United Healthcare 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

becomes known or when we do not anticipate holding the investment until recovery. If any of our investments

experience a decline in fair value that is determined to be other-than-temporary, based on analysis of relevant

factors, we record a realized loss in our Consolidated Statements of Operations. We do not consider the

unrealized losses on each of the investments described above to be other-than-temporarily impaired at

December 31, 2007.

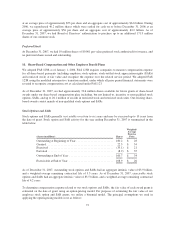

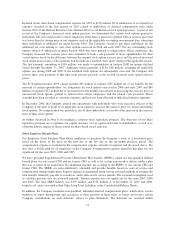

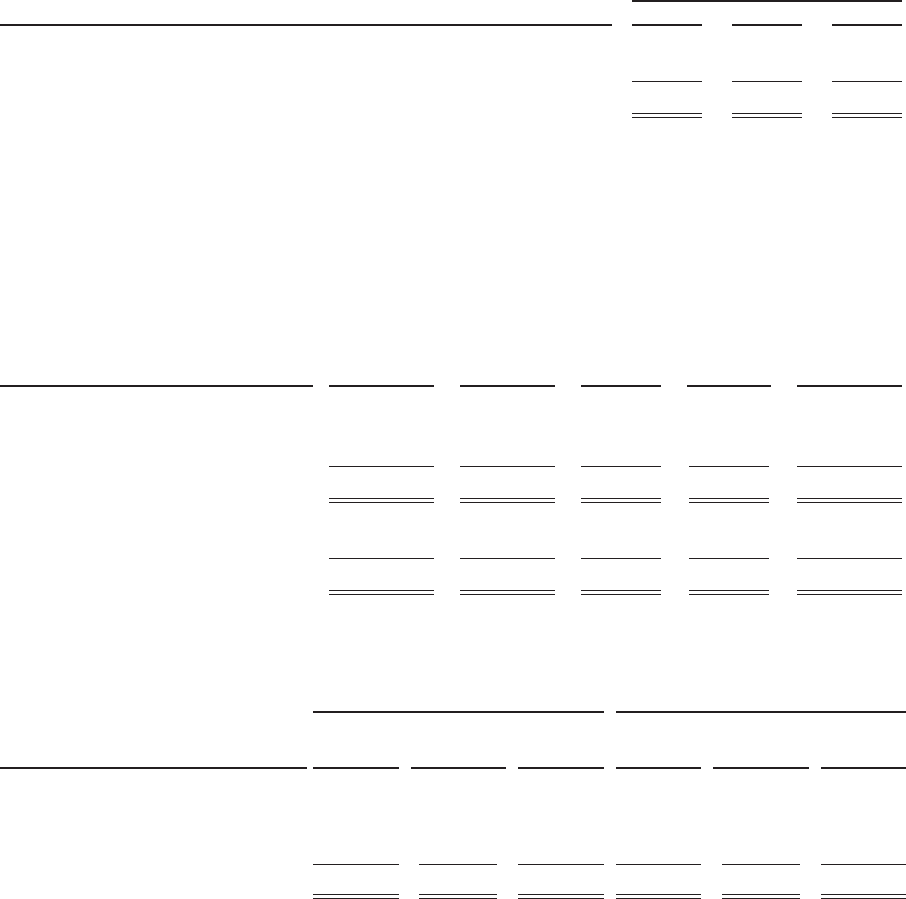

We recorded realized gains and losses on sales of investments, as follows:

For the Year Ended

December 31,

(in millions) 2007 2006 2005

Gross Realized Gains ........................................... $ 57 $ 41 $ 60

Gross Realized Losses ........................................... (19) (37) (50)

Net Realized Gains ......................................... $ 38 $ 4 $ 10

Included in the realized losses above are impairment charges of $6 million, $4 million and $8 million for 2007,

2006 and 2005, respectively.

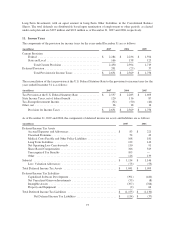

6. Goodwill and Other Intangible Assets

Changes in the carrying amount of goodwill, by segment, during the years ended December 31, 2007 and 2006,

were as follows:

(in millions)

Health

Care

Services OptumHealth Ingenix

Prescription

Solutions Consolidated

Balance at December 31, 2005 ...... $ 14,105 $ 742 $ 715 $ 676 $ 16,238

Acquisitions and Subsequent

Payments/Adjustments .......... 161 331 92 — 584

Balance at December 31, 2006 ...... $ 14,266 $ 1,073 $ 807 $ 676 $ 16,822

Acquisitions and Subsequent

Payments/Adjustments .......... (127) 7 151 1 32

Balance at December 31, 2007 ...... $ 14,139 $ 1,080 $ 958 $ 677 $ 16,854

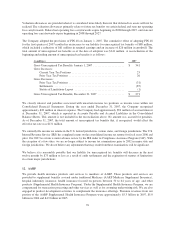

The gross carrying value, accumulated amortization and net carrying value of other intangible assets as of

December 31, 2007 and 2006, were as follows:

December 31, 2007 December 31, 2006

(in millions)

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

Customer Contracts and Membership

Lists ............................$ 1,879 $ (394) $ 1,485 $ 1,871 $ (246) $ 1,625

Patents, Trademarks and Technology .... 302 (121) 181 303 (89) 214

Other ............................. 109 (38) 71 103 (38) 65

Total .........................$ 2,290 $ (553) $ 1,737 $ 2,277 $ (373) $ 1,904

Amortization expense relating to intangible assets was $192 million in 2007, $181 million in 2006 and $94

million in 2005. Estimated full year amortization expense relating to intangible assets for each of the next five

years is as follows: $185 million in 2008, $167 million in 2009, $158 million in 2010, $153 million in 2011, and

$151 million in 2012.

67