Whirlpool 2005 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2005 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Whirlpool Corporation 25

Financing Activities Total repayments of short-term and long-term

debt, net of new borrowings, were $131 million, $58 million and

$208 million in 2005, 2004 and 2003, respectively.

During March 2003, the Company redeemed its $200 million 9%

Debentures using short-term notes payable.

Dividends paid to stockholders totaled $116 million, $116

million and $94 million in 2005, 2004 and 2003, respectively.

Under its stock repurchase programs, Whirlpool used $34

million, $251 million and $65 million to purchase approximately 0.5

million, 3.7 million and 1 million shares of common stock in 2005,

2004 and 2003, respectively.

The Company also redeemed $33 million in preferred stock of

its discontinued finance company, Whirlpool Financial Corporation,

in 2003.

Whirlpool received proceeds of $102 million in 2005, $64 million

in 2004 and $65 million in 2003 related to the exercise of Company

stock options.

Financial Condition and Liquidity

The Company’s objective is to finance its business through an

appropriate mix of long-term and short-term debt. By diversifying

its maturity structure, the Company avoids concentrations of

debt, reducing liquidity risk. Whirlpool has varying needs for

short-term working capital financing as a result of the nature

of its business. The volume and timing of refrigeration and air

conditioning production impact the Company’s cash flows, with

increased production in the first half of the year to meet increased

demand in the summer months. The Company finances its working

capital needs primarily through the commercial paper markets in

the U.S., Europe and Canada. These commercial paper programs

are supported by committed bank lines. In addition, outside the

U.S., short-term funding is also provided by bank borrowings on

uncommitted lines. The Company has access to long-term funding

in the U.S., European and other public bond markets.

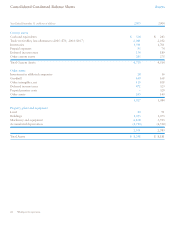

The Company’s financial position remains strong. At December

31, 2005 and 2004, the Company’s total assets were $8.2 billion.

Stockholders’ equity increased from $1.6 billion at the end of 2004

to $1.7 billion at the end of 2005. The increase in equity is primarily

attributed to net earnings retention and proceeds received from the

exercise of stock options. These increases were offset by decreases

in equity due to minimum pension liability adjustments and share

repurchases.

The Company’s overall debt levels have decreased since 2004.

Cash flows from operations and proceeds from sales of assets/

businesses have been used to repay debt, fund capital expenditures

and pay dividends.

On December 2, 2005, the Company entered into an Amended

and Restated Long Term Five-Year Credit Agreement (the “Amended

and Restated Credit Agreement”) by and among the Company,

certain other borrowers, the lenders referred to therein, Citibank

N.A., as administrative agent and fronting agent, J.P. Morgan Chase

Bank, N.A., as syndication agent, and ABN Amro Bank N.V., Royal

Bank of Scotland and Bank of America, as documentation agents,

which amends and restates the Amended and Restated Long Term

Credit Agreement dated as of May 28, 2004. On December 2, 2005,

the parties to the Amended and Restated Credit Agreement also

entered into a 364-Day Credit Agreement (the “364-Day Credit

Agreement” and together with the Amended and Restated Credit

Agreement, the “Credit Facilities”). Additional information can

be obtained in the Financial Supplement to the Company’s Proxy

Statement and in the Financial Supplement to the 2005 Annual

Report on Form 10-K for the year ended December 31, 2005.

On February 7, 2006, the Company filed a shelf registration

statement with the U.S. Securities and Exchange Commission

(“SEC”) relating to an indeterminate amount of Debt Securities.

In August 2005, in connection with its proposed acquisition

of Maytag, Whirlpool was placed on credit watch with negative

implications by Standard & Poor’s, Moody’s Investors Service

and Fitch Ratings. No action has been taken by any of the rating

agencies concerning the Company’s rating, and action, if any, would

be taken after the acquisition of Maytag. The Company does not

anticipate that any future adjustments to these ratings would have

a material impact on its liquidity. The Company’s short-term credit

rating has been confirmed, and, accordingly, availability of the

commercial paper markets remains unchanged.

The Company’s Eurobonds of EUR 300 million principal amount

will mature in June 2006. The Eurobonds U.S. dollar value at

December 31, 2005 was $357 million. The Company anticipates

replacing the Eurobonds with a domestic bond offering and

commercial paper.

On December 12, 2005, the Company announced that it invested

$250 million in its North American manufacturing base during

2005. In the last 12 months, the Company has made improvements

to its washer and dryer facilities in Ohio, began production of

formed door refrigerators in Fort Smith, Arkansas, and began

production of a new clothes washer plant in Monterrey, Mexico.

In addition, the Company has completed the construction of

a refrigerator plant in Ramos Arizpe, Mexico, that will begin

producing refrigerators later in 2006. These investments continue

the Company’s ongoing effort to expand its innovation capability

and optimize its global operating platform.

Pending Maytag Acquisition

On August

22

,

2005

, Whirlpool entered into a definitive merger

agreement with Maytag to acquire all outstanding shares of Maytag

common stock. The aggregate transaction value, including the

payment to Maytag stockholders of approximately

$850

million

in cash, and between

9.2

million and

11.3

million shares of

Whirlpool common stock, and assumption of approximately

$972

million of Maytag debt (based on Maytag stock, exercisable stock

options and debt reported outstanding as of December

31

,

2005

),

is approximately

$2.7

billion. The number of shares of Whirlpool