U-Haul 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LIFE INSURANCE COMPANY

®

® ®

INTERNAT IONAL

®

TM

Table of contents

-

Page 1

® ® ® TM INTERNATIONAL ® LIFE INSURANCE COMPANY -

Page 2

.... We encourage the shared use of our resources by helping more families move with any given U-Haul truck or trailer. Our corporate-wide sustainability initiatives include: • Specialized Rental Equipment: In dashboard, truck fuel economy gauge; aerodynamic van box and side skirts • 100... -

Page 3

.... U-Haul's broad network of rental outlets has allowed customers to reduce the average miles traveled in an In-Town move. Our aerodynamic van boxes, fuel saving side skirts and exclusive fuel economy gauge are enabling customers to stretch their fuel dollar. Rental trailers are the ultimate way to... -

Page 4

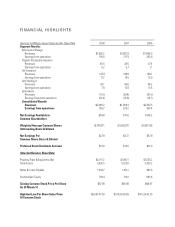

FINANCIAL HIGHLIGHTS Amounts in Millions, Except Share and Per Share Data Segment Results: Moving and Storage Revenues Earnings from operations Property & Casualty Insurance Revenues Earnings from operations Life Insurance Revenues Earnings from operations SAC Holding II Revenues Earnings from ... -

Page 5

... aggregate market value of AMERCO common stock held by non-affiliates on September 30, 2007 was $284,291,154. The aggregate market value was computed using the closing price for the common stock trading on NASDAQ on such date. Shares held by executive officers, directors and persons owning directly... -

Page 6

... Market Risk ...Financial Statements and Supplementary Data ...Changes in and Disagreements with Accountants on Accounting and Financial Disclosure...Controls and Procedures ...Other Information ...PART III Directors, Executive Officers and Corporate Governance ...Executive Compensation...Security... -

Page 7

...the best product and service to the most people at the lowest cost. We rent our distinctive orange and white U-Haul trucks and trailers as well as offer self-storage rooms through a network of nearly 1,450 Company operated retail moving centers and approximately 14,200 independent U-Haul dealers. In... -

Page 8

...engineering staff is committed to making our trailers easy to tow, aerodynamic and fuel efficient. To provide our self-move customers with added value, our rental trucks and trailers are designed with fuel efficiency in mind. Many of our newer trucks are fitted with fuel economy gauges, another tool... -

Page 9

...increasing staff by attracting and retaining "moonlighters" (part-time U-Haul employees with full-time jobs elsewhere) during our peak hours of operation. Effective marketing of our self-moving related products and services, such as boxes, pads and insurance, helps our customers have a better moving... -

Page 10

... storage market. Property and Casualty Insurance Operating Segment RepWest provides loss adjusting and claims handling for U-Haul through regional offices across North America. Through the Company' s affiliation with RepWest, U-Haul offers its customers moving and storage contents insurance products... -

Page 11

... eMove web sites. A significant driver of U-Haul' s rental transaction volume is our utilization of an online reservation and sales system, through www.uhaul.com, www.eMove.com and our 24-hour 1-800-GO-U-HAUL telephone reservations system. The Company' s 1-800-GO-U-HAUL telephone reservation line is... -

Page 12

..., and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements may include, but are not limited to, projections of revenues, earnings or loss; estimates of capital expenditures, plans for future operations, products or services; financing needs and plans; our perceptions... -

Page 13

... a decrease in occupancy levels, limit our ability to raise rental sales and require us to offer discounted rates that would have a material affect on operating results. Entry into the self-storage business through acquisition of existing facilities is possible for persons or institutions with the... -

Page 14

... lease commitments of $490.8 million. Although we believe that additional leverage can be supported by the Company' s operations, our existing debt could impact us in the following ways require us to allocate a considerable portion of cash flows from operations to debt service payments; limit... -

Page 15

.... We also operate over 250 fixed-site repair facilities located throughout the United States and Canada. These facilities are used primarily for the benefit of our Moving and Storage segment. SAC Holdings owns property, plant and equipment that are utilized in the sale of moving supplies, rental of... -

Page 16

...and operating expenditures to stay in compliance with environmental laws and has put in place a remedial plan at each site where it believes such a plan is necessary. Since 1988, Real Estate has managed a testing and removal program for underground storage tanks. Based upon the information currently... -

