Vodafone 1999 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 1999 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

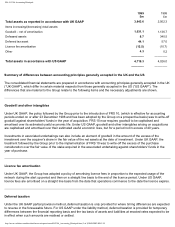

P58-59 USA Accounting Principals

Capitalisation of interest costs

Under UK GAAP, the policy of the Group is not to include interest on borrowings used to finance the construction of an

asset in the cost of the asset. Under US GAAP, the interest cost on borrowings used to finance the construction of an

asset is capitalised during the period of construction until the date that the asset is placed in service. This interest cost is

amortised over the estimated useful life of the related asset.

Pension costs

Under both UK GAAP and US GAAP pension costs are provided so as to provide for future pension liabilities. However,

there are differences in the prescribed methods of valuation, which give rise to GAAP adjustments to the pension cost and

the pension prepayment.

Employee share trusts

Under UK GAAP, the tax benefits receivable in relation to employee share trust arrangements are shown as a component

of the tax charge for the year. Under US GAAP this tax benefit is allocated to shareholders’ equity.

Dividends

Under UK GAAP, dividends are included in the financial statements when recommended by the Board of directors to the

shareholders in respect of the results for a financial year. Under US GAAP, dividends are not included in the financial

statements until declared by the Board of directors.

Defeasance of liabilities

Under UK GAAP, liabilities which have been unconditionally satisfied by monetary assets placed in trust and other set off

arrangements are considered to be extinguished. Under US GAAP, non-recognition of a liability is allowed only if the

liability has legally been extinguished.

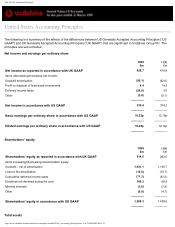

Earnings per ordinary share

Basic earnings per ordinary share has been calculated by dividing net income of £510.4m and £374.2m for the years

ended 31 March 1999 and 1998 respectively, by 3,089 million and 3,073 million, which are the approximate weighted

average number of ordinary shares outstanding for the years ended 31 March 1999 and 1998 respectively. For diluted

earnings per share, the approximate weighted average number of ordinary shares outstanding for the years ended 31

March 1999 and 1998 was 3,102 million and 3,082 million respectively.

http://www.vodafone.com/download/investor/reports/annual99/USA_Accounting_Principals.htm (3 of 3)30/03/2007 00:12:25