Whirlpool 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL SUMMARY

The following is a summary of Whirlpool Corporation’s financial condition and results of operations for 2013, 2012

and 2011. For a more complete understanding of our financial condition and results, this summary should be read

together with Whirlpool Corporation’s Financial Statements and related notes, and “Management’s Discussion and

Analysis.” This information appears in the Company’s 2013 Annual Report on Form 10-K filed with the Securities and

Exchange Commission, which is available on the company’s website at investors.whirlpoolcorp.com/sec.cfm.

FORWARD-LOOKING PERSPECTIVE

We currently estimate earnings per diluted share and industry demand for 2014 to be within the following ranges:

(Millions of dollars, except per share data)

2014

Current Outlook

Estimated GAAP earnings per diluted share, for the year ending December 31, 2014 $11.05–$11.55

Brazilian tax credits (BEFIEX) $ (0.21)

Restructuring expense $ 0.95

Investment expense $ 0.21

Estimated ongoing business operations earnings per diluted share $12.00–$12.50

Industry demand

North America 5%–7%

Latin America Flat

EMEA 0%–2%

Asia 0%–3%

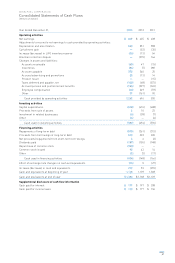

For the full-year 2014, we expect to generate free cash flow of approximately $700 million, including restructuring

cash outlays of up to $150 million, capital spending of $625 million to $675 million and U.S. pension contributions of

approximately $160 million.

The table below reconciles projected 2014 cash provided by operations determined in accordance with GAAP to

free cash flow, a non-GAAP measure. Management believes that free cash flow provides stockholders with a rele-

vant measure of liquidity and a useful basis for assessing Whirlpool’s ability to fund its activities and obligations.

There are limitations to using non-GAAP financial measures, including the difficulty associated with comparing

companies that use similarly named non-GAAP measures whose calculations may differ from our calculations.

We define free cash flow as cash provided by continuing operations less capital expenditures and including

proceeds from the sale of assets/businesses. For more information, see document titled “GAAP Reconciliations”

at investors.whirlpoolcorp.com/annuals.cfm.

(Millions of dollars)

2014

Current Outlook

Cash provided by operating activities $1,325–$1,375

Capital expenditures and proceeds from sale of assets/businesses (625)–(675)

Free cash flow $700–$700

The projections above are based on many estimates and are inherently subject to change based on future decisions

made by management and the Board of Directors of Whirlpool, and significant economic, competitive and other

uncertainties and contingencies.

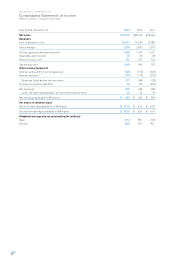

ONGOING BUSINESS OPERATIONS MEASURES: ADJUSTED OPERATING PROFIT AND ADJUSTED

EARNINGS PER DILUTED SHARE

The reconciliation provided below reconciles the non-GAAP financial measures, adjusted operating profit and adjusted

earnings per diluted share, with the most directly comparable GAAP financial measures, reported operating profit

and earnings per diluted share available to Whirlpool, for the twelve months ended December 31, 2013, December

31, 2012, and December 31, 2011. Adjusted operating profit margin is calculated by dividing adjusted operating profit

by adjusted net sales. Adjusted net sales excludes Brazilian (BEFIEX) tax credits from reported net sales. For more

information, see document titled “GAAP Reconciliations” at investors.whirlpoolcorp.com/annuals.cfm.

Twelve Months Ended December 31,

Operating Profit

Earnings Per

Diluted Share

(Millions of dollars, except per share data)

2013 2012 2011 2013 2012 2011

Reported GAAP measure $ 1,249 $ 869 $ 792 $ 10.24 $ 5.06 $ 4.99

Restructuring expense 196 237 136 1.84 2.15 1.13

Brazilian tax credits (BEFIEX) (109) (37) (266) (1.35) (0.47) (3.41)

U.S. Energy Tax Credits —— — (1.56) — (4.68)

Brazilian collection dispute and antitrust resolutions —— — 0.40 0.32 4.85

Investment expense 6— — 0.19 — —

Brazilian government settlement 11 — — 0.26 — —

Investment and intangible impairment —4 — —0.12 —

Benefit plan curtailment gain —(49) (35) —(0.38) (0.28)

Contract and patent resolutions —— — —0.17 —

Normalized tax rate adjustment —— — —0.08 —

Supplier quality recovery —— (61) —— (0.49)

Supplier-related quality issue —— (7) —— (0.06)

Ongoing business operations measure $ 1,353 $ 1,024 $ 559 $ 10.02 $ 7.05 $ 2.05

35