8 (2 ) 1 (1 ) $ 2013 Affected Line Item in Consolidated... -

Page 94

... Defined Benefit Pension & OPEB Plans Total (In millions) AOCI Balance, January 1, 2013 Other comprehensive income before reclassifications Amounts reclassified from AOCI Other comprehensive loss Income tax benefits on other comprehensive loss Other... -

Page 95

... Realized gains on sales of securities $ $ Defined benefit pension and OPEB plans Prior-Âservice costs $ $ (1) Year Ended December 31, (2) 2015 2014 (In millions) (10 10 ) 4 (6 ) $ 2013 Affected Line Item in Consolidated Statements... -

Page 96

... scale SS2014INT was utilized to determine the 2015 benefit cost and obligation as of December 31, 2015 for the FirstEnergy pension and OPEB plans. The impact of using the RP2014 mortality table and projection scale SS2014INT resulted in an increase in the... -

Page 97

...in AOCI: Prior service cost (credit) Assumptions Used to Determine Benefit Obligations (as of December 31) Discount rate Rate of compensation increase Assumed Health Care Cost Trend Rates (as of December 31) Health care cost trend rate assumed (pre/post... -

Page 98

... of Net Periodic Benefit Costs Service cost Interest cost Expected return on plan assets Amortization of prior service cost (credit) Pension & OPEB mark-Âto-Âmarket adjustment Net periodic cost (credit) $ $ 2015 193 $ 383 (443 ) 8 344... -

Page 99

...changes in the fair value of pension investments classified as Level 3 in the fair value hierarchy during 2015 and 2014: Private Equity Funds Balance as of January 1, 2014 Actual return on plan assets: Unrealized gains (losses) Realized gains Transfers... -

Page 100

...$ Excludes $(7) million as of December 31, 2015 of receivables, payables, taxes and accrued income associated with financial instruments reflected within the fair value table. December 31, 2014 Level 1 Cash and short-Âterm securities Equity investment... -

Page 101

... amounts reported for the health care plans. A one-Â percentage-Âpoint change in assumed health care cost trend rates would have the following effects: 1-ÂPercentage-Â Point Increase Effect on total of service and interest cost Effect on accumulated benefit... -

Page 102

... FES' share of the net periodic benefit cost (credit), including the pension and OPEB mark-Âto-Âmarket adjustment, for the three years ended December 31, 2015 was as follows: Pension 2015 Net Periodic Cost (Credit) 4. STOCK-ÂBASED COMPENSATION PLANS... -

Page 103

..., the fair value of restricted stock units vested was $22 million, $28 million, and $37 million, respectively. As of December 31, 2015, there was $32 million of total unrecognized compensation cost related to non-Âvested share-Âbased compensation arrangements... -

Page 104

...with the same performance conditions. The final account value may be adjusted based on the ranking of FE stock performance to a composite of peer companies. No performance shares were granted in 2015. In 2014, $3 million cash was paid to settle performance... -

Page 105

... the EDCP to eliminate the right to receive deferred shares after three years, effective for deferrals made on or after November 1, 2015. Awards deferred into a retirement stock account will pay out in cash upon separation from service, death or disability... -

Page 106

... Total provision for income taxes (benefits) FES Currently payable (receivable)-Â Federal State Deferred, net-Â Federal State Investment tax credit amortization Total provision for income taxes (benefits) (1) (1) 2015 2014 (In millions) 2013... -

Page 107

... tax rate was 35.3% compared to (24.6)% in 2014. The increase in the effective tax rate year-Âover-Âyear resulted from lower tax benefits in 2015 as compared to 2014, primarily related to IRS approved changes in accounting methods, reduced tax benefits... -

Page 108

... be utilized based on current estimates and assumptions. The ultimate utilization of these NOLs may be impacted by statutory limitations on the use of NOLs imposed by state and local tax jurisdictions, changes in statutory tax rates, and changes in business... -

Page 109

... tax rate. The following table summarizes the changes in unrecognized tax positions for the years ended 2015, 2014 and 2013: FirstEnergy Balance, January 1, 2013 Prior years increases Prior years decreases Balance, December 31, 2013 Current year increases... -

Page 110

General Taxes 2015 FirstEnergy KWH excise State gross receipts Real and personal property Social security and unemployment Other Total general taxes FES State gross receipts Real and personal property Social security and unemployment Other Total ... -

