Vodafone 1999 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1999 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

The increase in the minority interests in profit on ordinary activities after taxation is primarily due to the impact of the

increased profits arising in the Group’s 55% owned Greek subsidiary, Panafon.

BACK TO TOP

Future results

There are many factors that will influence the Group’s future performance, the most significant of these being the

proposed merger with AirTouch.

In respect of the Group’s continuing operations, factors affecting future turnover and profit performance are the potential

for growth of the mobile telecommunications markets, the Group’s market share, revenue per customer, the costs of

providing and selling existing services and start up costs of new businesses.

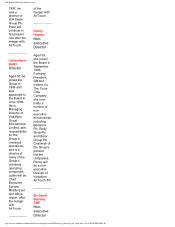

Potential for growth

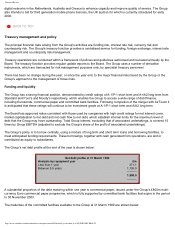

Market

penetration

Penetration

added in

Population 98/99 98/99

million % %

UK 58.4 25.5 10.0

Australia 18.7 32.2 3.7

Egypt 63.0 0.6 0.4

Fiji 0.8 1.0 0.4

France 58.6 21.4 10.1

Germany 82.3 18.8 7.5

Greece 10.5 22.8 12.6

Malta 0.4 6.3 1.2

Netherlands 15.7 26.4 13.4

New Zealand 3.8 20.8 4.0

South Africa 40.6 8.2 3.6

Sweden 8.9 54.0 16.4

Uganda 21.0 0.1 0.0

The global market for mobile

telecommunications continues to provide

the potential for significant growth. Cellular

penetration is expected to exceed 50% in

most of the Group’s major markets by the

end of the year 2002 as consumers endorse

the benefit of mobile telephony, enhanced

by increasingly lightweight, secure and

attractive equipment. Mobile telephony is

also expected to replace a large proportion

of telecommunications traffic currently

carried by fixed networks and will act as a

major platform for both voice and data

communications.

BACK TO TOP

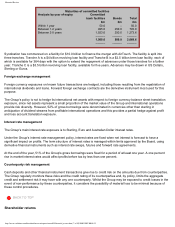

Balance sheet

Fixed assets

Total fixed assets increased by £940.6m, primarily due to the effect of continued capital investment in network operations,

goodwill arising on acquisitions and investment in new businesses. Intangible fixed assets, which are capitalised in

accordance with the Group’s accounting policy, increased by £191.7m, of which £172.6m related to goodwill, net of

amortisation charges, arising on acquisitions completed during the year. Tangible fixed assets increased by £578.7m,

primarily as a result of capital expenditure on digital networks in the UK, Australia, the Netherlands and Greece and the

inclusion of Vodafone New Zealand’s fixed assets on acquisition. The movement in investments, which includes equity

investments and loans advanced to associated undertakings and other investments, is analysed in the table below.

http://www.vodafone.com/download/investor/reports/annual99/financial_review.htm (4 of 10)30/03/2007 00:08:22