Access America 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial results

32

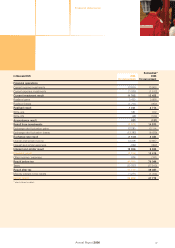

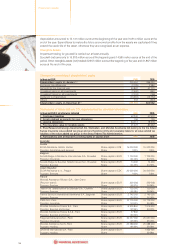

Reclassification of balance sheet and profit and loss statement of 2005

With the adoption of a new chart of accounts (adoption of the Allianz chart of accounts), the following

reclassifications were effective compared to the annual report 2005:

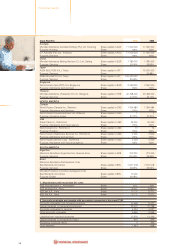

Balance Sheet

Loans

Other gross customer advances (1.2 million euros) are newly shown under loans instead of other

accounts receivable.

Accounts receivable

Under the new chart of accounts, one component account of receivables has been reclassified to other

liabilities (2.1 million euros).

Unearned premium reserves and deferred service income

The account provision for deferred service income (19.0 million euros) is shown under this account grouping

instead of the deferred income grouping.

Personnel provisions and similar liabilities

The account provision other staff – regulated provision (-0.09 million euros) is grouped in personnel provisions

and similar liabilities instead of other non-technical provisions.

Provision for income taxes and similar taxes

The account other taxes (9.1 million euros) is reclassified to this account grouping instead of other non-

technical provisions.

Other non-technical provisions

The account provision other staff – regulated provision (-0.09 million euros) and the account other taxes

(9,1 million euros) is newly grouped in provisions for income taxes and similar taxes and other non-technical

provisions.

Other liabilities

One component account of receivables (2.1 million euros) and the account liabilities to banks cash advance

& short term deposits (6.9 million euros) is reclassified to this account grouping.

Loans

The account liabilities to banks cash advance & short term deposits (6.9 million euros) is grouped newly in

loans instead of other liabilities.

Deferred income

The account provision for deferred service income (19.0 million euros) is reclassified to unearned premium

reserves and deferred service income as it is considered as a technical provision.

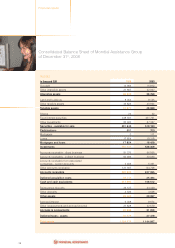

Profit and loss statement

Change of intercompany elimination between claims and services

The elimination of intercompany relationships between claims and services has changed due to the adoption

of the Allianz chart of accounts and changes to Allianz’ accounting principles. The change in the elimination

policy has a positive impact on the service margin and leads to an increase in claims incurred. In the past,

intercompany revenues were mainly eliminated against claims. In 2006, they are eliminated against service

expenses. The link elimination account is newly grouped in other service income / expenses, which was

previously grouped in service revenue (reclassification).

The intercompany elimination change concerns the subtotal claims incurred current year and the groupings

claims paid previous year and commissions paid.

With the adoption of the Allianz chart of accounts, further accounts were re-grouped compared to the

annual report 2005.

Other administration costs

The other administration costs grouping was partially reclassified (2.9 million euros) to other groupings

within the general expenses after transfer subtotal and to the groupings other technical income / expenses.

Current income investments

Interest and similar income are shown separately in current income investments.

Interest and similar income

Interest and similar income are shown separately from current income on investments.