Whirlpool 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During the year, we successfully implemented cost-based

price increases and drove a favorable mix of products in

the marketplace. The restructuring actions we announced

in 2011 remain on track to deliver $400 million in total

program fixed-cost savings by the end of 2013. Our legacy

legal liabilities are now largely behind us, and our strong

underlying cash generation resulted in a $1.2 billion cash

balance at the end of the year. The cash generation,

combined with promising trends in U.S. housing and

growth opportunities in emerging markets, created

positive momentum going into 2013.

INNOVATION, GROWTH AND LEADERSHIP

The company continued to be recognized for its product

leadership in 2012, receiving top ratings from leading

consumer product evaluation groups. We will accelerate

our actions in 2013, with higher investments in product

development, technology and marketing in every region

and for every product category. These investments begin

with innovation that meets consumers’ needs, and then

focuses everything we do to produce iconic, winning

brands and products that consumers want in their homes.

We know that we can best compete by focusing on

introducing new and innovative products, building strong

brands, continuing to expand globally, increasing our

margins and improving our cost structure. Our growth

opportunities include expansion into emerging markets in

Latin America, the Middle East and Asia. In Latin America,

for example, our business outside the Brazilian market is

producing record sales and operating profit. To capitalize

on this growth, we accelerated the launch of

Whirlpool

brand kitchen collections in 2012, and we will introduce

a strong cadence of new products throughout our Latin

America Region in 2013.

We are also continuing investments in higher-margin, faster-

growing adjacent businesses, such as water filtration and

small appliances. In 2012, we introduced new countertop

appliances and accessories in Latin America, Europe and

the United States, with additional launches targeted for

2013. At the same time, we maintained investments in our

core appliance business to push the innovation that is

fundamental to our growth. For example, in 2012 we

introduced the

Whirlpool

brand Ice Collection, appliance

suites with advanced innovation and design elements that

were created based on the ways consumers intuitively use

their appliances and expect them to fit in easily with their

busy lifestyles.

These investments will position us well to succeed on a

level competitive playing field that rewards investments

in innovation, employees and manufacturing. As we begin

2013, we have appropriately set the bar for the future by

promoting a fair trade environment in the United States,

with the U.S. government voting to impose trade remedies

on imports of unlawfully traded washers from South

Korea and Mexico. This decision is a great victory for

the U.S. appliance industry, and it is an important stride

toward enforcing laws that enable a balanced competitive

marketplace for manufacturers, their employees and

consumers.

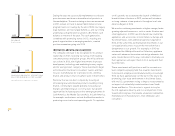

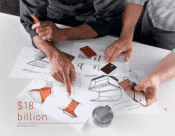

REVENUE

$ IN BILLIONS

2011 2012

ONGOING BUSINESS OPERATIONS

DILUTED EARNINGS PER SHARE*

2011 2012

$18.1

$18.7

$2.05

$7.05

*Non-GAAP measure; see page 29 for reconciliation.

4