Vodafone 1999 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 1999 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Remuneration Report of the Board

financial years ending 31 March 2001. If an executive chooses not to accept the provisional award of shares, he may

receive a cash bonus up to 25% of salary.

For the LTIP, the independent trustee of the Vodafone Group Employee Trust, a discretionary trust, purchases ordinary

shares in Vodafone Group Plc in the market. Shares are then awarded conditionally to eligible executive directors and

senior executives at the beginning of a three year period, the ultimate vesting of the award being conditional upon the

achievement of performance criteria set by the Remuneration Committee for that three year period. If the performance

criteria are met, the shares will be transferred from the Vodafone Group Employee Trust to the executive directors and

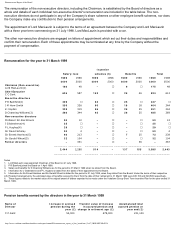

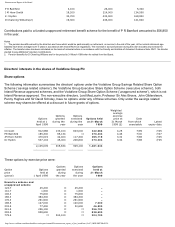

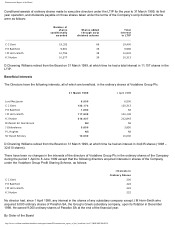

senior executives at nil consideration. Details of the benefits provided to the executive directors under the STIP and the

LTIP are in tables here.

All executive directors are contributing members of the Vodafone Group Pension Scheme, which is a scheme approved by

the Inland Revenue. P R Bamford, whose benefits under the scheme are restricted by Inland Revenue earnings limits, also

participates in a defined contribution funded unapproved retirement benefits scheme in order to bring his benefits into line

with those of the other executive directors. Details of the salaries and benefits of all the directors are set out in the table

here. A separate table shows the pension benefits earned by the directors in the year.

Annual salaries are reviewed each year with effect from 1 July and the Remuneration Committee takes into account not

only the individual performances and contributions of each of the executive directors but also the overall performance of the

Group, the earnings per share of the Group, the level of increases awarded to staff throughout the Group and information

provided to it on the salaries for similar roles in comparable companies. If the responsibilities of executive directors change

during the year, the Committee meets to discuss and review remuneration packages, including salaries, at that time.

Executive share ownership

The Remuneration Committee believes that share ownership by executive directors increases the link between the interests

of the directors and the interests of the Company’s shareholders. The Company’s executive share option schemes, in which

over three hundred of the Group’s directors, executives and senior managers participate, are operated on the basis that

options over the Company’s shares may be granted once each year at, for directors, a multiple of one times taxable

earnings subject to an overall maximum holding equivalent to four times taxable earnings at the date of grant. The savings

related share option scheme permits employees to save a fixed sum each month, up to a maximum of £250 per month, for

three or five years and to use the proceeds of the savings to exercise options granted at a price 20% below the market

price of the shares at the beginning of the savings period. The profit sharing share scheme similarly permits eligible

employees to contribute up to 5% of their salary each month, up to a maximum of £665 per month, to enable trustees of the

scheme to purchase shares on their behalf, with an equivalent number of shares being purchased for the employee by the

Company. All the executive directors participate in each of the share schemes. Share options are analysed in the table here.

Service contracts

The Remuneration Committee has determined that new appointments of executive directors to the Board will be on the

terms of a contract which can be terminated by the Company at the end of an initial term of two years or at any time

thereafter on one year’s notice. Contracts on such a basis were granted to J M Horn-Smith on 4 June 1996, to C C Gent

and K J Hydon on 1 January 1997 and to P R Bamford on 1 April 1998, each of which is now, therefore, terminable by the

Company on one year’s notice. The service contracts of all the executive directors contain a provision increasing the period

of notice required from the Company to two years in the event that the contract is terminated by the Company within one

year of a change of control of the Company. The directors are required to give the Company one year’s notice if they wish

to terminate their contracts.

Non-executive directors

http://www.vodafone.com/download/investor/reports/annual99/remuneration_report_of_the_board.htm (2 of 7)30/03/2007 00:09:24