U-Haul 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

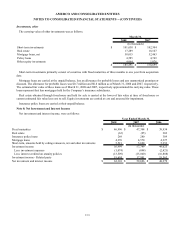

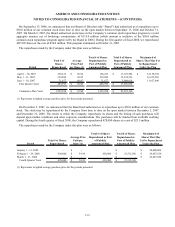

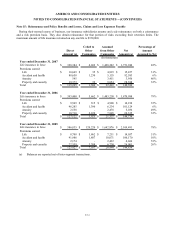

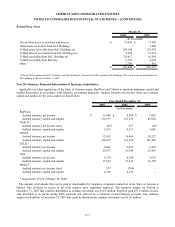

Financing Date

Outstanding as

of March 31,

2008 2008 2007 2006

June, 1991 $ 9,214 $ 675 $ 694 $ 1,070

March, 1999 40 4 5 9

February, 2000 314 27 31 53

April, 2001 117 7 6 10

Interest Payments

(In thousands)

Shares are released from collateral and allocated to active employees based on the proportion of debt service paid in the

plan year. Contributions to the Plan Trust (“ESOT”) during fiscal 2008, 2007 and 2006 were $2.1 million, $2.0 million and

$2.3 million, respectively.

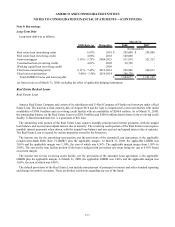

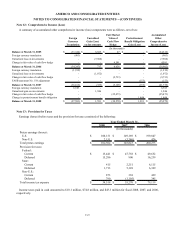

Shares held by the Plan were as follows:

2008 2007

Allocated shares 1,418 1,416

Unreleased shares 417 494

Fair value of unreleased shares $ 18,576 $ 26,288

Year Ended March 31,

(In thousands)

For purposes of the above schedule, the fair value of unreleased shares issued prior to 1992 is defined as the historical

cost of such shares. The fair value of unreleased shares issued subsequent to December 31, 1992 is defined as the trading

value of such shares as of March 31, 2008 and March 31, 2007, respectively.

Insurance Plans

Oxford insured various group life and group disability insurance plans covering employees of the Company. Premiums

earned by Oxford on these policies were $3.3 million and $3.5 million for the years ended December 31, 2006, and 2005,

respectively. The group life premiums were paid by the Company and those amounts were eliminated from the Company’ s

financial statements in consolidation. Oxford discontinued its participation in this program effective October 2006. The

employee group life coverage is now provided by an unrelated insurer. Oxford was the insurance carrier for the employee

disability plan through April 30, 2007. This program is now provided to employees by an unrelated insurer. The group

disability premiums are paid by the covered employees.

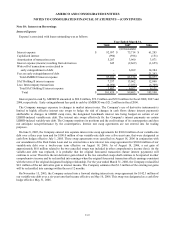

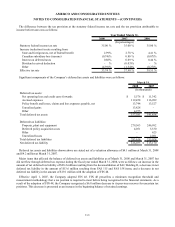

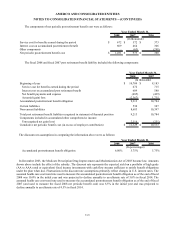

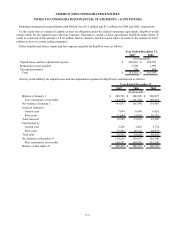

Post Retirement and Post Employment Benefits

The Company provides medical and life insurance benefits to its eligible employees and their dependents upon

retirement from the Company. The retirees must have attained age sixty-five and earned twenty years of full-time service

upon retirement for coverage under the medical plan. The medical benefits are capped at a $20,000 lifetime maximum per

covered person. The benefits are coordinated with Medicare and any other medical policies in force. Retirees who have

attained age sixty-five and earned at least ten years of full-time service upon retirement from the Company are entitled to

group term life insurance benefits. The life insurance benefit is $2,000 plus $100 for each year of employment over ten

years. The plan is not funded and claims are paid as they are incurred. For fiscal 2006 and prior years the Company elected

to use a December 31 measurement date for its post retirement benefit disclosures as of March 31.

Effective March 31, 2007, the Company adopted SFAS 158, which requires that the Consolidated Balance Sheet

reflect the unfunded status of the Company’ s postretirement benefit plan and measure these benefits as of the end of the

fiscal year. Previously, the Company had measured these benefits on a three month lag, as allowed by SFAS 106. SFAS

158 requires the valuation be performed as of the balance sheet date. The provisions of SFAS 158 do not permit

retrospective application. The portion of the net periodic cost associated with the elimination of the timing gap was $0.1

million, net of taxes, and was recorded as an adjustment to retained earnings in fiscal 2007. Additionally, SFAS 158

requires the unrecognized net gain or loss now be reclassified to accumulated other comprehensive income. As of March

31, 2007 this resulted in a reduction of accumulated other comprehensive income in the amount of $0.2 million, net of tax.

F-28