Page 17

... NASDAQ Global Select Market under the trading symbol "UHAL". The number of shareholders is derived using internal stock ledgers and utilizing Mellon Investor Services Stockholder listings. The following table sets forth the high and the low sales price of the common stock of AMERCO for the periods... -

Page 18

... on March 31, 2003 in the Company' s Common Stock and in each of comparison indices. The graph reflects the closing price of the Common stock trading on NASDAQ on March 31, 2004, 2005, 2006, 2007, and 2008. COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN* Among AMERCO, The Dow Jones US Index And... -

Page 19

... our Board of Directors (the "Board") had authorized us to repurchase up to $50.0 million of our common stock from time to time on the open market between September 13, 2006 and October 31, 2007. On March 9, 2007, the Board authorized an increase in the Company' s common stock repurchase program to... -

Page 20

..., 2008 (b), (c) Summary of Operations: Self-moving equipment rentals Self-storage revenues Self-moving and self-storage products and service sales Property management fees Life insurance premiums Property and casualty insurance premiums Net investment and interest income Other revenue Total revenues... -

Page 21

... selfstorage rental facilities and related moving and self-storage products and services. We are able to expand our distribution and improve customer service by increasing the amount of moving equipment and storage rooms available for rent, expanding the number of independent dealers in our network... -

Page 22

... of the rental of trucks, trailers, specialty rental items and self-storage spaces primarily to the household mover as well as sales of moving supplies, towing accessories and propane. Operations are conducted under the registered trade name U-Haul® throughout the United States and Canada. With... -

Page 23

... entity. While the deconsolidation affects AMERCO' s financial reporting, it has no operational or financial impact on the Company' s relationship with SAC Holding II. The deconsolidation, effective October 31, 2007 was accounted for as a distribution of SAC Holding II interests to Blackwater, the... -

Page 24

... rental equipment is considered part of cost. Depreciation is computed for financial reporting purposes using the straight-line or an accelerated method based on a declining balance formula over the following estimated useful lives: rental equipment 2-20 years and buildings and non-rental equipment... -

Page 25

... line approach for fiscal 2008, 2007 and 2006, respectively. We typically sell our used vehicles at our sales centers throughout North America, on our web site at trucksales.uhaul.com or by phone at 1-866-404-0355. Although we intend to sell our used vehicles for prices approximating book value... -

Page 26

... and SAC Holding II Corporation and its legal subsidiaries file separate consolidated tax returns, which are in no way associated with AMERCO' s consolidated returns. Recent Accounting Pronouncements In September 2006, the Financial Accounting Standards Board ("FASB") issued SFAS 157, Fair Value... -

Page 27

... number of rooms rented, rooms available and square footage available in the same time period. The deconsolidation of SAC Holding II for GAAP reporting purposes reduces consolidated self-storage revenues; however, there has been no change in the economics of our operational or financial relationship... -

Page 28

... the rotation of older trucks out of the active rental fleet. Benefits and operating expenses decreased at each of the insurance companies as business volumes decline. Other operating costs including personnel, property tax and certain legal-related expenses increased in fiscal 2008 as compared with... -

Page 29

... due to one-way pricing, the lack of certain mid-size trucks during the spring and summer months of fiscal 2007 and decreased fleet utilization. The Company' s response to competitive pricing issues further lowered self-moving rental revenues. Self-storage revenues increased $6.7 million in fiscal... -

Page 30

... which were used primarily during the previous ten years. While the Company generates a cash flow benefit from utilizing the depreciation deduction for income taxes, as compared to what the lease expense would have been, the consolidated statement of operations reflects an increase in depreciation... -

Page 31

... pricing. While average room occupancy rates for fiscal 2008 declined 2.6% from fiscal 2007 to 84.0%, the Company increased the total number of rooms rented, rooms available and square footage available in the same time period. Sales of self-moving and self-storage products and services decreased... -

Page 32

... due to one-way pricing, the lack of certain mid-size trucks during the spring and summer months of fiscal 2007 and decreased fleet utilization. The Company' s response to competitive pricing issues further lowered self-moving rental revenues. Self-storage revenues increased $5.6 million for fiscal... -

