U-Haul 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

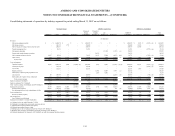

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

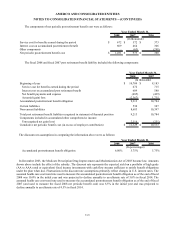

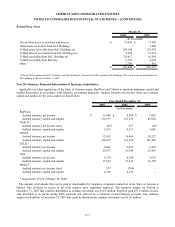

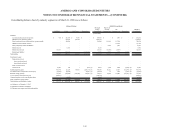

Related Party Assets

2008 2007

Private Mini notes, receivables and interest $ 71,038 $ 71,785

Oxford note receivable from SAC Holdings - 5,040

U-Haul notes receivable from SAC Holdings (a) 198,144 123,578

U-Haul interest receivable from SAC Holdings (a) 4,498 23,361

U-Haul receivable from SAC Holdings (a) 20,617 16,596

U-Haul receivable from Mercury 6,791 4,278

Other 2,798 541

$ 303,886 $ 245,179

March 31,

(In thousands)

(a) Fiscal 2008 includes both SAC Holding I and SAC Holding II, whereas fiscal 2007 includes SAC Holding I. This is due to the deconsolidation of

SAC Holding II effective October 31, 2007.

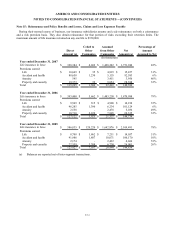

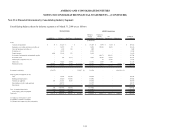

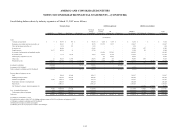

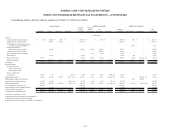

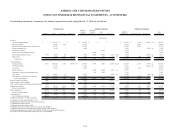

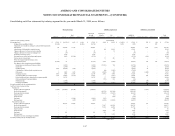

Note 20: Statutory Financial Information of Insurance Subsidiaries

Applicable laws and regulations of the State of Arizona require RepWest and Oxford to maintain minimum capital and

surplus determined in accordance with statutory accounting principles. Audited statutory net income (loss) and statutory

capital and surplus for the years-ended are listed below:

2007 2006 2005

RepWest:

Audited statutory net income $ 11,000 $ 8,980 $ 1,825

Audited statutory capital and surplus 110,197 101,236 89,824

NAFCIC:

Audited statutory net income (loss) (95) 517 (82)

Audited statutory capital and surplus 3,013 4,512 3,681

Oxford:

Audited statutory net income 13,038 14,869 10,237

Audited statutory capital and surplus 124,015 112,998 101,466

CFLIC:

Audited statutory net income 4,066 2,652 1,470

Audited statutory capital and surplus 25,075 21,040 22,455

NAI:

Audited statutory net income 6,374 6,198 3,076

Audited statutory capital and surplus 15,824 17,432 16,150

DGLIC*:

Audited statutory net income (loss) 337 (700) -

Audited statutory capital and surplus 4,199 4,354 -

* Acquired by CFLIC February 28, 2006.

Year Ended December 31,

(In thousands)

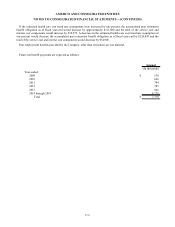

The amount of dividends that can be paid to shareholders by insurance companies domiciled in the State of Arizona is

limited. Any dividend in excess of the limit requires prior regulatory approval. The statutory surplus for Oxford at

December 31, 2007 that could be distributed as ordinary dividends was $12.2 million. RepWest paid $27.0 million in non-

cash dividends to its parent during 2005; payment was effected by a reduction in intercompany accounts. The statutory

surplus for RepWest at December 31, 2007 that could be distributed as ordinary dividends was $11.0 million.

F-37