Access America 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

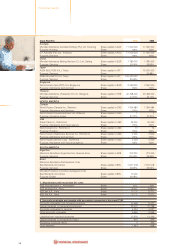

Notes to the consolidated

financial statements

Annual Report 2006 35

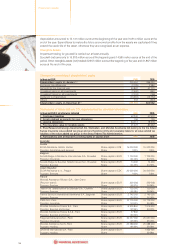

Explanation of the accounting and valuation policies differing from Swiss law

The most important differences are summarised below.

Investments available for sale (afs investments)

Investments available for sale are shown in the balance sheet at market value with the unrealised

gains / losses being included under other reserves in shareholders’ equity.

Claim equalisation reserves

Claim equalisation reserves and catastrophe reserves are not allowed under Mondial Assistance

Group accounting policies because they do not represent a present obligation towards third

parties.

Claims reserves

Under Mondial Assistance Group accounting policies, claims reserves usually are lower than

under statutory accounting principles as they are calculated at the best estimate of the ultimate

cost. The Swiss Code of Obligations requires a conservative calculation in accordance with

the prudence principles.

Acquisition costs

Under Mondial Assistance Group accounting policies acquisition costs are capitalised and

amortised over the term of policy.

Goodwill

Goodwill with an indefinite useful life is not amortised under Mondial Assistance Group

accounting policies. Impairment testing for goodwill is carried out at least annually and if an

impairment is applicable, it is recognised through the income.

Real Estate

The capitalised cost of buildings is calculated on the basis of acquisition cost and depreciation

over a maximum of 50 years in accordance with the useful life of the real estate. The gross

capitalised values totalled 18.639 million euros at the beginning of the year and 10.987 million

euros at the end of the year. Accumulated depreciation amounted to 10.504 million euros at the

beginning of the year and 2.933 million euros at the end of the year. No unscheduled depreciation

was recorded in 2006.

Tangible Assets

Tangible assets such as equipment, vehicles and hardware are depreciated over 3 to 10 years

according to their useful lives. The gross capitalised values totalled 112.995 million euros at

the beginning of the year and 118.637 million euros at the end of the year. Accumulated

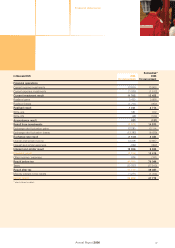

Valuation reserve securities

in thousand EUR 2006 2005

Fixed-income securities and other investments

Cost 530 321 511 099

Fair value 531 616 519 158

Revaluation reserve 1 295 8 059

Shares

Cost 17 17

Fair value 24 22

Revaluation reserve 7 5

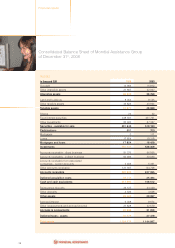

Intangible and tangible assets

in thousand EUR intangible assets tangible assets real estate Total

Balance value on December 31st, 2005 38 769 40 854 8 135 87 758

Exchange rate change (1 383) (300) 0 (1 683)

Additions 11 097 24 009 0 35 106

Change scope of consolidation (409) (267) 0 (676)

Disposals (3 008) (16 084) (2) (19 094)

Amortisation (8 234) (4 389) (79) (12 702)

Balance value on December 31st, 2006 36 832 43 823 8 054 88 709