U-Haul 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

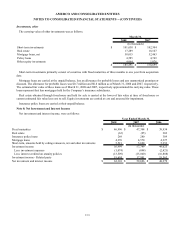

Deferred Policy Acquisition Costs

Commissions and other costs that fluctuate with, and are primarily related to the acquisition or renewal of certain

insurance premiums, are deferred. For Oxford, these costs are amortized in relation to revenue such that costs are realized

as a constant percentage of revenue. For RepWest, these costs are amortized over the related contract periods, which

generally do not exceed one year.

Environmental Costs

Liabilities are recorded when environmental assessments and remedial efforts, if applicable, are probable and the costs

can be reasonably estimated. The amount of the liability is based on management’ s best estimate of undiscounted future

costs. Certain recoverable environmental costs related to the removal of underground storage tanks or related contamination

are capitalized and amortized over the estimated useful lives of the properties. These costs improve the safety or efficiency

of the property or are incurred in preparing the property for sale.

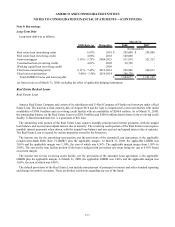

Income Taxes

AMERCO files a consolidated tax return with all of its legal subsidiaries, except for Dallas General Life Insurance

Company (“DGLIC”), a subsidiary of Oxford, which will file on a stand alone basis until 2012. SAC Holding Corporation

and its legal subsidiaries and SAC Holding II Corporation and its legal subsidiaries file consolidated tax returns, which are

in no way associated with AMERCO’ s consolidated returns. In accordance with SFAS 109, the provision for income taxes

reflects deferred income taxes resulting from changes in temporary differences between the tax basis of assets and liabilities

and their reported amounts in the financial statements. Effective April 1, 2007, the Company adopted Financial Accounting

Standards Board (“FASB”) Interpretation No. 48 (“FIN 48”) Accounting for Uncertainty in Income Taxes, an interpretation

of FAS 109.

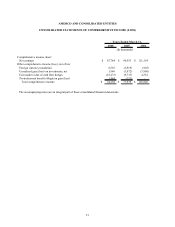

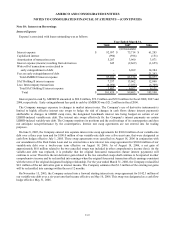

Comprehensive Income (Loss)

Comprehensive income (loss) consists of net earnings, foreign currency translation adjustments, unrealized gains and

losses on investments, the change in fair value of cash flow hedges and the change in postretirement benefit obligation.

Recent Accounting Pronouncements

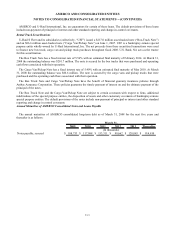

In September 2006, the FASB issued SFAS 157, Fair Value Measurements which establishes how companies should

measure fair value when they are required to use a fair value measure for recognition or disclosure purposes under GAAP.

This statement is effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim

periods within those years. The provisions of SFAS 157 which have not been deferred by the FASB are effective for us in

April 2008. The Company does not believe that the adoption of this statement will have a material impact on our financial

statements.

In February 2007, the FASB issued SFAS 159, The Fair Value Option for Financial Assets and Liabilities, including an

amendment of SFAS 115. This statement allows for a company to irrevocably elect fair value as the measurement attribute

for certain financial assets and financial liabilities. Changes in the fair value of such assets are recognized in earnings.

SFAS 159 is effective for fiscal years beginning after November 15, 2007. The provisions of SFAS 159 are effective for us

in April 2008. The Company does not believe that the adoption of this statement will have a material impact on our

financial statements.

In December 2007, the FASB issued SFAS 141(R), Business Combinations. SFAS 141(R) provides companies with

principles and requirements on how an acquirer recognizes and measures in its financial statements the identifiable assets

acquired, liabilities assumed, and any noncontrolling interest in the acquiree as well as the recognition and measurement of

goodwill acquired in a business combination. SFAS 141(R) also requires certain disclosures to enable users of the financial

statements to evaluate the nature and financial effects of the business combination. Acquisition costs associated with the

business combination will generally be expensed as incurred. SFAS 141(R) is effective for business combinations occurring

in fiscal years beginning after December 15, 2008, which will require us to adopt these provisions for business

combinations occurring in fiscal 2010 and thereafter. Early adoption of SFAS 141(R) is not permitted.

F-14