Page 33

... in short-term rates and sale of real estate. Net operating expenses were $8.8 million and $10.8 million for years ended December 31, 2006 and 2005, respectively. The decrease is due to a reduction of general administrative expenses due to the exit of the non U-Haul lines of business. Benefits and... -

Page 34

The following table illustrates the change in unpaid loss and loss adjustment expenses on a gross basis. The first line represents gross reserves (reserves prior to the effects of reinsurance) as originally reported at the end of the stated year. The second section, reading down, represents ... -

Page 35

... in Medicare supplement due to policy decrements and a decrease of $1.7 million in credit insurance due to decreased exposure, offset by life insurance benefits of $1.5 million due to increased sales. Amortization of deferred acquisition costs ("DAC") and the value of business acquired ("VOBA") was... -

Page 36

... product lines at SAC Holding II for fiscal 2008 and fiscal 2007: Year Ended March 31, 2008 (a) 2007 (In thousands) 5,846 $ 9,225 11,469 19,926 10,039 16,045 748 1,407 28,102 $ 46,603 Self-moving equipment rentals Self-storage revenues Self-moving and self-storage product and service sales Other... -

Page 37

..., U-Haul and Real Estate). As of March 31, 2008 (or as otherwise indicated), cash and cash equivalents, other financial assets (receivables, short-term investments, other investments, fixed maturities, and related party assets) and obligations of each operating segment were: Moving & Storage RepWest... -

Page 38

... sale of used equipment, and externally from debt and lease financing. In the future we anticipate that our internally generated funds will be used to service the existing debt and support operations. U-Haul estimates that during fiscal 2009 the Company will reinvest in its truck and trailer rental... -

Page 39

Moving and Storage continues to hold significant cash and has access to additional liquidity. Management may invest these funds in our existing operations, expand our product lines or pursue external opportunities in the selfmoving and storage market place. Property and Casualty Insurance State ... -

Page 40

... investment contract deposits. At December 31, 2007, RepWest held $291.3 million of estimated policy benefits and losses, claims and loss expenses payable. At March 31, 2008, U-Haul held $365.4 million of estimated self-insurance reserves. These are estimated general obligations of each company and... -

Page 41

... significant shareholder and director of AMERCO, has an interest in Mercury. The Company leases space for marketing company offices, vehicle repair shops and hitch installation centers from subsidiaries of SAC Holdings, 5 SAC and Galaxy. Total lease payments pursuant to such leases were $2.1 million... -

Page 42

... protection packages to U-Haul customers. Oxford is pursuing its goals of expanding its presence in the senior market through the sales of its Medicare supplement, life and annuity policies. As part of this strategy, Oxford is attempting to grow its agency force and develop new product offerings... -

Page 43

... investment portfolios expose the Company to interest rate risk. This interest rate risk is the price sensitivity of a fixed income security to changes in interest rates. As part of our insurance companies' asset and liability management, actuaries estimate the cash flow patterns of our existing... -

Page 44

... in the degree of compliance with policies or procedures. Changes in Internal Control over Financial Reporting There have not been any changes in the Company' s internal control over financial reporting (as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during the most... -

Page 45

... of our Board of Directors. Our independent registered public accounting firm, BDO Seidman, LLP, has audited the Company's internal control over financial reporting and has issued their report, which is included below. Item 9B. Other Information On April 10, 2008, U-Haul International, Inc. and... -

Page 46

...standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of the Company as of March 31, 2008 and 2007, and the related consolidated statements of operations, changes in stockholders' equity, other comprehensive income (loss), and cash flows for each... -

Page 47

... statement, which will be filed with the SEC within 120 days after the close of the 2008 fiscal year. The Company has adopted a code of ethics that applies to all directors, officers and employees of the Company, including the Company' s principal executive officer and principal accounting officer... -

Page 48

... IV Item 15. Exhibits, Financial Statement Schedules (a) The following documents are filed as part of this Report: Page No. 1. Financial Statements: Report of Independent Registered Public Accounting Firm Independent Auditors' Report Consolidated Balance Sheets - March 31, 2008 and 2007 Consolidated... -

Page 49

...Profit Sharing and Employee Stock Ownership Plan SAC Participation and Subordination Agreement, dated as of March 15, 2004 among SAC Holding Corporation, SAC Holding II Corporation, AMERCO, U-Haul International, Inc., and Law Debenture Trust Company of New York U-Haul Dealership Contract 10.1A* 10... -

