United Healthcare 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

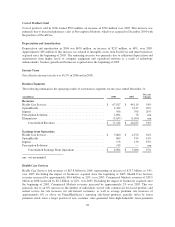

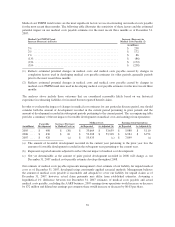

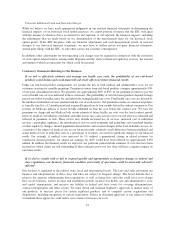

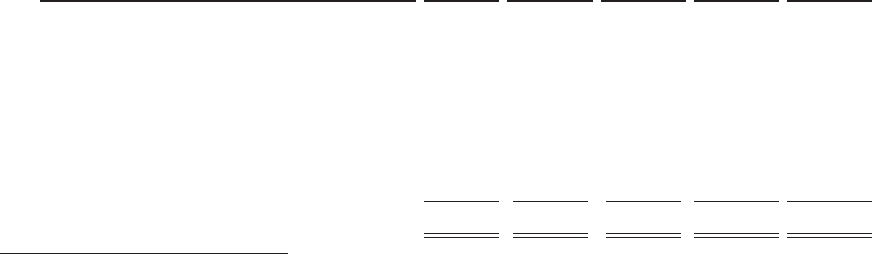

Contractual Obligations, Off-Balance Sheet Arrangements and Commitments

The following table summarizes future obligations due by period as of December 31, 2007, under our various

contractual obligations, off-balance sheet arrangements and commitments:

(in millions) 2008 2009 to 2010 2011 to 2012 Thereafter Total

Debt and Commercial Paper (1) ............ $ 1,946 $ 2,103 $ 1,197 $ 5,763 $ 11,009

Interest on Debt and Commercial Paper (2) . . .

484 804 655 4,147 6,090

Operating Leases ....................... 173 317 204 345 1,039

Purchase Obligations (3) ................. 204 161 17 — 382

Future Policy Benefits (4) ................ 167 335 327 1,187 2,016

Unrecognized Tax Benefits (5) ............ 4 — — 210 214

Unfunded Investment Commitments (6) ..... 131 221 6 3 361

Other Long-Term Obligations (7) .......... 7 31 — 408 446

Total Contractual Obligations ......... $ 3,116 $ 3,972 $ 2,406 $ 12,063 $ 21,557

(1) Debt payments could be accelerated upon violation of debt covenants. We believe the likelihood of

acceleration is remote.

(2) Calculated using stated rates from the debt agreements and related interest rate swap agreements and

assuming amounts are outstanding through their contractual term. For variable-rate obligations, we used the

rates in place as of December 31, 2007 to estimate all remaining contractual payments. Includes

unamortized discounts from par values.

(3) Includes fixed or minimum commitments under existing purchase obligations for goods and services,

including agreements which are cancelable with the payment of an early termination penalty. Excludes

agreements that are cancelable without penalty and also excludes liabilities to the extent recorded in our

Consolidated Balance Sheets at December 31, 2007.

(4) Estimated payments required under life and annuity contracts held by a divested entity. Under our

reinsurance arrangement with OneAmerica Financial Partners, Inc. (OneAmerica) these amounts are

payable by OneAmerica, but we remain primarily liable to the policyholders if they are unable to pay. We

have recorded a corresponding reinsurance receivable from OneAmerica in our Consolidated Financial

Statements.

(5) Unrecognized tax benefits relate to the provisions of Financial Accounting Standards Board (FASB)

Interpretation No. 48 (FIN 48). Since the timing of future settlements are uncertain, the long-term portion

has been classified as “Thereafter.” See Note 11 of Notes to the Consolidated Financial Statements for more

detail.

(6) Includes remaining capital commitments for equity investment funds and the investment commitment

related to the PacifiCare acquisition discussed below.

(7) Includes future payments to optionholders related to the application of Section 409A, as well as obligations

associated with certain employee benefit programs and charitable contributions related to the PacifiCare

acquisition discussed below, which have been classified as “Thereafter” due to uncertainty regarding

payment timing.

The table above includes a facility lease agreement that we signed in 2006. Lease payments are expected to

commence under this agreement in March 2009, at the time we occupy the facility, and extend over a 20-year

period with total estimated lease payments of $229 million.

In conjunction with the PacifiCare acquisition we committed to make $50 million in charitable contributions for

the benefit of California health care consumers, which has been accrued in our Consolidated Balance Sheets. We

have committed to specific projects totaling approximately $18 million of the $50 million charitable commitment

at December 31, 2007, of which $6 million was paid. Additionally, we agreed to invest $200 million in

35