Whirlpool 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 Whirlpool Corporation

Eleven-Year Consolidated Statistical Review

(Millions of dollars except share and employee data) 2005 2004 2003 2002

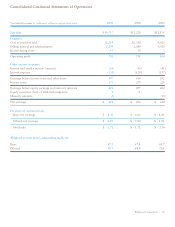

Consolidated Operations

Net sales $ 14,317 $ 13,220 $ 12,176 $ 11,016

Operating profit (1) 792 758 830 692

Earnings (loss) from continuing operations

before income taxes and other items 597 616 652 495

Earnings (loss) from continuing operations 422 406 414 262

Earnings (loss) from discontinued operations (2) – – – (43)

Net earnings (loss) (3) 422 406 414 (394)

Net capital expenditures 494 511 423 430

Depreciation 441 443 423 391

Dividends 116 116 94 91

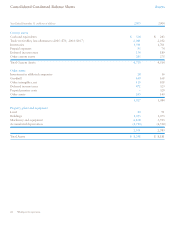

Consolidated Financial Position

Current assets 4,710 4,514 3,865 3,327

Current liabilities 4,301 3,985 3,589 3,505

Working capital 409 529 276 (178)

Property, plant and equipment-net 2,511 2,583 2,456 2,338

Total assets 8,248 8,181 7,361 6,631

Long-term debt 745 1,160 1,134 1,092

Stockholders’ equity 1,745 1,606 1,301 739

Per Share Data

Basic earnings (loss) from continuing operations before accounting change 6.30 6.02 6.03 3.86

Diluted earnings (loss) from continuing operations before accounting change 6.19 5.90 5.91 3.78

Diluted net earnings (loss) (3) 6.19 5.90 5.91 (5.68)

Dividends 1.72 1.72 1.36 1.36

Book value 25.54 23.31 18.56 10.67

Closing Stock Price - NYSE 83.76 69.21 72.65 52.22

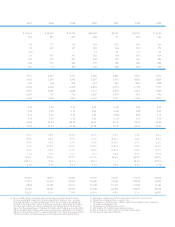

Key Ratios (4)

Operating profit margin 5.5% 5.7% 6.8% 6.3%

Pre-tax margin (5) 4.2% 4.7% 5.4% 4.5%

Net margin (6) 2.9% 3.1% 3.4% 2.4%

Return on average stockholders’ equity (7) 24.6% 30.3% 42.9% (26.5)%

Return on average total assets (8) 5.1% 5.2% 5.9% (5.8)%

Current assets to current liabilities 1.1 x 1.1 x 1.1 x 0.9 x

Total debt-appliance business as a percent of invested capital (9) 40.4% 45.7% 50.9% 65.1%

Price earnings ratio 13.5 x 11.7 x 12.3 x (9.2) x

Interest coverage (10) 5.6 x 5.8 x 5.7 x (0.4) x

Other Data

Number of common shares outstanding (in thousands):

Average – on a diluted basis 68,272 68,902 70,082 69,267

Year-end 67,880 66,604 68,931 68,226

Number of stockholders (year-end) 7,442 7,826 8,178 8,556

Number of employees (year-end) 65,682 68,125 68,407 68,272

Total return to shareholders (five year annualized) (11) 14.5% 3.7% 8.1% 1.4%

(1) Restructuring charges were $57 million in 2005, $15 million in 2004, $3 million in 2003, $101 million in 2002,

$150 million in 2001, $343 million in 1997, and $30 million in 1996.

(2) The Company’s financial services business was discontinued in 1997.

(3) Includes cumulative effect of accounting changes: 2002 – Accounting for goodwill under SFAS No. 141 and 142 and

impairments of $(613) million or $(8.84) per diluted share; 2001 – Accounting for derivative instruments and hedging

activities of $8 million or $0.12 per diluted share.