Vodafone 1999 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 1999 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Statement of Accounting Policies

Transactions in foreign currencies are recorded at the exchange rates ruling on the dates of those transactions, adjusted

for the effects of any hedging arrangements. Foreign currency monetary assets and liabilities, including the Group’s

interest in the underlying net assets of associated undertakings, are translated into sterling at year end rates.

The results of the international subsidiary and associated undertakings are translated into sterling at average rates of

exchange. The adjustment to year end rates is taken to reserves. Exchange differences which arise on the retranslation of

international subsidiary and associated undertakings’ balance sheets at the beginning of the year and equity additions and

withdrawals during the financial year are dealt with as a movement in reserves.

Other translation differences are dealt with in the profit and loss account.

Derivative financial instruments

Transactions in derivative financial instruments are for risk management purposes only.

The Group uses derivative financial instruments to hedge its exposure to interest rate and foreign currency risk. To the

extent that such instruments are matched against an underlying asset or liability, they are accounted for using hedge

accounting.

Gains or losses on interest rate instruments are matched against the corresponding interest charge or interest receivable

in the profit and loss account over the life of the instrument. For foreign exchange instruments, gains or losses and

premiums or discounts are matched to the underlying transactions being hedged.

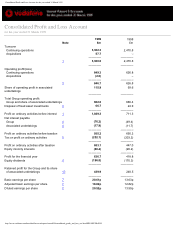

Turnover

Turnover represents the invoiced value, excluding value added tax, of services and goods supplied by the Group.

Pensions

Costs relating to defined benefit plans, which are periodically calculated by professionally qualified actuaries, are charged

against profits so that the expected costs of providing pensions are recognised during the period in which benefit is

derived from the employees’ services.

The costs of the various pension schemes may vary from the funding, dependent upon actuarial advice, with any

difference between pension cost and funding being treated as a provision or prepayment.

Defined contribution pension costs charged to the profit and loss account represent contributions payable in respect of the

period.

Research and development

Expenditure on research and development is written-off in the year in which it is incurred.

Scrip dividends

http://www.vodafone.com/download/investor/reports/annual99/statement_of_accounting_policies.htm (2 of 4)30/03/2007 00:11:50