Texas Instruments 2012 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2012 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL

REPORT

TEXAS INSTRUMENTS 2012 ANNUAL REPORT • 11

The amount of recognized amortization of acquired intangible assets resulting from the National acquisition is based on estimated

useful lives varying between two and ten years. See Note 10 for additional information.

Retention bonuses reflect amounts already or expected to be paid to former National employees who fulfill agreed-upon service

period obligations and are recognized ratably over the required service period.

Stock-based compensation was recognized for the accelerated vesting of equity awards upon the termination of employees, with

additional compensation being recognized over the applicable vesting period for the remaining grantees.

Severance and other benefits costs were for former National employees who were terminated after the closing date. These costs

totaled $70 million for the year ended December 31, 2011, with $41 million in charges related to change of control provisions under

existing employment agreements and $29 million in charges for announced employment reductions affecting about 350 jobs. All of

these jobs were eliminated by the end of 2012 as a result of redundancies and cost efficiency measures, with approximately $16 million

of additional expense recognized in 2012. Of the $86 million in cumulative charges recognized through December 31, 2012, $65 million

was paid in 2012 and $14 million was paid in 2011.

Transaction and other costs include various expenses incurred in connection with the National acquisition. In 2011, we also incurred

bridge financing costs.

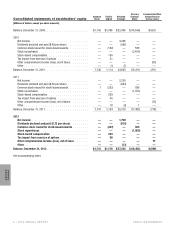

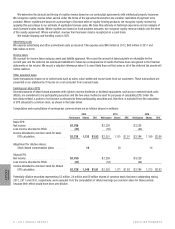

In conformance with Accounting Standards Codification (ASC) 805 – Business Combinations, the following unaudited summaries

of pro forma combined results of operation for the years ended December 31, 2011 and 2010, give effect to the acquisition as if it had

been completed on January 1, 2010. These pro forma summaries do not reflect any operating efficiencies, cost savings or revenue

enhancements that may be achieved by the combined companies. In addition, certain non-recurring expenses, such as restructuring

charges and retention bonuses, are not reflected in the pro forma summaries. These pro forma summaries are presented for

informational purposes only and are not indicative of what the actual results of operations would have been had the acquisition taken

place as of that date, nor are they indicative of future consolidated results of operations.

For Years Ended

December 31,

2011 2010

(Unaudited)

Revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $14,805 $15,529

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,438 3,218

Earnings per common share – diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2.05 $ 2.61

Other acquisitions

In October 2010, we acquired our first semiconductor manufacturing site in China, located in the Chengdu High-tech Zone. This

acquisition, which was recorded as a business combination, used net cash of $140 million. As contractually agreed, we made an

additional payment of $35 million to the seller in October 2011.

In August 2010, we completed the acquisition of two wafer fabs and equipment in Aizu-Wakamatsu, Japan, for net cash of

$130 million. The acquisition of the fabs and related 200-millimeter equipment was recorded as a business combination for net cash of

$59 million. We also settled a contractual arrangement with a third party for our benefit for net cash of $12 million, which was recorded

as a charge in COR in Other. Additionally, we incurred acquisition-related costs of $1 million, which were recorded in SG&A. This

acquisition also included 300-millimeter production tools, which we recorded as a capital purchase for net cash of $58 million.

The results of operations for these acquisitions have been included in our financial statements from their respective acquisition

dates. Operating results for transitional supply agreements are included in Other. Pro forma financial information for these acquisitions

would not be materially different from amounts reported.