Whirlpool 2005 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2005 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

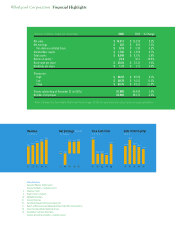

Whirlpool Corporation Financial Highlights

Table of Contents

Innovation Pipeline (foldout cover)

Financial Highlights (inside front cover)

2 Chairman’s Letter

6 People / Process / Products

15 Worldwide Operations

21 Financial Summary

27 Consolidated Condensed Financial Statements

31 Reports of Management and Independent Registered Public Accounting Firm

34 Eleven-Year Consolidated Statistical Review

36 Shareholders’ and Other Information

Directors & Executive Committee (inside back cover)

Free Cash Flow

($ in millions)

$533

$291 $302 $241

$412

01 02 03 04 05

Debt / Total Capital

(percent)

48.0

%

65.1

%

50.9

%

45.7

%

40.4

%

01 02 03 04 05

Revenue

($ in billions)

$10.3 $11.0

$12.2

$13.2

$14.3

01 02 03 04 05

Net Earnings (Loss)

($ in millions)

01 02 03 04 05

$21 ($394)

$414 $406 $422

(millions of dollars, except per share data) 2005 2004 % Change

Net sales $ 14,317 $ 13,220 8.3%

Net earnings $ 422 $ 406 3.9%

Per share on a diluted basis $ 6.19 $ 5.90 4.9%

Stockholders’ equity $ 1,745 $ 1,606 8.7%

Total assets $ 8,248 $ 8,181 0.8%

Return on equity * 24.6 30.3 -18.8%

Book value per share $ 25.54 $ 23.31 9.6%

Dividends per share $ 1.72 $ 1.72 0.0%

Share price

High $ 86.52 $ 80.00 8.1%

Low $ 60.78 $ 54.53 11.5%

Close $ 83.76 $ 69.21 21.0%

Shares outstanding at December 31 (in 000’s) 67,880 66,604 1.9%

Number of employees 65,682 68,125 -3.6%

*Refer to Eleven-Year Consolidated Statistical Review (pages 34-35) for more information about return on equity calculations.