Page 50

... AMERCO' s Quarterly Report on Form 10-Q for the quarter ended June 30, 2004, file no. 1-11255 10.51 Property Management Agreements among ThreeA through Three-D SAC Self-Storage Limited Partnership and the subsidiaries of U-Haul International, Inc. U-Haul Dealership Contract between U-Haul Leasing... -

Page 51

... June 8, 2005 by Amerco Real Estate Company, Amerco Real Estate Company of Texas, Inc., Amerco Real Estate Company of Alabama, Inc., U-Haul Co. of Florida, Inc. and U-Haul International, Inc. Form of Mortgage, Security Agreement, Assignment of Rents and Fixture Filing, dated June 8, 2005 in favor... -

Page 52

... U-Haul Leasing and Sales Co., U-Haul Co. of Arizona, BTMU Capital Corporation, and Orange Truck Trust 2006 Guarantee executed June 7, 2006, made by U-Haul International, Inc. and AMERCO in favor of BTMU Capital Corp. and Orange Truck Trust 2006. First Amendment to Security Agreement (New Truck Term... -

Page 53

... and Restated Credit Agreement, dated as of June 8, 2005, among Amerco Real Estate Company of Texas, Inc., Amerco Real Estate Company of Alabama, Inc., U-Haul Co. of Florida, Inc., UHaul International, Inc. and the Marketing Grantors named therein in favor of Merrill Lynch Commercial Financial Corp... -

Page 54

... I TO CARGO VAN/PICK-UP TRUCK BASE INDENTURE, dated as of June 1, 2007. Page or Method of Filing Incorporated by reference to AMERCO' s Annual Report on Form 10-K for the year ended March 31, 2007, file no. 1-11255 10.101 Incorporated by reference to AMERCO' s Annual Report on Form 10-K for the... -

Page 55

..., Inc. Amended and restated Property Management Agreement among Eleven SAC Self-Storage Corporation and Eleven SAC Self-Storage Odenton, Inc. and subsidiaries of U-Haul International, Inc. Page or Method of Filing Incorporated by reference to AMERCO' s Annual Report on Form 10-K for the year ended... -

Page 56

... pay to U-Haul International, Inc., a Nevada corporation Omnibus Termination and Release (Aged Truck Revolving Loan Facility), dated February 8, 2008 among U-Haul Leasing & Sales Co., U-Haul Co. of Arizona and U-Haul International, Inc. and Merrill Lynch Commercial Finance Corporation Code of Ethics... -

Page 57

Exhibit Number 32.2 Description Certificate of Jason A. Berg, Chief Accounting Officer of AMERCO pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 Page or Method of Filing Furnished herewith * Indicates compensatory plan arrangement. 52 -

Page 58

...Registered Public Accounting Firm Board of Directors and Stockholders AMERCO Reno, Nevada We have audited the accompanying consolidated balance sheets of AMERCO and consolidated subsidiaries (the "Company") as of March 31, 2008 and 2007 and the related consolidated statements of operations, changes... -

Page 59

... operations, stockholder' s deficit and its cash flows for the seven months ended October 31, 2007 and the years ended March 31, 2007 and 2006 in conformity with accounting principles generally accepted in the United States of America. /s/ Semple, Marchal & Cooper, LLP Phoenix, Arizona May 29, 2008... -

Page 60

...'s notes and loans payable SAC Holding II notes and loans payable, non-recourse to AMERCO Policy benefits and losses, claims and loss expenses payable Liabilities from investment contracts Other policyholders' funds and liabilities Deferred income Deferred income taxes Related party liabilities... -

Page 61

... ENTITIES CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended March 31, 2008 2007 2006 (In thousands, except share and per share data) Revenues: Self-moving equipment rentals Self-storage revenues Self-moving and self-storage products and service sales Property management fees Life insurance premiums... -

Page 62

... of tax Fair market value of cash flow hedges, net of tax Adjustment to post retirement benefit obligation Net earnings Preferred stock dividends: Series A ($2.13 per share for fiscal 2008) Treasury stock Contribution from related party SAC Holding II Corporation distribution Net activity Balance as... -

