Whirlpool 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Whirlpool Corporation 23

Interest Expense Interest expense in 2005 increased $2 million as

compared to 2004. The increase was due primarily to higher interest

rates and a shift in global borrowing positions. The primary impact

was in Brazil, which experienced both increased borrowing levels

and higher interest rates on a year-over-year basis. The interest

expense reduction during 2004 of $9 million was attributable

to a lower overall U.S. interest rate environment, a decrease in

borrowings in countries with higher interest rates, primarily Europe,

and maturity of the $200 million 9% Debentures in March 2003,

which was replaced with lower rate debt.

Income Taxes The effective income tax rate was 28.6% in 2005,

33.9% in 2004 and 35.0% in 2003. A primary driver of the effective

tax rate reduction during 2005 was the realization of foreign tax

credits associated with a comprehensive plan that simplified the

Company’s legal structure, thereby permitting the tax-efficient

repatriation of offshore cash via foreign tax credits. Additional

items impacting the effective tax rate during all periods presented

included the settlement of global tax audits and the overall

dispersion of global income.

Equity in Earnings (Loss) of Affiliated Companies and

Minority Interests Changes in equity in earnings (loss) of affiliated

companies and minority interests reflect higher earnings in Latin

America and India in 2005 and lower earnings in Latin America and

India during 2004.

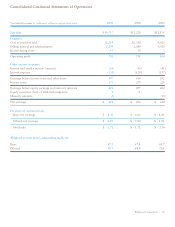

Net Earnings Net earnings were $422 million in 2005 versus

$406 million and $414 million in 2004 and 2003, respectively.

2005 earnings were impacted by cost-based price adjustments,

productivity improvements, administrative cost controls and a

reduction in the effective tax rate. These items were partially offset

by significantly higher material costs (particularly steel and resins),

unfavorable currency fluctuations, increased incentive compensation

expense, higher restructuring spending and increased legal reserves.

2004 earnings were significantly impacted by increases in material

and logistics costs, particularly in the second half of the year.

The higher costs in 2004 were partially offset by productivity

improvements, lower foreign currency losses on balance sheet

positions, an effective tax rate reduction, lower financing costs and

reduced minority interest earnings.

Forward-Looking Perspective During 2005, the Company incurred

approximately $530 million of higher material and oil-related

costs. In response to these increases, the Company introduced new

innovative products, improved productivity, reduced discretionary

costs and implemented global cost-based price adjustments in

key regions around the world. The combination of these actions

contributed to the ability of the Company to deliver a record year

of results.

The Company expects positive earnings momentum to

continue during 2006. New product introductions, productivity

improvements, continued expansion of the Company’s global

operating platform and strong cost controls are expected to more

than offset continued increases in material and oil-related costs.

In 2006, the Company will launch the largest number of new

products to market in its history. The Company’s innovation

product pipeline continues to grow, consumer and trade response

to its new offerings has been positive, and the Company continues

to consistently execute its strategy of delivering consumer-relevant

innovation to markets worldwide.

North America and Europe, the Company’s two largest

segments, expect 2006 industry growth of approximately 2 to 3%

and 1 to 2%, respectively.

Macro-economic conditions in Latin America are expected to

remain positive during 2006, and the Company expects industry

shipments to increase 6 to 8%.

The Company expects industry shipments within Asia to increase

5 to 7% in 2006.

In December 1996, Multibrás and Empresa Brasileira de

Compressores S.A. (“Embraco”), Brazilian subsidiaries, were

granted additional export incentives in connection with Befiex.

These incentives allowed the use of credits as an offset against

current Brazilian federal excise tax on domestic sales. During the

fourth quarter of 2005, the Company recognized $23 million in

export credits. The Company recognized no credits in 2004 and

credits of $5 million in 2003. The credits are treated as a reduction

of current excise taxes payable and, therefore, as an increase in net

sales. At December 31, 2005, the Company’s remaining credits are

approximately $600 million after adjusting for currency fluctuations

and a monetary adjustment. Currently, the Company is unable to

recognize these credits but is exploring possible strategies which

may permit future recognition of these credits.