United Healthcare 2007 Annual Report Download - page 73

Download and view the complete annual report

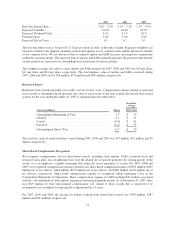

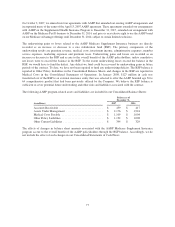

Please find page 73 of the 2007 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Instruments and Hedging Activities” (FAS 133), whereby the hedges are reported in our Consolidated Balance

Sheets at fair value, and the carrying value of the long-term debt is adjusted for an offsetting amount representing

changes in fair value attributable to the hedged risk. Since these amounts completely offset, we have reported

both the swap asset and the debt liability within debt in our Consolidated Balance Sheets and there have been no

net gains or losses recognized in our Consolidated Statements of Operations. At December 31, 2007, the rates

used to accrue interest expense on these agreements ranged from 4.1% to 6.1%.

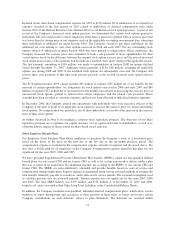

Our debt arrangements and credit facilities contain various covenants, the most restrictive of which require us to

maintain a debt-to-total-capital ratio (calculated as the sum of commercial paper and debt divided by the sum of

commercial paper, debt and shareholders’ equity) below 50%. We were in compliance with the requirements of

all debt covenants as of December 31, 2007. On August 28, 2006, we received a purported notice of default from

persons claiming to hold our 5.8% Senior Unsecured Notes due March 15, 2036 alleging a violation of the

indenture governing those debt securities. This followed our announcement that we would delay filing our

quarterly report on Form 10-Q for the quarter ended June 30, 2006 (See Note 13).

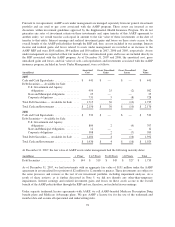

PacifiCare had approximately $100 million par value of 3% convertible subordinated debentures (convertible

notes) which were convertible into approximately 5.2 million shares of UnitedHealth Group’s common stock and

$102 million of cash as of December 31, 2005. In December 2005, we initiated a consent solicitation to all of the

holders of outstanding convertible notes pursuant to which we offered to compensate all holders who elected to

convert their notes in accordance with existing terms and consent to an amendment to a covenant in the indenture

governing the convertible notes. The compensation consisted of the present value of interest through October 18,

2007, the earliest mandatory redemption date, plus a pro rata share of $1 million. On January 31, 2006,

approximately $91 million of the convertible notes were tendered pursuant to the offer, for which we issued

4.8 million shares of UnitedHealth Group common stock, valued at $282 million, and cash of $93 million and

amended the indenture governing these notes. During 2007, approximately $9 million of convertible notes were

tendered for conversion, for which we issued 470,119 shares of UnitedHealth Group common stock, valued at

approximately $24 million, and cash of approximately $10 million. In September 2007, we notified the

remaining holders of our intent to fully redeem all outstanding convertible notes on October 18, 2007, the earliest

redemption date. As of October 16, 2007, all convertible notes were tendered pursuant to this redemption notice.

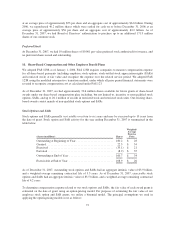

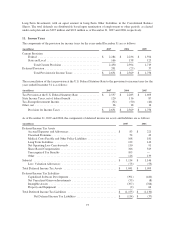

9. Shareholders’ Equity

Regulatory Capital and Dividend Restrictions

We conduct a significant portion of our operations through subsidiaries that are subject to standards established

by the National Association of Insurance Commissioners. These standards, among other things, require these

subsidiaries to maintain specified levels of statutory capital, as defined by each state, and restrict the timing and

amount of dividends and other distributions that may be paid to their parent companies. Generally, the amount of

dividend distributions that may be paid by a regulated subsidiary, without prior approval by state regulatory

authorities, is limited based on the entity’s level of statutory net income and statutory capital and surplus. At

December 31, 2007, approximately $2.4 billion of our $22.3 billion of cash and investments was held by

non-regulated subsidiaries and was available for general corporate use, including acquisitions and common stock

repurchases.

As of December 31, 2007, our regulated subsidiaries had aggregate statutory capital and surplus of approximately

$10.0 billion, which is significantly more than the aggregate minimum regulatory requirements.

Stock Repurchase Program

Under our Board of Directors’ authorization, we maintain a common stock repurchase program. Repurchases

may be made from time to time at prevailing prices, subject to certain restrictions on volume, pricing and timing.

During 2007, we repurchased 125.3 million shares which were settled for cash on or before December 31, 2007

71