Access America 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2006 31

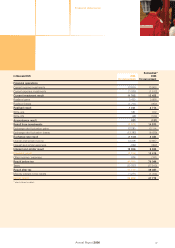

Consolidation scope

The consolidated financial statements of Mondial Assistance Group comprise the annual

accounts of Mondial Assistance AG and subsidiaries, which are prepared in accordance with

the accounting and valuation principles of the Mondial Assistance Group. Consolidated

subsidiaries are listed further in the notes to the consolidated financial statements.

The holding company SACNAS International S.A., France, merged with Mondial Assistance

S.A.S, France. Mondial Assistance France S.A.S was incorporated with the purpose of service

and brokerage.

The Japanese company AS24 (NIJUYKON K.K.) has been renamed to Millea Mondial Co Ltd,

Tokyo, and the group’s participation reduced to 50%.

In Brazil, the broker company Mondial Protection Corretora de Seguros Ltda was founded.

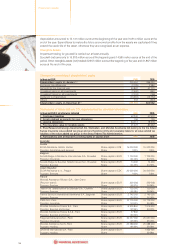

Consolidation principles

Subsidiaries have been recorded according to the full consolidation method when subject to

the majority control of the Mondial Assistance Group.

All intra-group transactions and balances have been eliminated.

Interests in joint ventures are recognised by including the accounts using the proportionate

consolidation basis, i.e. by including in the accounts under the appropriate financial statement

headings the Group’s proportion of the joint venture revenues, costs, assets and liabilities.

Equity investments in which the Mondial Assistance Group owns at least 20% of the voting

rights are accounted for using the equity method, except for investments in which the Mondial

Assistance Group is not able to exercise significant influence, in which case, the cost method

is used.

Investments in which the company owns less than 20% are accounted for under the cost

method.

The equity and net income attributable to minority shareholders’ interests are disclosed separately

in the balance sheet and income statement respectively.

The purchase method of accounting is used for acquired businesses. Companies acquired

or disposed of during the year are included in the consolidated financial statements from the

date of acquisition or to the date of disposal respectively.

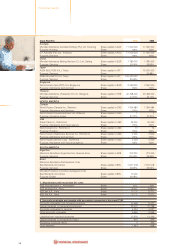

Foreign currency translation

The Group’s reporting currency is the Euro (€). The functional currency for each Group company

is the currency of the environment where the enterprise carries on its activities. Assets and

liabilities are translated at the closing rate on the balance sheet date. Expenses and income

are translated at the annual average rate from the functional currency into the reporting currency.

Translation differences between the functional currency and reporting currency, including those

arising in the process of equity consolidation, are taken to shareholders’ equity without affecting

earnings. Translation differences between the transaction currency and functional currency

are reported in earnings.

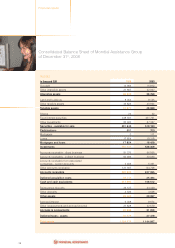

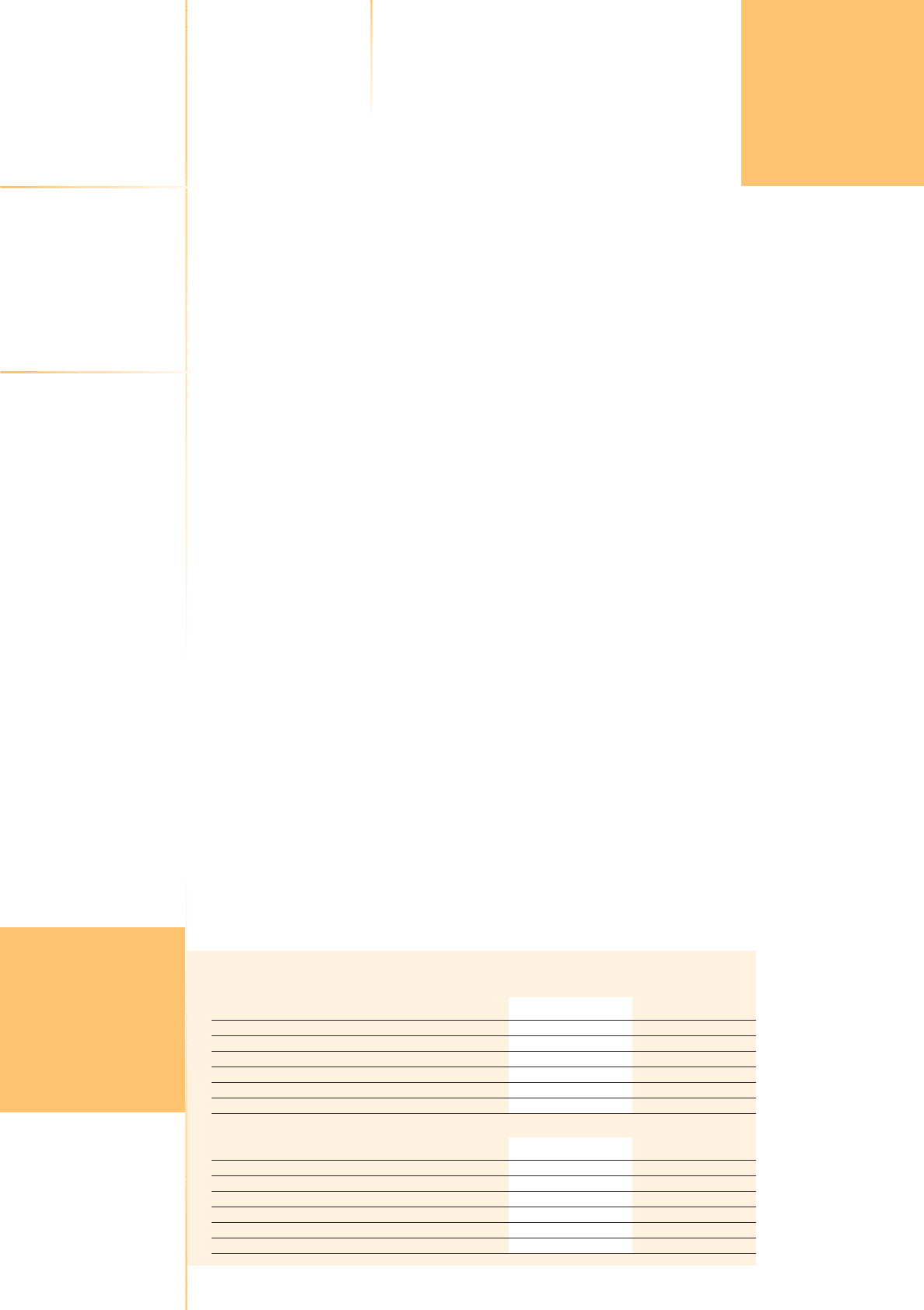

Exchange rates of principal currencies

Balance sheet year end rate

(against 1 euro) 2006 2005

Australia (AUD) 1.6691 1.6109

Japan (JPY) 156.9300 138.9000

Brazil (BRL) 2.8133 2.7515

United Kingdom (GBP) 0.6715 0.6853

Switzerland (CHF) 1.6069 1.5551

USA (USD) 1.3170 1.1797

Income statement average rate

(against 1 euro) 2006 2005

Australia (AUD) 1.6669 1.6322

Japan (JPY) 146.0642 136.8628

Brazil (BRL) 2.7327 2.8979

United Kingdom (GBP) 0.6818 0.6839

Switzerland (CHF) 1.5731 1.5482

USA (USD) 1.2557 1.2443

Notes to the consolidated financial

statements of Mondial Assistance Group

Notes to the consolidated

financial statements