Whirlpool 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26 Whirlpool Corporation

common stock to be issued will depend on the volume weighted

average trading prices of Whirlpool common stock during a twenty

trading day period ending shortly before completion of the merger.

The transaction was approved by Maytag shareholders on December

22

,

2005,

and is pending regulatory clearance as discussed below.

Whirlpool has sufficient resources to finance the acquisition. The

acquisition and upcoming debt maturities of the combined company

are expected to be financed initially through commercial paper

supported by existing bank agreements and with new committed

bank facilities. The Company expects to eventually refinance a

portion of its commercial paper in the capital markets.

Whirlpool currently expects the merger with Maytag to

generate approximately $300 million to $400 million of annual

pre-tax cost savings by the third year following completion of the

merger. Efficiencies are expected to come from all areas across

the value chain, including product manufacturing and marketing,

global procurement, logistics, infrastructure and support areas.

Achieving these efficiencies will require one-time costs and capital

investments currently estimated to be in the range of $350 million

to $500 million, a majority of which currently are anticipated to be

capitalized or accrued in purchase accounting. Whirlpool currently

anticipates incurring these costs during the first two years following

completion of the merger.

The merger is subject to clearance under the Hart-Scott-

Rodino Antitrust Improvements Act, and other customary

closing conditions. On December 1, 2005, Whirlpool and Maytag

announced that they had certified substantial compliance with

the Antitrust Division of the Department of Justice in response to

a request for additional information (“second request”) and had

agreed not to close the proposed merger before February 27, 2006,

without the Antitrust Division’s concurrence, recognizing that the

Antitrust Division could request additional time for review. On

February 13, 2006, Whirlpool and Maytag announced that they

agreed with the Antitrust Division to a limited extension of time to

complete the review of the proposed merger. The companies have

agreed not to close the transaction before March 30, 2006, without

the Antitrust Division’s concurrence.

Whirlpool and Maytag are working closely with the Department

of Justice and continue to cooperate fully with its investigation and

respond promptly to its inquiries.

On August 22, 2005, Whirlpool paid Maytag $40 million to

reimburse Maytag for its payment of a fee to terminate its prior

merger agreement with Triton Acquisition Holding Co. Whirlpool

has agreed to pay up to $15 million to assist Maytag in retaining

key employees while the merger is pending. Whirlpool also has

agreed to pay Maytag a “reverse break-up fee” of $120 million

under certain circumstances if the transaction cannot be closed due

to an inability to obtain regulatory clearance.

Other Matters

Whirlpool contributed approximately $15 million to its U.S.

pension plans during 2005, of which $13 million was a voluntary

contribution to its funded plans and $2 million was required. The

Company also contributed $25 million to its foreign pension plans

during 2005. At December 31, 2005, the Company’s defined benefit

pension plans still remain underfunded on a combined basis.

The Company recognized consolidated pre-tax pension cost of

$94 million, $91 million and $78 million in 2005, 2004 and 2003,

respectively. Consolidated pension cost in 2006 is anticipated to be

approximately $95 million, relatively unchanged from 2005. The

Company currently expects that U.S. pension costs for 2006 will

be approximately $72 million, using an expected rate of return on

assets assumption of 8.5% and a discount rate of 5.6%. The $72

million compares to pension cost of $66 million in 2005.

On November 14, 2005, the Company amended the Whirlpool

Employees Pension Plan (“WEPP”). The amendment will be

reflected in the Company’s 2006 pension cost and did not affect the

accumulated benefit obligation (the “ABO”) or projected benefit

obligation (the “PBO”) at December 31, 2005.

In January 2005, the Company amended the WEPP. The

Company remeasured the net periodic cost and funded status of the

plan at January 1, 2005, to reflect the amendment. The amendment

reduced the PBO by approximately $80 million. The ABO was

not affected by the amendment since the accrued benefits as of

December 31, 2005, were not affected by this change.

The Company is involved in various legal actions arising in the

normal course of business. Management, after considering legal

counsel’s evaluation of such actions, is of the opinion that the

outcome of these matters will not have a material adverse effect on

the Company’s financial position or results of operations.

Market Risk

The Company is exposed to market risk from changes in foreign

currency exchange rates, domestic and foreign interest rates, and

commodity prices, which can affect the Company’s operating results

and overall financial condition. Whirlpool manages its exposure to

these market risks through its operating and financing activities and,

when deemed appropriate, through the use of derivative financial

instruments. Derivative financial instruments are viewed as risk

management tools and are not used for speculation or for trading

purposes. Derivative financial instruments are contracted with

a diversified group of investment grade counterparties to reduce

exposure to nonperformance on such instruments. The Company’s

sensitivity analysis reflects the effects of changes in market risk.

Whirlpool uses foreign currency forward contracts, currency

options and currency swaps to hedge the price risk associated with

firmly committed and forecasted cross-border payments and receipts

related to its ongoing business and operational financing activities.

Foreign currency contracts are sensitive to changes in foreign

currency exchange rates.

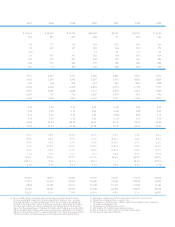

Financial Summary