Page 63

... CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) Years Ended March 31, 2008 2007 2006 (In thousands) Comprehensive income (loss): Net earnings Other comprehensive income (loss), net of tax: Foreign currency translation Unrealized gain (loss) on investments, net Fair market value of cash flow... -

Page 64

..., plant and equipment Short term investments Fixed maturity investments Equity securities Cash received in excess of purchase of company acquired Preferred stock Real estate Mortgage loans Payments from notes and mortgage receivables Net cash used by investing activities Cash flow from financing... -

Page 65

... to fund its own operations and execute its business plan without any future subordinated financial support; therefore, the Company was no longer considered to be the primary beneficiary of SAC Holding II as of the date of Blackwater' s contribution. Accordingly, at the dates AMERCO ceased to have... -

Page 66

...include AMERCO, U-Haul, and Real Estate and the wholly-owned subsidiaries of UHaul and Real Estate and consist of the rental of trucks and trailers, sales of moving supplies, sales of towing accessories, sales of propane, the rental of self-storage spaces to the "do-it-yourself" mover and management... -

Page 67

...sale, long-term investments, mortgage loans and notes on real estate, and interest rate cap and swap contracts are based on quoted market prices, dealer quotes or discounted cash flows. Fair values of trade receivables approximate their recorded value. Limited credit risk exists on trade receivables... -

Page 68

... held for retail sales Inventories consist primarily of truck and trailer parts and accessories used to manufacture and repair rental equipment as well as products and accessories available for retail sale. Inventory is held at Company-owned locations; our independent dealers do not hold any of the... -

Page 69

... value of surplus real estate, which is lower than market value at the balance sheet date, was $10.3 million and $10.8 million for fiscal 2008 and 2007, respectively, and is included in Investments, other. Receivables Accounts receivable include trade accounts from moving and self-storage customers... -

Page 70

... in accounts payable on the consolidated balance sheets. Revenue Recognition Self-moving rentals are recognized for the period that trucks and moving equipment are rented. Self-storage revenues, based upon the number of paid storage contract days, are recognized as earned during the period. Sales of... -

Page 71

... sale. Income Taxes AMERCO files a consolidated tax return with all of its legal subsidiaries, except for Dallas General Life Insurance Company ("DGLIC"), a subsidiary of Oxford, which will file on a stand alone basis until 2012. SAC Holding Corporation and its legal subsidiaries and SAC Holding II... -

Page 72

... stock. Note 5: Reinsurance Recoverables and Trade Receivables, Net Reinsurance recoverables and trade receivables, net were as follows: March 31, 2008 Reinsurance recoverable Paid losses recoverable Trade accounts receivable Accrued investment income Premiums and agents' balances Independent dealer... -

Page 73

... ENTITIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED) Note 6: Notes and Mortgage Receivables, Net Notes and mortgage receivables, net were as follows: March 31, 2008 Notes, mortgage receivables and other, net of discount Less: Allowance for doubtful accounts $ $ (In thousands) 2,403... -

Page 74

... to be other-thantemporary and the Company recognized these write-downs through earnings in the amounts of approximately $0.5 million in 2007, $1.4 million in 2006 and $5.3 million in 2005. The adjusted cost and estimated market value of available-for-sale investments at December 31, 2007 and... -

Page 75

... current estimated fair value less cost to sell. Equity investments are carried at cost and assessed for impairment. Insurance policy loans are carried at their unpaid balance. Note 8: Net Investment and Interest Income Net investment and interest income, were as follows: 2008 Fixed maturities Real... -

Page 76

... NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED) Note 9: Borrowings Long-Term Debt Long-term debt was as follows: 2008 Rate (a) Real estate loan (amortizing term) Real estate loan (revolving credit) Senior mortgages Construction loan (revolving credit) Working capital loan (revolving... -

Page 77

...loans include non-payment of principal or interest and other standard reporting and change-in-control covenants. There are limited restrictions regarding our use of the funds. Construction / Working Capital Loans Amerco Real Estate Company and a subsidiary of U-Haul International, Inc. entered into... -

Page 78

... cargo vans and pickup trucks that were purchased and the operating cash flows associated with their operation. The Box Truck Note and Cargo Van/Pickup Note have the benefit of financial guaranty insurance policies through Ambac Assurance Corporation. These policies guarantee the timely payment of... -

