Vodafone 1999 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 1999 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

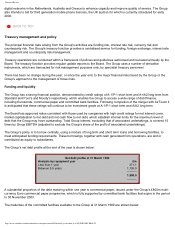

Maturities of committed facilities

Analysis by year of expiry Committed

bank facilities Bonds Total

£m £m £m

Within 1 year 50.0 – 50.0

Between 1-2 years 495.0 250.0 745.0

Between 2-5 years 1,023.6 250.0 1,273.6

–––––– –––––– ––––––

1,568.6 500.0 2,068.6

–––––– –––––– ––––––

Syndication has commenced on a facility for $10.0 billion to finance the merger with AirTouch. The facility is split into

three tranches. Tranche A is a $4 billion revolving loan facility and Tranche B is a $2.5 billion term loan facility, each of

which is available for 364 days with the option to extend the repayment of advances under those tranches for a further

year. Tranche C is a $3.5 billion revolving loan facility, available for five years. Advances may be drawn in US Dollars,

Sterling or Euros.

Foreign exchange management

Foreign currency exposures on known future transactions are hedged, including those resulting from the repatriation of

international dividends and loans. Forward foreign exchange contracts are the derivative instrument most used for this

purpose.

The Group’s policy is not to hedge its international net assets with respect to foreign currency balance sheet translation

exposure, since net assets represent a small proportion of the market value of the Group and international operations

provide risk diversity. However, 52% of gross borrowings were denominated in currencies other than sterling in

anticipation of dividend streams from profitable international operations and this provides a partial hedge against profit

and loss account translation exposure.

Interest rate management

The Group’s main interest rate exposure is to Sterling, Euro and Australian Dollar interest rates.

Under the Group’s interest rate management policy, interest rates are fixed when net interest is forecast to have a

significant impact on profits. The term structure of interest rates is managed within limits approved by the Board, using

derivative financial instruments such as interest rate swaps, futures and forward rate agreements.

At the end of the year, 51% of the Group’s gross borrowings were fixed for a period of at least one year. A one percent

rise in market interest rates would affect profits before tax by less than one percent.

Counterparty risk management

Cash deposits and other financial instrument transactions give rise to credit risk on the amounts due from counterparties.

The Group regularly monitors these risks and the credit rating of its counterparties and, by policy, limits the aggregate

credit and settlement risk it may have with any one counterparty. Whilst the Group may be exposed to credit losses in the

event of non-performance by these counterparties, it considers the possibility of material loss to be minimal because of

these control procedures.

BACK TO TOP

Shareholder returns

http://www.vodafone.com/download/investor/reports/annual99/financial_review.htm (7 of 10)30/03/2007 00:08:22