Access America 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

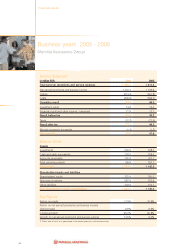

Financial results

34

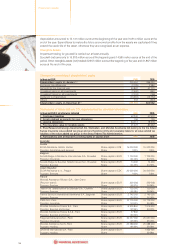

Deferred tax

The calculation of deferred tax is based on temporary differences between the carrying amounts of assets

or liabilities in the published balance sheet and their tax basis, and on differences arising from the application

of uniform valuation policies for consolidation purposes. The tax rates used for the calculation of deferred

taxes are the local rates applicable in the countries concerned. Substantively enacted changes in tax laws

are already taken into account as at balance sheet date.

Impairment of assets

All assets are reviewed regularly to ensure that no further value adjustments are required. Valuation write-downs

are charged to the income statement if any permanent diminution in value is identified. Write-downs are

based on the relevant estimated recoverable amounts.

Accounting for operating leases

Accounting for equipment and vehicles under operating leases, whereby the risks and benefits relating to

ownership of the assets remain with the lessor, are not recorded in the balance sheet and all related

expenses are accounted for in the income statement in the period they arise.

Technical provisions

Technical provisions include unearned premium reserves, deferred service income, claim reserves and

other technical provisions.

Premiums written and service revenue attributable to future periods are deferred under unearned premium

reserves respectively under service deferred income on a pro-rata basis, over the period of the contract

on a daily basis.

Claim reserves are assessed according to local regulatory requirements, on a case by case basis and are

supplemented by reserves for claims incurred but not reported based on management and statistical

estimates.

Non-technical provisions

These include personnel provisions and similar liabilities, provision for income taxes and other non-technical

provisions.

Pension and similar reserves are calculated taking local circumstances into account as well as expected future

trends in salaries and wages, retirement rates and pension increases.

Defined benefit plans are recognised using the method of accruing actuarial gains and losses through

income.

Provisions for income taxes are calculated in accordance with the relevant local tax regulations.

Other liabilities

Other liabilities include deposits received from reinsurers, loans, liabilities direct / indirect business, liabilities

with associated companies (current accounts), deferred income and other liabilities.

Income statement

Turnover

Turnover includes insurance premiums and service revenue.

Premiums earned

Premiums written for travel insurance are reported proportionately as income over the term of the insurance

contract on a daily basis.

Claims and service administration expenses (internal claims handling costs ICHC and internal service

handling costs ISHC)

Claims and service handling costs are assessed according to business management criteria and reported

under claims incurred and service administration expenses.

Ordinary result

Interest income and interest expense are recognised on an accrual basis. Dividends are recognised as

income when received.

Interest on finance leases is recognised as interest expense over the term of the respective lease.

Income Taxes

Income tax expense includes current income taxes and deferred income taxes.