Page 79

... for fiscal 2008, 2007 and 2006, respectively. Early extinguishment fees paid in cash by AMERCO was $21.2 million in fiscal 2006. The Company manages exposure to changes in market interest rates. The Company' s use of derivative instruments is limited to highly effective interest rate swaps to... -

Page 80

... quarterly interest payments) impact earnings and when interest payments are either made or received. For the year ended March 31, 2008, the Company recognized net losses of $2.5 million from highly effective cash flow hedges, which are attributable to the portion of the change in the fair value of... -

Page 81

... our Board of Directors (the "Board") had authorized us to repurchase up to $50.0 million of our common stock from time to time on the open market between September 13, 2006 and October 31, 2007. On March 9, 2007, the Board authorized an increase in the Company' s common stock repurchase program to... -

Page 82

... on investments Change in fair value of cash flow hedge FASB statement No. 158 adjustment Balance at March 31, 2007 Foreign currency translation Unrealized gain on investments Change in fair value of cash flow hedge Change in postretirement benefit obligation Balance at March 31, 2008 $ $ (33,344... -

Page 83

... to meet before being recognized in the financial statements. As a result of the adoption of FIN 48, the Company recognized a $6.8 million decrease to its previous reserves for uncertain tax positions. This decrease is presented as an increase in the beginning balance of retained earnings. F-26 -

Page 84

... of funds for retirement on a tax-deferred basis and provide for annual discretionary employer contributions. Amounts to be contributed are determined by the Chief Executive Officer ("CEO") of the Company under the delegation of authority from the Board, pursuant to the terms of the Profit... -

Page 85

... have attained age sixty-five and earned at least ten years of full-time service upon retirement from the Company are entitled to group term life insurance benefits. The life insurance benefit is $2,000 plus $100 for each year of employment over ten years. The plan is not funded and claims are paid... -

Page 86

... to AAA rated or equivalent) fixed income investments with cash flow streams sufficient to satisfy benefit obligations under the plan when due. Fluctuations in the discount rate assumptions primarily reflect changes in U.S. interest rates. The assumed health care cost trend rate used to measure the... -

Page 87

AMERCO AND CONSOLIDATED ENTITIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED) If the estimated health care cost trend rate assumptions were increased by one percent, the accumulated post retirement benefit obligation as of fiscal year-end would increase by approximately $111,880 and the... -

Page 88

AMERCO AND CONSOLIDATED ENTITIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED) Note 15: Reinsurance and Policy Benefits and Losses, Claims and Loss Expenses Payable During their normal course of business, our insurance subsidiaries assume and cede reinsurance on both a coinsurance and a ... -

Page 89

... of these agreements, RepWest holds letters of credit at years-end in the amount of $3.8 million from re-insurers and has issued letters of credit in the amount of $14.7 million in favor of certain ceding companies. Policy benefits and losses, claims and loss expenses payable for RepWest were as... -

Page 90

... Company leases a portion of its rental equipment and certain of its facilities under operating leases with terms that expire at various dates substantially through 2014, with the exception of one land lease expiring in 2034. At March 31, 2008, AMERCO has guaranteed $165.5 million of residual values... -

Page 91

...and operating expenditures to stay in compliance with environmental laws and has put in place a remedial plan at each site where it believes such a plan is necessary. Since 1988, Real Estate has managed a testing and removal program for underground storage tanks. Based upon the information currently... -

Page 92

... believes that its sales of self-storage properties to SAC Holdings has provided a unique structure for the Company to earn moving equipment rental revenues and property management fee revenues from the SAC Holdings selfstorage properties that the Company manages. During fiscal 2008, subsidiaries of... -

Page 93

... significant shareholder and director of AMERCO, has an interest in Mercury. The Company leases space for marketing company offices, vehicle repair shops and hitch installation centers from subsidiaries of SAC Holdings, 5 SAC and Galaxy. Total lease payments pursuant to such leases were $2.1 million... -

Page 94

... FINANCIAL STATEMENTS -- (CONTINUED) Related Party Assets March 31, 2008 Private Mini notes, receivables and interest Oxford note receivable from SAC Holdings U-Haul notes receivable from SAC Holdings (a) U-Haul interest receivable from SAC Holdings (a) U-Haul receivable from SAC Holdings (a) U-Haul... -

