United Healthcare 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

products and a 5% decrease in the number of individuals served by commercial risk-based products in 2006

primarily due to the Company’s internal pricing decisions in a competitive commercial risk-based pricing

environment and the conversion of certain groups to fee-based products. Ovations revenues of $24.6 billion in

2006 increased by approximately $15.2 billion, or 162%, over 2005. Excluding the impact of acquisitions since

the beginning of 2005, Ovations revenues increased by $7.8 billion, or 85%, over 2005. The increase was

primarily driven by the successful launch of the Medicare Part D program, which had premium revenues of $5.7

billion for 2006, and an increase in the number of individuals served by Medicare Advantage and standardized

Medicare supplement products, as well as rate increases on these products. The remaining increase in Health

Care Services revenues is attributable to a 8% increase in AmeriChoice revenues, excluding the impact of

businesses acquired since the beginning of 2005, primarily driven by membership growth and premium revenue

rate increases on Medicaid products.

Health Care Services earnings from operations in 2006 were $5.9 billion, representing an increase of $1.5 billion,

or 34%, over 2005. This increase was principally driven by acquisitions and increases in the number of

individuals served by Ovations’ Medicare and Part D products and Commercial Markets’ fee-based products.

The segment also benefited by productivity gains from technology deployment and other cost management

initiatives, including cost savings associated with the PacifiCare acquisition integration. These initiatives also

reduced labor and occupancy costs in the transaction processing and customer service, billing and enrollment

functions. The Commercial Markets medical care ratio increased to 80.5% in 2006 from 79.6% in 2005 and the

UnitedHealthcare medical care ratio increased to 79.8% in 2006 from 78.6% in 2005, mainly due to the impact of

the PacifiCare acquisition and changes in product, business and customer mix. Health Care Services’ operating

margin for 2006 was 8.6%, a decrease from 9.9% in 2005. This decrease was driven mainly by the acquisition of

PacifiCare and the new Medicare Part D program, which have lower operating margins than historic

UnitedHealth Group businesses.

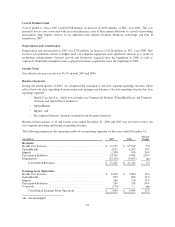

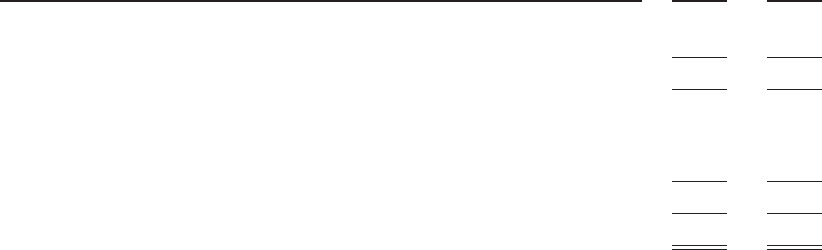

The following table summarizes the number of individuals served by Health Care Services, by major market

segment and funding arrangement, as of December 31:

(in thousands) 2006 2005

Commercial Risk-based ............................................ 11,285 11,350

Commercial Fee-based ............................................. 14,415 13,240

Total Commercial ............................................. 25,700 24,590

Medicare Advantage ............................................... 1,445 1,185

Medicaid ........................................................ 1,465 1,290

Standardized Medicare Supplement ................................... 2,275 2,150

Total Public and Senior ......................................... 5,185 4,625

Total Health Care Services Medical Benefits ........................ 30,885 29,215

The number of individuals served by commercial products as of December 31, 2006 increased by approximately

1.1 million, or 5%, over the prior year. Excluding the impact of businesses acquired since the beginning of 2005,

commercial business individuals served increased by 565,000, or 3%, over the prior year. This included an

increase of approximately 1.0 million in the number of individuals served with commercial fee-based products,

driven by new customer relationships and customers converting from risk-based products to fee-based products,

offset by a decrease of approximately 475,000 in the number of individuals served with commercial risk-based

products primarily due to the Company’s internal pricing decisions in a competitive commercial risk-based

pricing environment and the conversion of certain groups to fee-based products.

Excluding businesses acquired since the beginning of 2005, the number of individuals served by Medicare

Advantage products increased by 230,000 from 2005 primarily due to new customer relationships, while

individuals served by standardized Medicare supplement products increased by 125,000, or 6%, due to new

29