Whirlpool 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

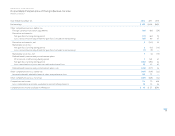

WHIRLPOOL CORPORATION

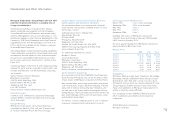

Five-Year Selected Financial Data

(Millions of dollars, except share and employee data)

2012 2011 2010 2009 2008

Consolidated Operations

Net sales $ 18,1 43 $ 18,666 $ 18,3 66 $ 17,099 $ 18 ,907

Restructuring costs 237 136 74 126 149

Depreciation and amortization(1) 551 558 555 525 597

Operating profit 869 792 1,008 688 549

Earnings (loss) before income taxes and other items 558 (28)586 293 246

Net earnings 425 408 650 354 447

Net earnings available to Whirlpool 401 390 619 328 418

Capital expenditures 476 608 593 541 547

Dividends 155 148 132 128 128

Consolidated Financial Position

Current assets $ 6,827 $ 6,422 $ 7,315 $ 7,025 $ 6,044

Current liabilities 6,510 6,297 6,149 5,941 5,563

Accounts receivable, inventories and accounts payable, net 694 947 1,410 1,389 1,889

Property, net 3,034 3,102 3,134 3,117 2,985

Total assets 15,396 15,181 15,584 15,094 13,532

Long-term debt 1,944 2,129 2,195 2,502 2,002

Total debt(2) 2,461 2,491 2,509 2,903 2,597

Whirlpool stockholders’ equity 4,260 4,181 4,226 3,664 3,006

Per Share Data

Basic net earnings available to Whirlpool $ 5.14 $ 5.07 $ 8.12 $ 4.39 $ 5.57

Diluted net earnings available to Whirlpool 5.06 4.99 7.97 4.34 5.50

Dividends 2.00 1.93 1.72 1.72 1.72

Book value(3) 53.70 53.50 54.48 48.48 39.54

Closing Stock Price—NYSE 101.75 47.45 88.83 80.66 41.35

Key Ratios

Operating profit margin 4.8%4.2%5.5%4.0%2.9%

Pre-tax margin(4) 3.1%(0.2)% 3.2%1.7%1.3%

Net margin(5) 2.2%2.1%3.4%1.9%2.2%

Return on average Whirlpool stockholders’ equity(6) 9.5%9.3%15.7%9.8%10.7%

Return on average total assets(7) 2.6%2.5%4.0%2.3%3.0%

Current assets to current liabilities 1.0 1.0 1.2 1.2 1.1

Total debt as a percent of invested capital(8) 36.0%36.8%36.7%43.6%46.0%

Price earnings ratio(9) 20.1 9.5 11.2 18.6 7.5

Other Data

Common shares outstanding (in thousands):

Average number—on a diluted basis 79,337 78,143 77,628 75,584 76,019

Year-end common shares outstanding 78,407 76,451 76,030 74,704 73,536

Year-end number of stockholders 12,759 13,527 14,080 14,930 14,515

Year-end number of employees 68,000 68,000 71,000 67,000 70,000

Five-year annualized total return to stockholders(10) 7.6%(8.1)% 3.8%5.8%(8.5)%

(1) Depreciation method changed prospectively from a straight-line method to a modified units of production method in 2009.

(2) Total debt includes notes payable and current and long-term debt.

(3) Total Whirlpool stockholders’ equity divided by average number of shares on a diluted basis.

(4) Earnings (loss) before income taxes, as a percent of net sales.

(5) Net earnings available to Whirlpool, as a percent of net sales.

(6) Net earnings available to Whirlpool, divided by average Whirlpool stockholders’ equity.

(7) Net earnings available to Whirlpool, divided by average total assets.

(8) Total debt divided by total debt and total stockholders’ equity.

(9) Closing stock price divided by diluted net earnings available to Whirlpool.

(10) Stock appreciation plus reinvested dividends, divided by share price at the beginning of the period.