Page 95

... Geographic Area Financial information by geographic area for fiscal 2008 is as follows: Year Ended March 31, 2008 Total revenues Depreciation and amortization, net of (gains) losses on disposal Interest expense Pretax earnings Income tax expense Identifiable assets United States Canada Consolidated... -

Page 96

... AMERCO has four reportable segments. They are Moving and Storage, Property and Casualty Insurance, Life Insurance and SAC Holding II. Management tracks revenues separately, but does not report any separate measure of the profitability for rental vehicles, rentals of self-storage spaces and sales... -

Page 97

...Note 21A: Financial Information by Consolidating Industry Segment: Consolidating balance sheets by industry segment as of March 31, 2008 are as follows: Moving & Storage Moving & Storage Consolidated (In thousands) Assets: Cash and cash equivalents Reinsurance recoverables and trade receivables, net... -

Page 98

... STATEMENTS -- (CONTINUED) Consolidating balance sheets by industry segment as of March 31, 2008 are as follows: Moving & Storage Moving & Storage Consolidated (In thousands) Liabilities: Accounts payable and accrued expenses AMERCO's notes and loans payable Policy benefits and losses, claims... -

Page 99

...CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED) Consolidating balance sheets by industry segment as of March 31, 2007 are as follows: Moving & Storage Moving & Storage Consolidated AMERCO Legal Group Property & Casualty Insurance (a) AMERCO as Consolidated AMERCO U-Haul Real Estate Eliminations... -

Page 100

... Insurance (a) Eliminations (In thousands) Liabilities: Accounts payable and accrued expenses AMERCO's notes and loans payable SAC Holding II Corporation notes and loans payable, non-recourse to AMERCO Policy benefits and losses, claims and loss expenses payable Liabilities from investment contracts... -

Page 101

... Life Insurance (a) Insurance (a) Eliminations (In thousands) AMERCO as Consolidated AMERCO Consolidated Total Consolidated SAC Holding II (h) Eliminations Revenues: Self-moving equipment rentals Self-storage revenues Self-moving & self-storage products & service sales Property management fees... -

Page 102

... as Consolidated Total Consolidated AMERCO U-Haul Real Estate Eliminations Eliminations SAC Holding II Eliminations Revenues: Self-moving equipment rentals Self-storage revenues Self-moving & self-storage products & service sales Property management fees Life insurance premiums Property and... -

Page 103

... as Consolidated Total Consolidated AMERCO U-Haul Real Estate Eliminations Eliminations SAC Holding II Eliminations Revenues: Self-moving equipment rentals Self-storage revenues Self-moving & self-storage products & service sales Property management fees Life insurance premiums Property and... -

Page 104

... expenses Policy benefits and losses, claims and loss expenses payable Other policyholders' funds and liabilities Deferred income Related party liabilities Net cash provided (used) by operating activities Cash flows from investing activities: Purchases of: Property, plant and equipment Short term... -

Page 105

... contract deposits Investment contract withdrawals Net cash provided (used) by financing activities Effects of exchange rate on cash Increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period U-Haul Real Estate... -

Page 106

...: Property, plant and equipment Short term investments Fixed maturity investments Cash received in excess of purchase of company acquired Preferred stock Real estate Mortgage loans Payments from notes and mortgage receivables Net cash provided (used) by investing activities (a) Balance for the year... -

Page 107

... Employee Stock Ownership Plan - repayments from loan Treasury stock repurchases Proceeds from (repayment of) intercompany loans Preferred stock dividends paid Investment contract deposits Investment contract withdrawals Net cash provided (used) by financing activities Effects of exchange rate... -

Page 108

... expenses Policy benefits and losses, claims and loss expenses payable Other policyholders' funds and liabilities Deferred income Related party liabilities Net cash provided (used) by operating activities Cash flows from investing activities: Purchases of: Property, plant and equipment Short term... -

Page 109

... Employee Stock Ownership Plan - repayments from loan Proceeds from (repayment of) intercompany loans Preferred stock dividends paid Investment contract deposits Investment contract withdrawals Net cash provided (used) by financing activities Effects of exchange rate on cash Increase (decrease... -

Page 110

... ENTITIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED) Note 22: Subsequent Events Preferred Stock Dividends On May 2, 2008, the Board of Directors of AMERCO, the holding Company for U-Haul International, Inc., and other companies, declared a regular quarterly cash dividend of $0.53125... -

