U-Haul 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

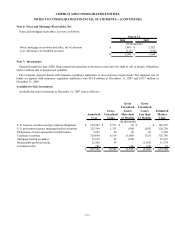

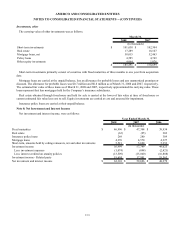

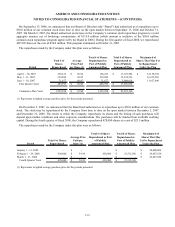

Investments, other

The carrying value of other investments was as follows:

2008 2007

Short-term investments $ 101,638 $ 102,304

Real estate 17,289 18,107

Mortgage loans, net 58,015 52,463

Policy loans 4,585 4,749

Other equity investments 4,064 1,076

$ 185,591 $ 178,699

March 31,

(In thousands)

Short-term investments primarily consist of securities with fixed maturities of three months to one year from acquisition

date.

Mortgage loans are carried at the unpaid balance, less an allowance for probable losses and any unamortized premium or

discount. The allowance for probable losses was $0.7 million and $0.8 million as of March 31, 2008 and 2007, respectively.

The estimated fair value of these loans as of March 31, 2008 and 2007, respectively approximated the carrying value. These

loans represent first lien mortgages held by the Company’ s insurance subsidiaries.

Real estate obtained through foreclosure and held for sale is carried at the lower of fair value at time of foreclosure or

current estimated fair value less cost to sell. Equity investments are carried at cost and assessed for impairment.

Insurance policy loans are carried at their unpaid balance.

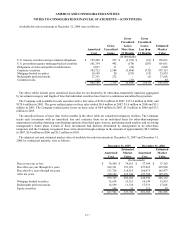

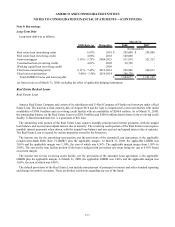

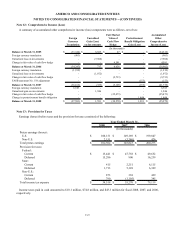

Note 8: Net Investment and Interest Income

Net investment and interest income, were as follows:

2008 2007 2006

Fixed maturities $ 46,996 $ 47,304 $ 38,934

Real estate (63) (95) 203

Insurance policy loans 269 280 309

Mortgage loans 4,276 4,570 4,327

Short-term, amounts held by ceding reinsurers, net and other investments 5,521 5,690 5,252

Investment income 56,999 57,749 49,025

Less: investment expenses (1,074) (894) (2,421)

Less: interest credited on annuity policies (13,509) (15,060) (16,888)

Investment income - Related party 19,694 17,901 18,563

Net investment and interest income $ 62,110 $ 59,696 $ 48,279

Year Ended March 31,

(In thousands)

F-18