Vodafone 1999 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1999 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

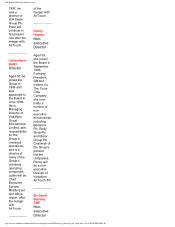

Average exchange rates

Year to

31 March

Year to

31 March

Percentage

change

Currency 1999 1998 %

Australian Dollar 2.68 2.30 16.5

Dutch Guilder 3.26 3.28 (0.6)

French Franc 9.68 9.80 (1.2)

German Mark 2.89 2.92 (1.0)

Greek Drachma 488.69 462.40 5.7

South African Rand 9.61 7.75 24.0

Swedish Krona 13.18 12.85 2.6

The

adverse

impact of

exchange

rates on

total

Group

operating

profit

was

£22.7m,

due

primarily

to the

strength

of

sterling

against

the

South

African

Rand

and

Greek

Drachma.

Proportionate EBITDA, which reflects the cash flow of all the Group’s activities, increased

by 33% to £1,218.0m from £919.0m. Proportionate EBITDA is defined as operating profit

before exceptional reorganisation costs plus depreciation and amortisation of

subsidiaries, associated undertakings and investments, proportionate to equity stakes.

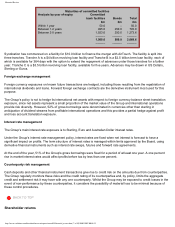

Profit on disposal of fixed asset investments and businesses

The profit on disposal of fixed asset investments of £66.7m arose principally from the

part-disposal of the Group’s interest in Globalstar, reducing its interest from 5.2% to

3.0%. The Group also disposed of the business and net assets of its French service

provider business, which was operated by Vodafone SA, in November 1998.

Interest

The Group’s net interest cost increased by £33.0m as net borrowings increased by £391.0m to finance international

acquisitions.

Taxation

The effective tax rate decreased by 4.3% to 27.0% primarily as a result of the utilisation of brought forward losses in

overseas operations. Excluding the effect of disposals, the effective rate decreased from 32.5% to 28.7%.

Minority interests

http://www.vodafone.com/download/investor/reports/annual99/financial_review.htm (3 of 10)30/03/2007 00:08:22