Vtech 2015 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2015 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 Source: NPD Group, Retail Tracking Service

3 Source: NPD Group, Retail Tracking Service. Ranking based on total retail sales in

the combined toy categories of infant electronic learning, other infant toys and

preschool electronic learning for the 12 months ending December 2014

4 Source: MZA Ltd, 2015

5 Source: Manufacturing Market Insider, March 2015

The Group’s proven strategy focuses

on four main areas: product innovation,

market share gains, geographic

expansion and operational excellence.

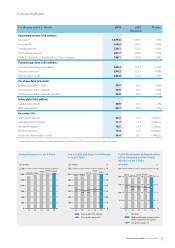

In contrast to children’s educational tablets, standalone

products recorded growth in sales, with the Go! Go! Smart

family of infant vehicles and playsets performing particularly

well. In the calendar year 2014, VTech strengthened its

position as the number one infant toy manufacturer in

France, the UK and Germany, while becoming the largest

infant toy manufacturer in Spain2. In the US, VTech became

the number one manufacturer in Infant and Preschool

Electronic Learning toys3. In the financial year 2015, standalone

products accounted for approximately 77% of total ELPs

revenue, while platform products accounted for about 23%,

as compared to approximately 68% and 32% respectively in the

financial year 2014. This decline in the share of revenue from

platform products was mainly due to lower sales of children’s

educational tablets.

TEL products revenue returned to a growth path in the financial

year 2015. All regions recorded increased sales, which were

driven by market share gains in residential phones and higher

sales of commercial phones and other telecommunication

products. In residential phones, VTech strengthened its position

as the number one cordless phone manufacturer globally,

gaining market share in North America, Asia Pacific and Other

Regions, while market share in Europe held steady4.

In commercial phones and other telecommunication products,

baby monitors saw a particularly strong performance. This

came as the Group expanded its distribution channels to

increase market presence, while major retailers in the US

moved to replace the older analogue models on the market

with VTech digital baby monitors. Within this category, video

baby monitors sold especially well. In commercial phones,

shipment of ErisStation™, the Group’s first conference phone

with wireless microphones, and ErisTerminal™, its SIP (Session

Initiation Protocol) phone systems, generated incremental

sales. In the financial year 2015, commercial phones and other

telecommunication products grew to approximately 19% of

total TEL products revenue, compared to around 14% in the

previous financial year.

CMS marked its 13th consecutive year of growth in the

financial year 2015, once again outperforming the global EMS

market5. Growth in wireless products was robust, while there

were good sales increases in switching mode power supplies,

home appliances and solid-state lighting. A strong reputation,

expertise in certain product categories and excellent customer

service have enabled VTech consistently to grow with existing

customers while adding new ones. This in turn has allowed

the Group to expand into new product categories such as

wearable and smart hearable devices. In the financial year 2015,

professional audio equipment, wireless products, switching

mode power supplies and solid-state lighting remained the top

four product categories for CMS.

Our Strategy

The Group’s proven strategy focuses on four main areas:

product innovation, market share gains, geographic expansion

and operational excellence.

Product Innovation

Product innovation is the key to VTech staying ahead of the

competition in fast-changing markets.

With regard to ELPs, the Group has a strong pipeline of

products. In standalone products, the successful Go! Go! Smart

family is being expanded through the introduction of different

themes, more vehicles and more playsets. In the US, Go! Go!

Smart Friends®, which was launched exclusively with Toys“R”Us

last year, will be introduced nationwide in the calendar year

2015. VTech will also enter new aisles by launching new

categories of product. The global launch of Flipsies™, a range

of transformable dolls and playsets, will enable the Group to

penetrate into the girl aisle. VTech is also successfully breaking

into the dolls aisle with a range of interactive dolls, branded

Little Love® in Europe and Baby Amaze™ in the US, which was

first launched in the European markets in June 2014. Kidizoom

Action Cam, the latest addition to VTech’s range of cameras

for children, will also be launched globally in the calendar

year 2015. For core learning products, VTech will continue to

broaden and refresh its product portfolio, adding over 100 new

models worldwide.

3VTech Holdings Limited Annual Report 2015