U-Haul 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

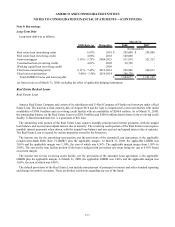

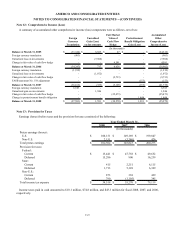

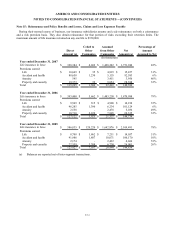

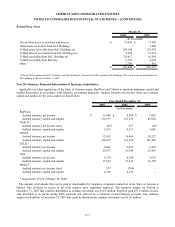

The components of net periodic post retirement benefit cost were as follows:

2008 2007 2006

Service cost for benefits earned during the period $ 672 $ 572 $ 373

Interest cost on accumulated postretirement benefit 609 464 306

Other components - (63) (299)

Net periodic postretirement benefit cos

t

$ 1,281 $ 973 $ 380

Year Ended March 31,

(In thousands)

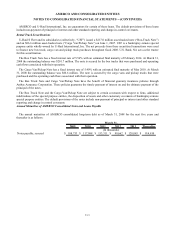

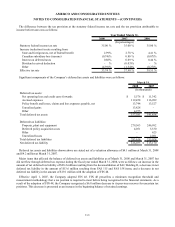

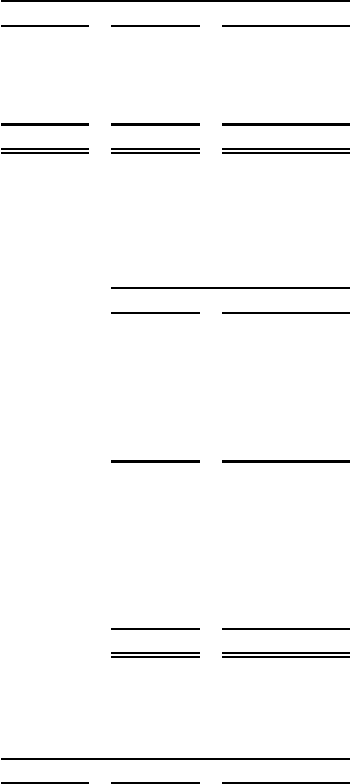

The fiscal 2008 and fiscal 2007 post retirement benefit liability included the following components:

2008 2007

$ 10,784 $ 8,183

672 715

609 580

(485) (429)

(2,367) 1,735

9,213 10,784

Current liabilities 530 387

8,683 10,397

9,213 10,784

2,116 (251)

$ 11,329 $ 10,533

Year Ended March 31,

(In thousands)

Service cost for benefits earned during the period

Interest cost on accumulated post retirement benefit

Net benefit payments and expense

Components included in accumulated other comprehensive income:

Unrecognized net gain (loss)

Cumulative net periodic benefit cost (in excess of employer contribution)

Beginning of year

Actuarial (gain) loss

Accumulated postretirement benefit obligation

Non-current liabilities

Total post retirement benefit liability recognized in statement of financial position

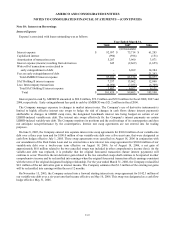

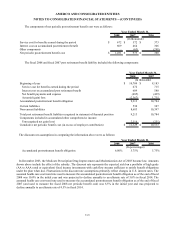

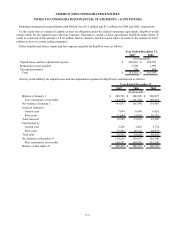

The discount rate assumptions in computing the information above were as follows:

2008 2007 2006

Accumulated postretirement benefit obligation 6.00% 5.75% 5.75%

Year Ended March 31,

(In percentages)

In December 2003, the Medicare Prescription Drug Improvement and Modernization Act of 2003 became law. Amounts

shown above include the effect of the subsidy. The discount rate represents the expected yield on a portfolio of high grade

(AA to AAA rated or equivalent) fixed income investments with cash flow streams sufficient to satisfy benefit obligations

under the plan when due. Fluctuations in the discount rate assumptions primarily reflect changes in U.S. interest rates. The

assumed health care cost trend rate used to measure the accumulated postretirement benefit obligation as of the end of fiscal

2008 was 10.0% in the initial year and was projected to decline annually to an ultimate rate of 5.0% in fiscal 2014. The

assumed health care cost trend rate used to measure the accumulated postretirement benefit obligation as of the end of fiscal

2007 (and used to measure the fiscal 2008 net periodic benefit cost) was 6.5% in the initial year and was projected to

decline annually to an ultimate rate of 4.5% in fiscal 2014.

F-29