Page 111

... have the right to purchase the facilities at the expiration of the basic lease term or any renewal term at a price equal to the fair market value of the facilities. The basic rental payments are adjusted when applicable federal tax law changes. In... -

Page 112

... These rights allow FES to supply electric generation to customers, and the recorded value is being amortized ratably over the term of the related contracts. 8. VARIABLE INTEREST ENTITIES FirstEnergy performs qualitative analyses based on control and... -

Page 113

...construct environmental control facilities. The special purpose limited liability companies own the irrevocable right to collect non-Â bypassable environmental control charges from all customers who receive electric delivery service in MP's and PE's West Virginia... -

Page 114

... sells substantially all of its output to the applicable utilities and the contract price for power is correlated with the plant's variable costs of production. FirstEnergy maintains 15 long-Âterm power purchase agreements with NUG entities that were entered... -

Page 115

...or charges) based on the hourly day-Â ahead congestion price differences across transmission paths. FTRs are acquired by FirstEnergy in the annual, monthly and long-Âterm RTO auctions and are initially recorded using the auction clearing price less cost. After... -

Page 116

...the reporting period. There were no transfers between levels during the years ended December 31, 2015 and 2014. The following tables set forth the recurring assets and liabilities that are accounted for at fair value by level within the fair value hierarchy... -

Page 117

... Model Significant Input RTO auction clearing prices Generation Regional electricity prices Range ($3.90) to $6.90 400 to 3,871,000 $38.10 to $45.60 Weighted Average $1.00 839,000 $40.20 Level 3 Quantitative Information Units Dollars/MWH MWH... -

Page 118

...Unrealized gain (loss) Purchases Settlements December 31, 2015 Balance $ Level 3 Quantitative Information The following table provides quantitative information for FTRs held by FES that are classified as Level 3 in the fair value hierarchy for the... -

Page 119

..., unrealized gains (there were no unrealized losses) and fair values of investments held in NDT, nuclear fuel disposal and NUG trusts as of December 31, 2015 and December 31, 2014: December 31, 2015 Cost Basis Debt securities FirstEnergy FES Equity... -

Page 120

...FirstEnergy is exposed to financial risks resulting from fluctuating interest rates and commodity prices, including prices for electricity, natural gas, coal and energy transmission. To manage the volatility related to these exposures, FirstEnergy's Risk Policy... -

Page 121

...qualify for hedge accounting. Electricity forwards are used to balance expected sales with expected generation and purchased power. Natural gas futures are entered into based on expected consumption of natural gas primarily for use in FirstEnergy's combustion... -

Page 122

...to their estimated fair value at the end of each accounting period prior to settlement. Changes in the fair value of FTRs held by FES and AE Supply are included in other operating expenses as unrealized gains or losses. Unrealized gains or losses on FTRs... -

Page 123

... Value (In millions) (In millions) The following table summarizes the volumes associated with FirstEnergy's outstanding derivative transactions as of December 31, 2015: Purchases Power Contracts FTRs NUGs Natural Gas 16 29 4 83 Sales... -

Page 124

... $67 million for FTRs associated with FES. Realized losses on financially settled wholesale sales contracts of $252 million resulting from higher market prices were netted in purchased power. Includes $365 million for commodity contracts associated with... -

Page 125

...Stock Issuance In each of 2015 and 2014, FE issued approximately 2.5 million shares of common stock to registered shareholders and its employees and the employees of its subsidiaries under its Stock Investment Plan and certain share-Âbased benefit plans... -

Page 126

PREFERRED AND PREFERENCE STOCK FirstEnergy and the Utilities were authorized to issue preferred stock and preference stock as of December 31, 2015, as follows: Preferred Stock Shares Authorized FirstEnergy OE OE Penn CEI TE TE JCP&L ME PN MP ... -

Page 127

...of the senior notes were used: (i) to fund capital expenditures, including with respect to TrAIL's transmission expansion plans;; and (ii) for working capital needs and other general business purposes. Additionally, in October 2015, ATSI issued in total... -

Page 128

...subsidiaries of MP and PE. Proceeds from the bonds were used to construct environmental control facilities. Principal and interest owed on the environmental control bonds is secured by, and payable solely from, the proceeds of the environmental control charges... -

