U-Haul 2008 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

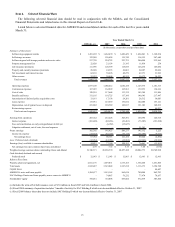

Item 6.

Selected Financial Data

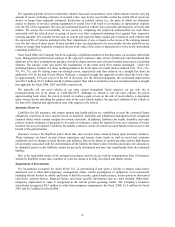

The following selected financial data should be read in conjunction with the MD&A, and the Consolidated

Financial Statements and related notes in this Annual Report on Form 10-K.

Listed below is selected financial data for AMERCO and consolidated entities for each of the last five years ended

March 31:

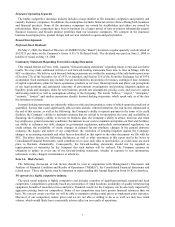

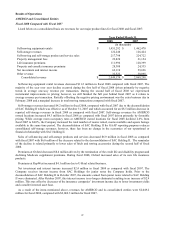

2008 (b), (c) 2007 2006 2005 2004

Summary of Operations:

Self-moving equipment rentals $ 1,451,292 $ 1,462,470 $ 1,489,429 $ 1,424,841 $ 1,368,814

Self-storage revenues 122,248 126,424 119,742 114,155 247,640

Self-moving and self-storage products and service sales 217,798 224,722 223,721 206,098 232,965

Property management fees 22,820 21,154 21,195 11,839 259

Life insurance premiums 111,996 120,399 118,833 126,236 145,082

Property and casualty insurance premiums 28,388 24,335 26,001 24,987 92,036

Net investment and interest income 62,110 59,696 48,279 49,171 31,992

Other revenue 32,522 30,098 40,325 30,172 38,523

Total revenues 2,049,174 2,069,298 2,087,525 1,987,499 2,157,311

Operating expenses 1,077,108 1,080,412 1,082,158 1,123,975 1,181,313

Commission expenses 167,945 162,899 165,961 159,253 134,616

Cost of sales 120,210 117,648 113,135 105,309 111,906

Benefits and losses 111,195 118,725 117,160 140,343 217,447

Amortization of deferred policy acquisition costs 13,181 17,138 24,261 28,512 39,083

Lease expense 133,931 147,659 136,652 142,008 153,121

Depreciation, net of (gains) losses on disposal 221,882 189,589 142,817 121,103 148,813

Restructuring expense - - - - 44,097

Total costs and expenses 1,845,452 1,834,070 1,782,144 1,820,503 2,030,396

Earnings from operations 203,722 235,228 305,381 166,996 126,915

Interest expense (101,420) (82,436) (69,481) (73,205) (121,690)

Fees and amortization on early extinguishment of debt (a) - (6,969) (35,627) - -

Litigation settlement, net of costs, fees and expenses - - - 51,341 -

Pretax earnings 102,302 145,823 200,273 145,132 5,225

Income tax expense (34,518) (55,270) (79,119) (55,708) (8,077)

Net earnings (loss) 67,784 90,553 121,154 89,424 (2,852)

Less: Preferred stock dividends (12,963) (12,963) (12,963) (12,963) (12,963)

Earnings (loss) available to common shareholders $ 54,821 $ 77,590 $ 108,191 $ 76,461 $ (15,815)

Net earnings (loss) per common share basic and diluted $ 2.78 $ 3.72 $ 5.19 $ 3.68 $ (0.76)

Weighted average common shares outstanding: Basic and diluted 19,740,571 20,838,570 20,857,108 20,804,773 20,749,998

Cash dividends declared and accrued

Preferred stock $ 12,963 $ 12,963 $ 12,963 $ 12,963 $ 12,963

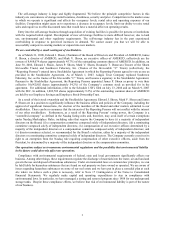

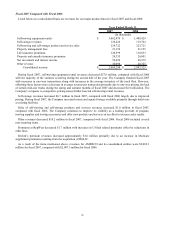

Balance Sheet Data:

Property, plant and equipment, net 2,011,176 1,897,071 1,535,165 1,354,468 1,451,805

Total assets 3,832,487 3,523,048 3,367,218 3,116,173 3,394,748

Capital leases - - - - 99,607

AMERCO's notes and loans payable 1,504,677 1,181,165 965,634 780,008 862,703

SAC Holdings II notes and loans payable, non re-course to AMERCO - 74,887 76,232 77,474 78,637

Stockholders' equity 758,431 718,098 695,604 572,839 503,846

(a) Includes the write-off of debt issuance costs of $7.0 million in fiscal 2007 and $14.4 million in fiscal 2006.

(b) Fiscal 2008 summary of operations includes 7 months of activity for SAC Holding II which was deconsolidated effective October 31, 2007.

(c) Fiscal 2008 balance sheet data does not include SAC Holding II which was deconsolidated effective October 31, 2007

Year Ended March 31,

(In thousands, except share and per share data)

15