United Healthcare 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.claims processing and formulary design and management. Product revenues include ingredient costs (net of

rebates), a negotiated dispensing fee and customer co-payments for drugs dispensed through our mail-service

pharmacy. In all retail pharmacy transactions, revenues recognized always exclude the member’s applicable

co-payment. Product revenues are recognized upon sale or shipment. Service revenues are recognized when the

prescription claim is adjudicated. The Company has entered into retail service contracts that separately obligate us

to pay our network pharmacy providers for benefits provided to its customers, whether or not we are paid. We are

also involved in establishing the prices charged by retail pharmacies, determining which drugs will be included in

formulary listings and selecting which retail pharmacies will be included in the network offered to plan sponsors’

members. As a result, revenues are reported on a gross basis in accordance with Emerging Issues Task Force (EITF)

Issue No. 99-19, “Reporting Gross Revenue as a Principal versus Net as an Agent.” Product revenues also include

sales of Ingenix syndicated content products which are recognized as revenue upon shipment.

Medical Costs and Medical Costs Payable

Medical costs and medical costs payable include estimates of our obligations for medical care services that have

been rendered on behalf of insured consumers but for which we have either not yet received or processed claims,

and for liabilities for physician, hospital and other medical cost disputes. We develop estimates for medical costs

incurred but not reported using an actuarial process that is consistently applied, centrally controlled and

automated. The actuarial models consider factors such as time from date of service to claim receipt, claim

backlogs, care professional contract rate changes, medical care consumption and other medical cost trends. We

estimate liabilities for physician, hospital and other medical cost disputes based upon an analysis of potential

outcomes, assuming a combination of litigation and settlement strategies. Each period, we re-examine previously

established medical costs payable estimates based on actual claim submissions and other changes in facts and

circumstances. As the liability estimates recorded in prior periods become more exact, we adjust the amount of

the estimates, and include the changes in estimates in medical costs in the period in which the change is

identified. In every reporting period, our operating results include the effects of more completely developed

medical costs payable estimates associated with previously reported periods.

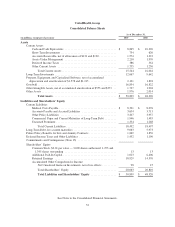

Cash, Cash Equivalents and Investments

Cash and cash equivalents are highly liquid investments that generally have an original maturity of three months

or less. The fair value of cash and cash equivalents approximates their carrying value because of the short

maturity of the instruments. Investments with maturities of less than one year are classified as short-term. We

may sell investments classified as long-term before their maturities to fund working capital or for other purposes.

Because of regulatory requirements, certain investments are included in long-term investments regardless of their

maturity date. We classify these investments as held-to-maturity and report them at amortized cost. All other

investments are classified as available for sale and reported at fair value based on quoted market prices.

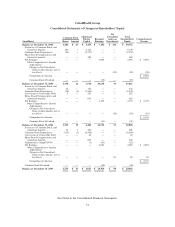

We exclude unrealized gains and losses on investments available for sale from earnings and report them, net of

income tax effects, as a separate component of shareholders’ equity. We continually monitor the difference

between the cost and estimated fair value of our investments. For those investments in an unrealized loss

position, we analyze relevant factors individually and in combination including the length of time and extent to

which market value has been less than cost, the financial condition and near-term prospects of the issuer as well

as specific events or circumstances that may influence the operations of the issuer, and our intent and ability to

hold the investment for a sufficient time to recover our cost. New information and the passage of time can change

these judgments. We revise impairment judgments when new information becomes known or when we do not

anticipate holding the investment until the forecasted recovery. If any of our investments experience a decline in

value that is determined to be other than temporary, based on analysis of relevant factors, we record a realized

loss in Investment and Other Income in our Consolidated Statements of Operations. We manage our investment

portfolio to limit our exposure to any one issuer or industry and largely limit our investments to U.S. Government

and Agency securities, state and municipal securities, and corporate debt obligations that are investment grade.

To calculate realized gains and losses on the sale of investments, we use the specific cost or amortized cost of

each investment sold.

56