Page 129

...to the benefit of irrevocable bank LOCs, to pay principal of, or interest on, the applicable PCRBs. To the extent that drawings are made under the LOCs, FG is entitled to a credit against its obligation to repay those bonds. FG pays annual fees based on... -

Page 130

...the limitations on short-Âterm indebtedness applicable to each borrower under current regulatory approvals and applicable statutory and/or charter limitations, as of December 31, 2015: Revolving Credit Facility Sub-ÂLimits $ 3,500 1,500 1,000 1,000... -

Page 131

... to borrow or accelerate payment of outstanding advances in the event of any change in credit ratings of the borrowers. Pricing is defined in "pricing grids," whereby the cost of funds borrowed under the Facilities is related to the credit ratings of the... -

Page 132

..., Pennsylvania, Illinois, Michigan, New Jersey and Maryland, FES and AE Supply are subject to state laws applicable to competitive electric suppliers in those states, including affiliate codes of conduct that apply to FES, AE Supply and their public utility... -

Page 133

...fixed price service and is intended for smaller commercial and residential customers. All New Jersey EDCs participate in this competitive BGS procurement process and recover BGS costs directly from customers as a charge separate from base rates... -

Page 134

... the PUCO's termination of Rider RRS charges/credits associated with any plants or units that may be sold or transferred Continuing to provide power to non-Âshopping customers at a market-Âbased price set through an auction process Continuing Rider DCR with... -

Page 135

.... On December 18, 2015, FES filed an Application for Rehearing seeking to change the ruling or have it only apply to residential and small commercial customers. PENNSYLVANIA The Pennsylvania Companies currently operate under DSPs that expire... -

Page 136

... for: a $15 million increase in annual base rate revenues effective February 25, 2015;; the implementation of a Vegetation Management Surcharge to recover all costs related to both new and existing vegetation maintenance programs;; authority to establish... -

Page 137

...to allocate costs for new transmission facilities. While FirstEnergy and other parties advocate for a traditional "beneficiary pays" (or usage based) approach, others advocate for "socializing" the costs on a load-Âratio share basis, where each customer in the... -

Page 138

... the functional control of PJM, and PJM will provide transmission service using these facilities under the PJM Tariff. During the third quarter of 2015, FirstEnergy responded to FERC Staff's request for additional information regarding the application. FERC... -

Page 139

... estimate of loss or range of loss cannot be predicted at this time. PATH Transmission Project On August 24, 2012, the PJM Board of Managers canceled the PATH project, a proposed transmission line from West Virginia through Virginia and into Maryland... -

Page 140

...AND CONTINGENCIES NUCLEAR INSURANCE The Price-ÂAnderson Act limits the public liability which can be assessed with respect to a nuclear power plant to $13.5 billion (assuming 103 units licensed to operate) for a single nuclear incident... -

Page 141

... costs. The NRC requires nuclear power plant licensees to obtain minimum property insurance coverage of $1.06 billion or the amount generally available from private sources, whichever is less. The proceeds of this insurance are required to be used first... -

Page 142

... burning lower-Âsulfur fuel, utilizing combustion controls and post-Âcombustion controls, generating more electricity from lower or non-Âemitting plants and/or using emission allowances. CSAPR requires reductions of NOx and SO2 emissions in two phases (2015... -

Page 143

... plants in Pennsylvania and the coal-Âfired Fort Martin and Willow Island plants in West Virginia. The EPA's NOV alleges equipment replacements during maintenance outages triggered the pre-Â construction permitting requirements under the NSR and PSD programs... -

Page 144

..., 2014 EPA Report. Due to plant deactivations and increased efficiencies, FirstEnergy anticipates its CO2 emissions will be reduced 25% below 2005 levels by 2015, exceeding the President's Climate Action Plan goals both in terms of timing and reduction... -

Page 145

... protection procedures and other operational and reporting procedures to assure the safe disposal of CCRs from electric generating plants. Based on an assessment of the finalized regulations, the future cost of compliance and expected timing of spend had no... -

Page 146

...primary affiliated company transactions for FES during the three years ended December 31, 2015 are as follows: FES Revenues: Electric sales to affiliates $ Other Expenses: Purchased power from affiliates Fuel Support services Investment Income... -

