Vodafone 1999 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 1999 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

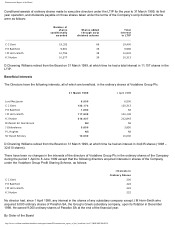

Remuneration Report of the Board

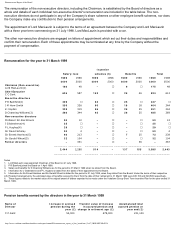

P R Bamford 3,100 26,000 5,300

J M Horn-Smith 18,200 214,000 134,500

K J Hydon 30,700 432,000 168,900

D Channing Williams(2) 19,300 236,000 141,600

Contributions paid to a funded unapproved retirement benefit scheme for the benefit of P R Bamford amounted to £56,850

in the year.

Notes

1. The pension benefits earned by the directors are those which would be paid annually on retirement, on service to the end of the year, at the normal retirement age.

Salaries have been averaged over 3 years in accordance with Inland Revenue regulations. The increase in accrued pension during the year excludes any increase for

inflation. The transfer value has been calculated on the basis of actuarial advice in accordance with the Faculty and Institute of Actuaries’ Guidance Note GN11. No director

elected to pay Additional Voluntary Contributions.

2. Pension benefits for D Channing Williams are for the period to 31 March 1999 when he retired from the Board.

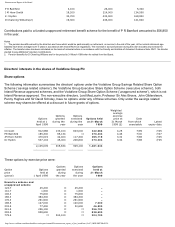

Directors’ interests in the shares of Vodafone Group Plc

Share options

The following information summarises the directors’ options under the Vodafone Group Savings Related Share Option

Scheme (‘savings related scheme’), the Vodafone Group Executive Share Option Scheme (‘executive scheme’), both

Inland Revenue approved schemes, and the Vodafone Group Share Option Scheme (‘unapproved scheme’), which is not

Inland Revenue approved. The non-executive directors, Lord MacLaurin, Professor Sir Alec Broers, John Gildersleeve,

Penny Hughes and Sir David Scholey, have no options under any of these schemes. Only under the savings related

scheme may shares be offered at a discount in future grants of options.

Options

held at 1

April 1998

Options

granted

during the

year

Options

exercised

during the

year

Options held

at 3 1 March

199 9

Weighted

average

exercise

price at

31 March

1999 (£)

Date

from which

exercisable Latest

expiry date

CC Gent 912,586 133,100 603,000 442,686 4.25 7/99 7/05

PR Bamford 185,300 85,134 – 270,434 4.46 7/00 7/07

JM Horn-Smith 470,019 42,400 117,300 395,119 3.30 7/98 7/05

KJ Hydon 537,104 45,000 208,800 373,304 3.34 7/98 7/05

__________ __________ __________ __________

2,105,009 305,634 929,100 1,4 81,543

__________ __________ __________ __________

These options by exercise price were:

Options Options Options

Option Options granted exercised held at

price held at during during 31 March

(pence) 1 April 1998 the year the year 199 9

Executive schem e and

unapproved schem e

124.7 25,200 – 25,200 –

141.7 1,500 – 1,500 –

146.3 75,600 – 75,600 –

166.3 384,300 – 384,300 –

176.3 291,900 – 291,900 –

198.5 127,000 – 120,000 7,0 0 0

233.5 77,400 – 30,600 46,8 0 0

241.5 256,100 – – 256,100

293.5 838,600 – – 838,600

779.5 – 304,100 – 304,100

http://www.vodafone.com/download/investor/reports/annual99/remuneration_report_of_the_board.htm (4 of 7)30/03/2007 00:09:24