United Healthcare 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Long-Term Investments with an equal amount in Long-Term Other Liabilities in the Consolidated Balance

Sheets. The total deferrals are distributable based upon termination of employment or other periods, as elected

under each plan and are $225 million and $212 million as of December 31, 2007 and 2006, respectively.

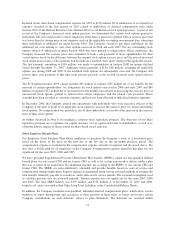

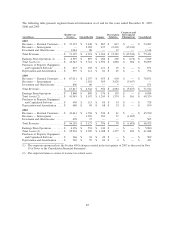

11. Income Taxes

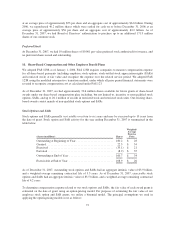

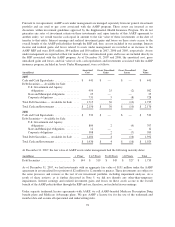

The components of the provision for income taxes for the years ended December 31 are as follows:

(in millions) 2007 2006 2005

Current Provision

Federal ........................................... $ 2,284 $ 2,236 $ 1,594

State and Local ..................................... 166 158 125

Total Current Provision .......................... 2,450 2,394 1,719

Deferred Provision ...................................... 201 (25) 37

Total Provision for Income Taxes .................. $ 2,651 $ 2,369 $ 1,756

The reconciliation of the tax provision at the U.S. Federal Statutory Rate to the provision for income taxes for the

years ended December 31 is as follows:

(in millions) 2007 2006 2005

Tax Provision at the U.S. Federal Statutory Rate .............. $ 2,557 $ 2,285 $ 1,693

State Income Taxes, net of federal benefit .................... 120 116 87

Tax-Exempt Investment Income ........................... (52) (50) (40)

Other, net ............................................. 26 18 16

Provision for Income Taxes ........................... $ 2,651 $ 2,369 $ 1,756

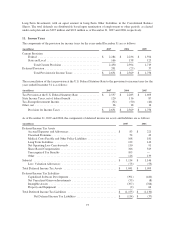

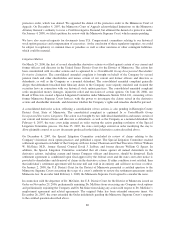

As of December 31, 2007 and 2006, the components of deferred income tax assets and liabilities are as follows:

(in millions) 2007 2006

Deferred Income Tax Assets

Accrued Expenses and Allowances ................................. $ 83 $ 221

Unearned Premiums ............................................. 54 43

Medical Costs Payable and Other Policy Liabilities .................... 168 181

Long Term Liabilities ........................................... 132 142

Net Operating Loss Carryforwards ................................. 110 91

Share-Based Compensation ....................................... 346 329

Unrecognized Tax Benefits ....................................... 105 —

Other ........................................................ 116 139

Subtotal .......................................................... $ 1,114 $ 1,146

Less: Valuation Allowances ...................................... (73) (53)

Total Deferred Income Tax Assets ..................................... $ 1,041 $ 1,093

Deferred Income Tax Liabilities

Capitalized Software Development ................................. (391) (420)

Net Unrealized Gains on Investments ............................... (55) (8)

Intangible Assets ............................................... (707) (766)

Property and Equipment ......................................... (2) 64

Total Deferred Income Tax Liabilities .................................. $ (1,155) $ (1,130)

Net Deferred Income Tax Liabilities ............................ $ (114) $ (37)

75