Whirlpool 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22 Whirlpool Corporation

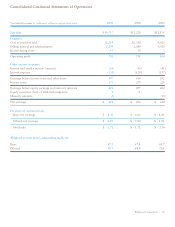

Gross Margin The consolidated gross margin percentage in 2005

decreased 40 basis points versus 2004. Consolidated results in 2005

were significantly impacted by higher material and oil-related cost

increases, which were mitigated by the combination of cost-based

price adjustments and productivity improvements. Consolidated

gross margin also benefited from the Brazilian government’s

export incentive program (“Befiex”) tax credits and was negatively

impacted by higher incentive compensation.

The consolidated gross margin percentage in 2004 decreased

90 basis points versus 2003, due primarily to second half material

cost increases and global pricing pressures. These increases were

partly mitigated by higher volume and record levels of controllable

productivity.

Significant regional trends were as follows:

• The 2005 North America gross margin decreased 80 basis points

as compared to 2004, largely due to higher material and oil-

related costs. Results also reflect the impact of cost-based price

adjustments, productivity improvements and higher incentive

compensation. The 2004 gross margin decreased 70 basis points

compared to 2003, due primarily to higher material costs for

steel and resins. In addition, the market continued to experience

increased pricing pressures during 2004. Margin declines were

partially offset by higher volume, productivity improvements and

some cost-based price adjustments.

• The 2005 Europe gross margin decreased 70 basis points as

compared to 2004, largely driven by higher material and oil-

related costs, partially offset by increased productivity, an

improved product mix and, to a lesser extent, a gain on the sale

of assets. In 2004, Europe gross margin improved slightly versus

2003 as productivity improvements and sales volume more than

offset pricing pressure. European operations continue to realize

savings from ongoing restructuring efforts in Europe.

• The 2005 Latin America gross margin increased 250 basis points

as compared to 2004, as the combination of cost-based price

adjustments, increased productivity and Befiex tax credits more

than offset higher material and oil-related costs, unfavorable

currency, and increased incentive compensation. In 2004, Latin

America gross margin declined 260 basis points versus 2003, due

primarily to higher material costs for steel and resins. Higher

costs were partially offset by increased volume and cost-based

price adjustments on both appliances and compressors and

favorable product mix.

•

The 2005 Asia gross margin increased 40 basis points as compared

to 2004, due to improved product mix, productivity improvements

and cost-based price adjustments that were partially offset by

higher material and oil-related costs. Asia gross margin declined

380 basis points versus 2003, due primarily to the trade inventory

reduction strategy in India and regional pricing pressures.

Selling, General and Administrative In 2005, consolidated selling,

general and administrative expenses, as a percent of consolidated

net sales, declined 50 basis points as compared to 2004, as

administrative cost reductions and scale efficiencies offset higher

freight and warehousing costs and incentive compensation in North

America and Latin America. Europe results primarily reflect the

positive impact from administrative productivity improvements and

business scale. The Asia region also benefited from scale efficiencies.

The consolidated selling, general and administrative expenses in

2004, as a percent of consolidated net sales, remained relatively

unchanged versus 2003. Higher freight rates in North and Latin

America in 2004 were partially offset by productivity in other

non-logistic areas. Europe results reflect the positive impact from

administrative productivity improvements and business scale. The

increase in Asia’s selling, general and administrative expenses as a

percent of sales in 2004 was due primarily to lower overall sales

and higher administrative support costs. In 2003, higher pension

and freight costs in North America were partially offset by cost

controls on discretionary spending. The European increase in 2003

was a result of expense reclassification into selling, general and

administrative expenses, while Latin America’s improvement was

primarily driven by lower bad debt expense in 2003. Asia’s higher

selling, general and administrative expenses as a percent of sales in

2003 were due to higher operating reserves.

Restructuring Restructuring initiatives resulted in charges of

$57 million, $15 million and $3 million in 2005, 2004 and 2003,

respectively. These amounts have been identified as a separate

component of operating profit. The Company expects to expense up

to $100 million for restructuring during 2006.

At December 31, 2005, a liability of $6 million remains for

actions yet to be completed under the global restructuring plan that

was originally announced in December of 2000. The remaining

liability pertains to lease exit costs. The restructuring plan included

the elimination of over 7,100 positions worldwide, of which

substantially all had left the Company through December 31, 2005.

Interest and Sundry Income/Expense Interest and sundry expense

increased by $51 million versus 2004. The primary drivers of this

increase were an increase in legal reserves of approximately $21

million, higher foreign currency losses on balance sheet positions,

the absence of prior year interest received on foreign tax audit

settlements in Latin America and a $9 million gain on the sale of

a partial interest in an equity investment during 2004. Interest and

sundry expense for 2004 decreased $27 million compared to 2003.

The improvement was primarily attributable to lower losses of $17

million on foreign currency balance sheet positions, primarily in

Europe, and a $9 million gain on the sale of a partial interest in an

equity investment in Latin America.

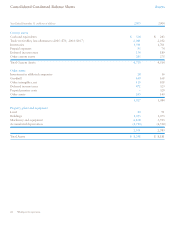

Financial Summary