Texas Instruments 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL

REPORT

TEXAS INSTRUMENTS8 • 2012 ANNUAL REPORT

We determine the amount and timing of royalty revenue based on our contractual agreements with intellectual property licensees.

We recognize royalty revenue when earned under the terms of the agreements and when we consider realization of payment to be

probable. Where royalties are based on a percentage of licensee sales of royalty-bearing products, we recognize royalty revenue by

applying this percentage to our estimate of applicable licensee sales. We base this estimate on historical experience and an analysis of

each licensee’s sales results. Where royalties are based on fixed payment amounts, we recognize royalty revenue ratably over the term

of the royalty agreement. Where warranted, revenue from licensees may be recognized on a cash basis.

We include shipping and handling costs in COR.

Advertising costs

We expense advertising and other promotional costs as incurred. This expense was $46 million in 2012, $43 million in 2011 and

$44 million in 2010.

Income taxes

We account for income taxes using an asset and liability approach. We record the amount of taxes payable or refundable for the

current year and the deferred tax assets and liabilities for future tax consequences of events that have been recognized in the financial

statements or tax returns. We record a valuation allowance when it is more likely than not that some or all of the deferred tax assets will

not be realized.

Other assessed taxes

Some transactions require us to collect taxes such as sales, value-added and excise taxes from our customers. These transactions are

presented in our statements of income on a net (excluded from revenue) basis.

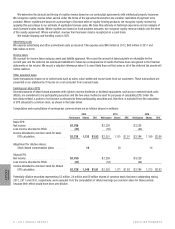

Earnings per share (EPS)

Unvested awards of share-based payments with rights to receive dividends or dividend equivalents, such as our restricted stock units

(RSUs), are considered to be participating securities and the two-class method is used for purposes of calculating EPS. Under the

two-class method, a portion of net income is allocated to these participating securities and, therefore, is excluded from the calculation

of EPS allocated to common stock, as shown in the table below.

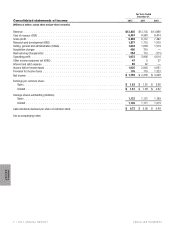

Computation and reconciliation of earnings per common share are as follows (shares in millions):

2012 2011 2010

Net Income Shares EPS Net Income Shares EPS Net Income Shares EPS

Basic EPS:

Net income . . . . . . . . . . . . . . . . . . . $1,759 $2,236 $ 3,228

Less income allocated to RSUs . . . . . . . . . (31) (35) (44)

Income allocated to common stock for basic

EPS calculation . . . . . . . . . . . . . . . $1,728 1,132 $1.53 $2,201 1,151 $1.91 $ 3,184 1,199 $2.66

Adjustment for dilutive shares:

Stock-based compensation plans . . . . . 14 20 14

Diluted EPS:

Net income . . . . . . . . . . . . . . . . . . . $1,759 $2,236 $ 3,228

Less income allocated to RSUs . . . . . . . . . (31) (34) (44)

Income allocated to common stock for diluted

EPS calculation . . . . . . . . . . . . . . . $1,728 1,146 $1.51 $2,202 1,171 $1.88 $ 3,184 1,213 $2.62

Potentially dilutive securities representing 52 million, 24 million and 66 million shares of common stock that were outstanding during

2012, 2011 and 2010, respectively, were excluded from the computation of diluted earnings per common share for these periods

because their effect would have been anti-dilutive.