Vtech 2015 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2015 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion and Analysis Financial Review

Liquidity and Financial

Resources

Shareholders’ funds as at 31 March 2015

were US$540.8 million, a decrease of

3.8% from US$562.4 million in the last

financial year. Shareholders’ funds per

share decreased by 4.0% from US$2.24

to US$2.15.

The Group had no borrowings as at

31 March 2014 and 31 March 2015.

The Group’s financial resources remain

strong. As at 31 March 2015, deposits

and cash decreased from US$322.9

million to US$294.2 million, a decrease

of 8.9% compared with the last financial

year-end-date. It was mainly due to the

unfavourable foreign currency exchange

movements on the Group’s net assets

as a result of the depreciation in foreign

currencies against United States Dollar

during the year.

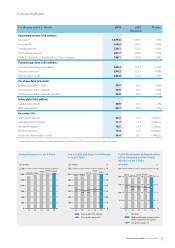

Analysis of Cash Flow from Operations

2015

US$ million

2014

(Restated)

US$ million

Change

US$ million

Operating profit 220.1 226.6 (6.5)

Depreciation and amortisation 31.6 30.8 0.8

EBITDA 251.7 257.4 (5.7)

Gain on disposal of tangible assets (0.2) (0.1) (0.1)

Working capital change (1.1) (0.1) (1.0)

Cash generated from operations 250.4 257.2 (6.8)

The Group’s cash generated from operations for the year ended 31 March 2015 was

US$250.4 million, a decrease of 2.6% as compared to US$257.2 million in the previous

financial year. The reduction was mainly attributable to the decrease in EBITDA in the

financial year 2015 and the higher working capital investment compared with the

previous financial year.

Working Capital Change

Balance as at

31 March 2014

(Restated)

US$ million

Hedging

and others

US$ million

Working

capital

change per

cash flow

US$ million

Balance as at

31 March

2015

US$ million

Stocks 265.9 – 24.3 290.2

Trade debtors 208.6 – 13.3 221.9

Other debtors, deposits

and prepayments 27.2 6.0 4.8 38.0

Trade creditors (140.8) – (45.3) (186.1)

Other creditors

and accruals (163.6) 3.4 3.7 (156.5)

Provisions (27.9) – 0.6 (27.3)

Net obligations on

defined benefit

scheme (2.0) (0.7) (0.3) (3.0)

Total working capital 167.4 8.7 1.1 177.2

Stocks as of 31 March 2015 were US$290.2 million, increased from US$265.9 million as

of 31 March 2014. The turnover days also increased from 87 days to 96 days. The higher

stock level was primarily to cater for increased demand for the Group’s product in the

first quarter of the financial year 2016. Furthermore, we had arranged early production of

the Group’s products in order to better utilise the Group’s production capacities.

As at 31 March 2015 and 2014

All figures are in US$ million unless stated otherwise 2015 2014

Stocks 290.2 265.9

Average stocks as a percentage of Group revenue 14.8% 14.3%

Turnover days 96 days 87 days

Deposits and Cash in Last 5 Years

(As at 31 March)

US$ million

400

350

300

250

200

100

150

50

011 12 13 14 15

333.1 326.5 308.6 322.9

294.2

10 VTech Holdings Limited Annual Report 2015