U-Haul 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

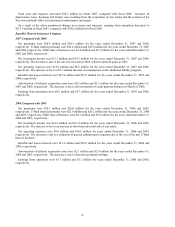

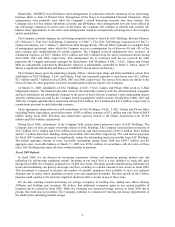

2006 Compared with 2005

Net premiums were $121.6 million and $120.4 million for the years ended December 31, 2006 and 2005,

respectively. Medicare supplement premiums increased by $10.6 million primarily due to the acquisition of DGLIC.

The Company stopped writing new credit insurance business in 2006 and as a result, credit insurance premiums

decreased by $9.1 million.

Net investment income was $22.5 million and $22.0 million for the years ended December 31, 2006 and 2005,

respectively. The increase was primarily due to a reduction in realized losses on disposals from 2005, offset by a net

reduction in invested assets. Investment yields were consistent between the two years.

Other income was $4.7 million and $5.8 million for the years ended December 31, 2006 and 2005, respectively.

This decrease was the result of decreased surrender charge income of $0.5 million and a decrease in administrative

income of $0.6 million.

Net operating expenses were $30.9 million and $27.0 million for the years ended December 31, 2006 and 2005,

respectively. The increase is primarily due to the acquisition of DGLIC.

Benefits incurred were $88.3 million and $85.7 million, for the years ended December 31, 2006 and 2005,

respectively. This increase was primarily a result of a $3.8 million increase in Medicare supplement benefits due to

the acquisition of DGLIC, partially offset by a slightly improved loss ratio. Credit insurance benefits decreased $4.4

million due to decreased exposure. Other health benefits increased $1.1 million during the current period due to an

adjustment for current claim trends. Life insurance benefits increased $1.4 million due to increased sales.

Amortization of DAC and VOBA was $15.1 million and $21.4 million for the years ended December 31, 2006

and 2005, respectively. During the fourth quarter of 2005 and 2006, the Company made adjustments to the

assumptions for expected future profits for the annuity business. These included changes to the assumptions for

lapse rates, interest crediting and investment returns. Amortization expense was reduced by $4.7 million during

2006 as a result of these changes, including $1.3 million in the fourth quarter of 2006. The credit business had a

decrease of amortization of $3.2 million due to decreased business. VOBA amortization increased $0.7 million due

to the acquisition of DGLIC. DAC amortization in the life segment increased due to increased new business.

Earnings from operations were $14.5 million and $13.9 million for the years ended December 31, 2006 and 2005,

respectively.

SAC Holding II

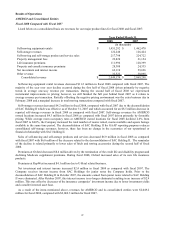

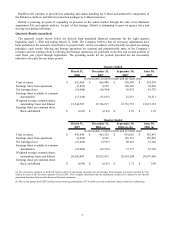

Fiscal 2008 Compared with Fiscal 2007

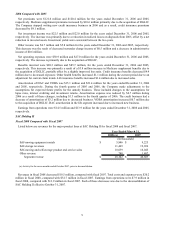

Listed below are revenues for the major product lines at SAC Holding II for fiscal 2008 and fiscal 2007:

2008 (a) 2007

Self-moving equipment rentals $ 5,846 $ 9,225

Self-storage revenues 11,469 19,926

Self-moving and self-storage product and service sales 10,039 16,045

Other revenue 748 1,407

Segment revenue $ 28,102 $ 46,603

(a) Activity for the seven months ended October 2007, prior to deconsolidation.

(In thousands)

Year Ended March 31,

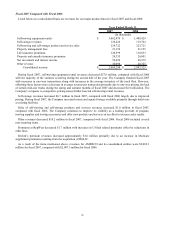

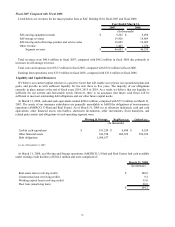

Revenues in fiscal 2008 decreased $18.5 million, compared with fiscal 2007. Total costs and expenses were $20.2

million in fiscal 2008, compared with $32.7 million in fiscal 2007. Earnings from operations were $7.9 million in

fiscal 2008, compared with $13.9 million in fiscal 2007. Each of these decreases was due to the deconsolidation of

SAC Holding II effective October 31, 2007.

31