Whirlpool 2005 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2005 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Whirlpool Corporation 21

Executive Level Overview

Whirlpool Corporation is a global manufacturer of major home

appliances with 2005 revenues of $14.3 billion and net earnings of

$422 million. The Company’s four reportable segments are based

on geography and consist of North America (61% of revenue),

Europe (22% of revenue), Latin America (14% of revenue), and

Asia (3% of revenue). The Company is a leading producer of major

home appliances in North America and Latin America and has a

significant presence in markets throughout Europe, India and China.

Whirlpool received worldwide recognition for accomplishments in a

variety of business and social efforts, including leadership, diversity,

innovative product design, business ethics, social responsibility and

community involvement.

Overall Results of Operations

Net Sales The total number of units, which includes primarily

major and small appliances, sold in 2005 increased 1.3% over

2004. Consolidated net sales increased 8.3% over 2004. Excluding

currency fluctuations, net sales increased approximately 6%.

Total number of units sold in 2004 increased 4.9% over 2003.

Consolidated 2004 net sales increased 8.6% over 2003. Excluding

currency fluctuations, net sales increased approximately 6%.

Significant regional trends were as follows:

• In 2005, North America unit volumes increased approximately

1%, as compared to the 2004 period, reaching record levels.

Volume increases, driven by continued consumer demand for the

Company’s new product innovations, were partially offset by

lower OEM shipments. Net sales increased 8% during 2005, or

approximately 7% excluding currency fluctuations, to a record

$8.9 billion. The higher net sales were driven by the combination

of cost-based price adjustments and volume increases in the

Whirlpool and KitchenAid brands during 2005. In 2004, North

America unit volumes increased 4.6% as compared to 2003, due

to higher sales growth in Whirlpool and KitchenAid branded

products combined with strong Canadian performance. Net sales

increased 4.8% as compared to 2003, to $8.3 billion. Currency

fluctuations did not materially impact net sales comparisons.

• In 2005, Europe unit volumes increased 2.1%, reaching record

levels and outpacing industry growth. Solid demand for

Whirlpool branded products and continued strong performance

within the Company’s built-in appliance business drove the

increase. Net sales increased 3.2% to a record $3.2 billion in

2005. Currency did not have a material impact on sales during

the year. In 2004, Europe unit volumes increased 4.4%, ahead of

industry growth, as compared to 2003, driven largely by strong

Whirlpool brand performance and expansion of the Company’s

built-in appliance business. Europe’s net sales increased 13.8%,

or approximately 3% excluding currency fluctuations. Overall

market share improved due to Whirlpool brand performance and

new product introductions.

• In 2005, Latin America unit volumes increased 1.5% versus 2004,

due mainly to increases in the Brazilian appliance market. Net

sales increased 17.2% as compared to 2004, or approximately

6% excluding currency fluctuations, to $2.0 billion, due primarily

to increased unit volumes and cost-based price adjustments on

compressors and appliances. Strong demand for home appliances

in Latin America during 2004 resulted in a 14.9% increase in

unit volumes versus 2003. Economic conditions within Brazil

were strong during 2004, driven by GDP expansion, lower

unemployment and positive real wage growth. Net sales increased

24% in the region during 2004, and were approximately 20%

higher excluding currency fluctuations, due to market share

gains, strong volume, cost-based price adjustments and favorable

product mix.

•

In

2005

, Asia unit volumes increased

3.1%

as compared to

2004

,

driven mainly by industry growth and new product introductions.

Net sales improved

10.5%

, or approximately

8%

excluding

currency fluctuations, due largely to an improved product mix and

cost-based price adjustments implemented in

2005

. In

2004

, Asia

unit volumes declined

8.6%

versus

2003,

with a corresponding

decline in net sales of

8.2%

. Excluding currency fluctuations, net

sales declined approximately

12%

. Management’s decision to

implement a trade inventory reduction strategy in India negatively

impacted

2004

volume and sales. The strategy change improves

the speed, flexibility and overall efficiency within sales and

distribution processes, and enables the Company to launch new

product introductions more frequently and faster to the market.

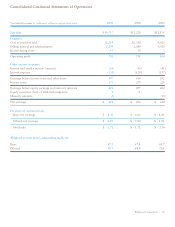

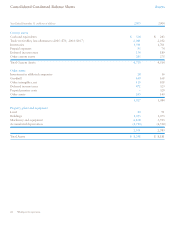

Financial Summary

The following is a summary of the Company’s financial condition and results of operations for 2005 and 2004. For a

more complete understanding of the Company’s financial condition and results, this summary should be read together

with the Company’s Consolidated Financial Statements and related notes, and the “Management’s Discussion and

Analysis.” This information appears in the Financial Supplement to the Company’s Proxy Statement mailed with this

Annual Report and in the Financial Supplement to the 2005 Annual Report on Form 10-K filed with the Securities and

Exchange Commission, both of which are also available through the Internet at www.whirlpoolcorp.com.