Page 147

... bases include multiple factor formulas: each company's proportionate amount of FirstEnergy's aggregate direct payroll, number of employees, asset balances, revenues, number of customers, other factors and specific departmental charge ratios. Management believes... -

Page 148

... under the facility lease for the Bruce Mansfield sale and leaseback that underlie outstanding registered pass-Âthrough trust certificates. Investments in wholly owned subsidiaries are accounted for by FES using the equity method. Results of operations for FG... -

Page 149

... LOSS: Pension and OPEB prior service costs Amortized gain on derivative hedges Change in unrealized gain on available-Âfor-Âsale securities Other comprehensive loss Income tax benefits on other comprehensive loss Other comprehensive loss, net of tax... -

Page 150

...) NET INCOME (LOSS) OTHER COMPREHENSIVE INCOME (LOSS): Pension and OPEB prior service costs Amortized gain on derivative hedges Change in unrealized gain on available-Âfor-Âsale securities Other comprehensive income (loss) Income taxes (benefits) on other... -

Page 151

... LOSS: Pension and OPEB prior service costs Amortized gain on derivative hedges Change in unrealized gain on available-Âfor-Âsale securities Other comprehensive loss Income tax benefits on other comprehensive loss Other comprehensive loss, net of tax... -

Page 152

... Construction work in progress INVESTMENTS: Nuclear plant decommissioning trusts Investment in affiliated companies Other DEFERRED CHARGES AND OTHER ASSETS: Accumulated deferred income tax benefits Customer intangibles Goodwill Property taxes Derivatives... -

Page 153

...INVESTMENTS: Nuclear plant decommissioning trusts Investment in affiliated companies Other DEFERRED CHARGES AND OTHER ASSETS: Accumulated deferred income tax benefits Customer intangibles Goodwill Property taxes Unamortized sale and leaseback costs Derivatives... -

Page 154

..., net Common stock dividend payment Other Net cash provided from (used for) financing activities CASH FLOWS FROM INVESTING ACTIVITIES: Property additions Nuclear fuel Proceeds from asset sales Sales of investment securities held in trusts Purchases of... -

Page 155

...: Property additions Nuclear fuel Proceeds from asset sales Sales of investment securities held in trusts Purchases of investment securities held in trusts Loans to affiliated companies, net Other Net cash used for investing activities Net change in... -

Page 156

... ACTIVITIES: Property additions Nuclear fuel Proceeds from asset sales Sales of investment securities held in trusts Purchases of investment securities held in trusts Loans to affiliated companies, net Other Net cash provided from (used for) investing... -

Page 157

..., West Virginia, Maryland, New Jersey and New York, and purchases power for its POLR, SOS, SSO and default service requirements in Ohio, Pennsylvania, New Jersey and Maryland. This segment also includes regulated electric generation facilities located primarily... -

Page 158

Segment Financial Information Regulated Distribution Regulated Transmission Competitive Energy Services Corporate / Other Reconciling Adjustments For the Years Ended December 31, 2015 External revenues Internal revenues Total revenues Depreciation ... -

Page 159

19. DISCONTINUED OPERATIONS On February 12, 2014, certain of FirstEnergy's subsidiaries sold eleven hydroelectric power stations to a subsidiary of LS Power for approximately $394 million (FES -Â $307 million). The carrying value of the assets sold was $... -

Page 160

... related to the correction of amounts included in the Company's tax basis balance sheet. Management determined that this adjustment was not material to 2014 or any prior period. (2) Total quarterly earnings per share information may not equal annual... -

Page 161

...& President, FirstEnergy Utilities (B) President (C)(D)(H)(I)(L) Vice President, Distribution Support (B) Regional President (K) Vice President, Controller and Chief Accounting Officer (A)(B) Vice President and Controller (C)(D)(E)(F)(G)(H)(I)(J)(L) Vice President... -

Page 162

... the company's Stock Investment Plan, visit AST's website at www.amstock.com/company/firstenergy.asp or contact AST toll-free at 1-800-736-3402. DIRECT DIVIDEND DEPOSIT Registered shareholders can have their dividend payments automatically deposited to checking, savings or credit union accounts at... -

Page 163

PRESORTED STD U.S. POSTAGE PAID AKRON, OH PERMIT No. 561 76 South Main Street, Akron, Ohio 44308-1890