United Healthcare 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

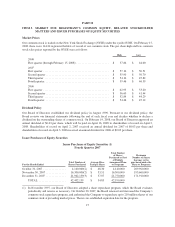

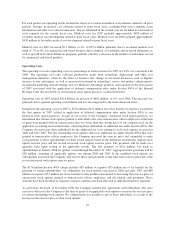

The following table summarizes the number of individuals served by Health Care Services, by major market

segment and funding arrangement, as of December 31:

(in thousands) 2007 2006

Commercial Risk-based ...................................................... 10,805 11,285

Commercial Fee-based ....................................................... 14,720 14,415

Total Commercial ....................................................... 25,525 25,700

Medicare Advantage ......................................................... 1,370 1,445

Medicaid .................................................................. 1,710 1,465

Standardized Medicare Supplement ............................................. 2,400 2,275

Total Public and Senior ................................................... 5,480 5,185

Total Health Care Services Medical Benefits .................................. 31,005 30,885

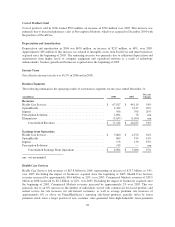

The number of individuals served with commercial products as of December 31, 2007 decreased by 175,000, or

1%, from the prior year. The number of individuals served with commercial fee-based products as of

December 31, 2007 increased by 305,000, or 2%, over 2006 driven by new customer relationships and customers

converting from risk-based products to fee-based products, partially offset by employment attrition at continuing

customers. The number of individuals served with commercial risk-based products decreased by 480,000, or 4%,

primarily due to a competitive pricing environment and the conversion of individuals to fee-based products.

The number of individuals served by Medicare Advantage products as of December 31, 2007 decreased by

75,000, or 5%, from 2006, primarily due to a decline in participation in private-fee-for-service offerings, while

individuals served by standardized Medicare supplement products increased by 125,000, or 5%, due to new

customer relationships. Medicaid enrollment increased 245,000, or 17%, in 2007 primarily due to new customer

gains, including 180,000 individuals served under the TennCare program in Tennessee.

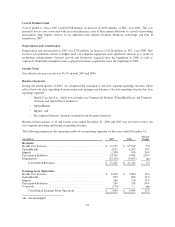

OptumHealth

OptumHealth provides health, well-being and financial services to people and organizations nationwide through

personalized health advocacy and engagement, specialized benefits such as behavioral, dental and vision

offerings, and health-based financial services. OptumHealth revenues of $4.9 billion increased by $579 million,

or 13%, over 2006. This increase was principally driven by an increase in the number of individuals served by

several of its specialty benefit businesses and rate increases related to these businesses.

OptumHealth earnings from operations in 2007 of $895 million increased $86 million, or 11%, over 2006

primarily due to the membership growth and rate increases discussed above. The OptumHealth operating margin

declined from 18.6% in 2006 to 18.2% in 2007 due to a continued business mix shift toward higher revenue,

lower margin products, partially offset by effective operating cost management.

Ingenix

Ingenix offers solutions to a spectrum of health care market participants on a national and international basis,

including data management services, software products, publications, consulting and actuarial services, business

process outsourcing services, clinical research outsourcing, pharmaceutical data and consulting services, and

revenue cycle management solutions. Ingenix revenues for 2007 of $1.3 billion increased by $348 million, or

36%, over 2006. This was primarily driven by new business growth in the health information and contract

research businesses as well as from businesses acquired since the beginning of 2006.

Ingenix earnings from operations in 2007 were $266 million, up $90 million, or 51%, from 2006. This increase in

earnings from operations was primarily due to growth in the health information and contract research businesses,

businesses acquired since the beginning of 2006 and effective operating cost management. The operating margin

25