Page 111

SCHEDULE I CONDENSED FINANCIAL INFORMATION OF AMERCO BALANCE SHEETS March 31, 2008 (In thousands) ASSETS Cash and cash equivalents Investment in subsidiaries Investment in SAC Holding II Related party assets ... notes are an integral part of these condensed consolidated financial statements. F-54 -

Page 112

... income from subsidiaries Expenses: Operating expenses Other expenses Total expenses Equity in earnings of subsidiaries and SAC Holding II Interest income (expense) Fees on early extinguishment of debt Pretax earnings Income tax benefit (expense) Net earnings Less: Preferred stock dividends Earnings... -

Page 113

... and SAC Holding II Adjustments to reconcile net earnings to cash provided by operations: Depreciation Write-off of unamortized debt issuance costs Deferred income taxes Net change in other operating assets and liabilities: Prepaid expenses Other assets Related party assets Accounts payable and... -

Page 114

... of Significant Accounting Policies AMERCO, a Nevada corporation, was incorporated in April, 1969, and is the holding Company for U-Haul International, Inc., Amerco Real Estate Company, Republic Western Insurance Company and Oxford Life Insurance Company. The financial statements of the Registrant... -

Page 115

SCHEDULE II AMERCO AND CONSOLIDATED SUBSIDIARIES VALUATION AND QUALIFYING ACCOUNTS Years Ended March 31, 2008, 2007 and 2006 Balance at Beginning of Year Year ended March 31, 2008 Allowance for doubtful accounts (deducted from trade receivable) Allowance for doubtful accounts (deducted from notes ... -

Page 116

SCHEDULE V AMERCO AND CONSOLIDATED SUBSIDIARIES SUPPLEMENTAL INFORMATION (FOR PROPERTY-CASUALTY INSURANCE UNDERWRITERS) Years Ended December 31, 2007, 2006 AND 2005 Year Reserves for Unpaid Claims Deferred Policy and Adjustment Expenses Affiliation with Registrant Acquisition Cost Discount if any... -

Page 117

...the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. Signature Title Date /s/ EDWARD J. SHOEN Chairman of the Board and President (Principal Executive Officer) Chief Accounting... -

Page 118

...the consolidated financial statements and financial statement schedules, and the effectiveness of the Company' s internal control over financial reporting, which appear in the Company' s Annual Report on Form 10-K for the year ended March 31, 2008. /s/ BDO Seidman, LLP Phoenix, Arizona June 2, 2008 -

Page 119

... financial statements of SAC Holding II Corporation (A Wholly-Owned Subsidiary of Blackwater Investments, Inc.) and its subsidiaries' consolidated in the Company' s Annual Report on Form 10-K for the year ended March 31, 2008. /s/ Semple, Marchal & Cooper, LLP Phoenix, Arizona May 29, 2008 -

Page 120

... report financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant' s internal control over financial reporting. (b) /s/ Edward J. Shoen Edward J. Shoen President and Chairman of the Board of AMERCO Date... -

Page 121

... report financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant' s internal control over financial reporting. (b) /s/ Jason A. Berg Jason A. Berg Chief Accounting Officer of AMERCO Date: June 4, 2008 -

Page 122

...the Securities Exchange Act of 1934; and (2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. AMERCO, a Nevada corporation /s/ Edward J. Shoen Edward J. Shoen President and Chairman of the Board Date... -

Page 123

... Securities Exchange Act of 1934; and (2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. AMERCO, a Nevada corporation /s/ Jason A. Berg Jason A. Berg Chief Accounting Officer Date: June 4, 2008 -

Page 124

... Company." The Company is primarily engaged in the shortterm rental of trucks, trailers and related equipment to the do-it-yourself mover. The Company also sells related moving products and services, and rents self-storage facilities and general rental items. In addition, the Company's insurance... -

Page 125

... Director of AMERCO, U-Haul and Amerco Real Estate Company, Retired Executive Vice President Field Operations of U-Haul Director of AMERCO, Director of Pinnacle West Capital Corporation, co-founding partner of Gallagher & Kennedy, P.A., a Phoenix-based business law ï¬rm Director of AMERCO, Retired... -

Page 126

UH-6000-2008(0) ©07/2008 AMERCO®