Texas Instruments 2012 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2012 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL

REPORT

TEXAS INSTRUMENTS16 • 2012 ANNUAL REPORT

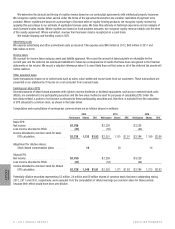

Summarized information as of December 31, 2012, about outstanding stock options that are vested and expected to vest, as well as

stock options that are currently exercisable, is as follows:

Outstanding Stock Options (Fully

Vested and Expected to Vest) (a) Options

Exercisable

Number of outstanding (shares) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 96,121,395 68,534,425

Weighted average remaining contractual life (in years) . . . . . . . . . . . . . . . . . . . 4.7 3.3

Weighted average exercise price per share . . . . . . . . . . . . . . . . . . . . . . . . . $ 28.75 $ 27.30

Intrinsic value (millions of dollars) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 398 $ 300

(a) Includes effects of expected forfeitures of approximately 4 million shares. Excluding the effects of expected forfeitures, the

aggregate intrinsic value of stock options outstanding was $414 million.

As of December 31, 2012, the total future compensation cost related to equity awards not yet recognized in the Consolidated statements

of income was $460 million, consisting of $143 million related to unvested stock options and $317 million related to RSUs. The

$460 million will be recognized as follows: $205 million in 2013, $153 million in 2014, $94 million in 2015 and $8 million in 2016.

Employee stock purchase plan

Options outstanding under the employee stock purchase plan at December 31, 2012, had an exercise price of $27.47 per share

(85 percent of the fair market value of TI common stock on the date of automatic exercise). Of the total outstanding options, none were

exercisable at year-end 2012.

Employee stock purchase plan transactions during 2012 were as follows:

Employee Stock

Purchase Plan

(Shares) Exercise Price

Outstanding grants, December 31, 2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 580,095 $25.29

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,931,354 25.64

Exercised . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,829,498) 25.12

Outstanding grants, December 31, 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 681,951 $27.47

The weighted average grant date fair value of options granted under the employee stock purchase plans during the years 2012, 2011

and 2010 was $4.52, $4.59 and $3.97 per share, respectively. During the years ended December 31, 2012, 2011 and 2010, the total

intrinsic value of options exercised under these plans was $13 million, $10 million and $9 million, respectively.

Effect on shares outstanding and treasury shares

Our practice is to issue shares of common stock upon exercise of stock options generally from treasury shares and, on a limited basis,

from previously unissued shares. We settled stock option plan exercises using treasury shares of 25,064,951 in 2012; 27,308,311 in

2011 and 19,077,274 in 2010; and previously unissued common shares of 180,955 in 2012; 390,438 in 2011 and 342,380 in 2010.

Upon vesting of RSUs, we issued treasury shares of 3,187,490 in 2012; 3,748,623 in 2011 and 1,392,790 in 2010, and previously

unissued common shares of 4,593 in 2012; 73,852 in 2011, with none in 2010.

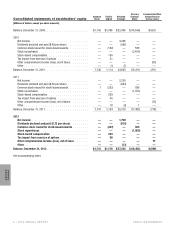

Shares available for future grant and reserved for issuance are summarized below:

As of December 31, 2012

Shares

Long-term Incentive

and Director

Compensation Plans Employee Stock

Purchase Plan Total

Reserved for issuance (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 197,554,600 25,137,819 222,692,419

Shares to be issued upon exercise of outstanding options and RSUs . . . . . (123,143,365) (681,951) (123,825,316)

Available for future grants . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74,411,235 24,455,868 98,867,103

(a) Includes 129,033 shares credited to directors’ deferred compensation accounts that settle in shares of TI common stock. These

shares are not included as grants outstanding at December 31, 2012.

Effect on cash flows

Cash received from the exercise of options was $523 million in 2012, $690 million in 2011 and $407 million in 2010. The related net tax

impact realized was $56 million, $45 million and $21 million (which includes excess tax benefits realized of $38 million, $31 million and

$13 million) in 2012, 2011 and 2010, respectively.