Texas Instruments 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL

REPORT

TEXAS INSTRUMENTS 2012 ANNUAL REPORT • 13

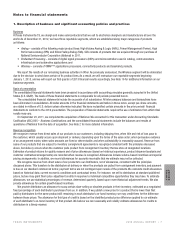

2011 action

Beginning in the fourth quarter of 2011, we recognized restructuring charges associated with the announced plans to close two older

semiconductor manufacturing facilities in Hiji, Japan, and Houston, Texas, in 2013. Each facility employed about 500 people. The

total charge for these closures is estimated at $215 million, of which $161 million has been recognized through December 31, 2012,

consisting of: $113 million for severance and benefit costs, $23 million of accelerated depreciation of the facilities’ assets and

$25 million for other exit costs. Of the estimated $215 million total cost, about $135 million will be for severance and related benefits,

about $30 million will be for accelerated depreciation of facility assets and about $50 million will be for other exit costs. In 2012,

$11 million was paid to terminated employees for severance and benefits related to this action.

The restructuring action related to the acquisition of National is discussed in Note 2 and is reflected in Acquisition charges in our

Consolidated statements of income.

2008/2009 actions

In October 2008, we announced actions to reduce expenses in our Wireless segment, especially our baseband operation. In

January 2009, we announced actions that included broad-based employment reductions to align our spending with weakened demand.

Combined, these actions eliminated about 3,900 jobs; they were completed in 2009.

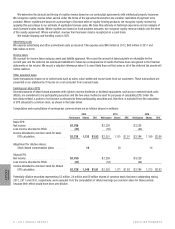

The table below reflects the changes in accrued restructuring balances associated with these actions:

2012 Action 2011 Action 2008/2009 Actions

Severance

and Benefits Other

Charges Severance

and Benefits Other

Charges Severance

and Benefits Other

Charges Total

Accrual at December 31, 2009 . . . . . . . . . . $ — $ — $ — $ — $ 84 $ 10 $ 94

Restructuring charges . . . . . . . . . . . . . . . — — — — 33 — 33

Non-cash items (a) . . . . . . . . . . . . . . . . — — — — (33) — (33)

Payments . . . . . . . . . . . . . . . . . . . . . — — — — (62) (2) (64)

Remaining accrual at December 31, 2010 . . . . . — — — — 22 8 30

Restructuring charges . . . . . . . . . . . . . . . — — 107 5 — — 112

Non-cash items (a) . . . . . . . . . . . . . . . . — — (11) (5) — — (16)

Payments . . . . . . . . . . . . . . . . . . . . . — — — — (9) (1) (10)

Remaining accrual at December 31, 2011 . . . . . — — 96 — 13 7 116

Restructuring charges . . . . . . . . . . . . . . 245 106 6 43 — — 400

Non-cash items (a) . . . . . . . . . . . . . . . . — (106) 3 (18) — — (121)

Payments . . . . . . . . . . . . . . . . . . . . . (4) — (11) (22) (8) (1) (46)

Remaining accrual at December 31, 2012 . . . . $241 $ — $ 94 $ 3 $ 5 $ 6 $ 349

(a) Reflects charges for goodwill impairment, stock-based compensation, impacts of postretirement benefit plans and

accelerated depreciation.

The accrual balances above are a component of Accrued expenses and other liabilities or Deferred credits and other liabilities on our

Consolidated balance sheets, depending on the expected timing of payment.

Other

Gain on transfer of Japan substitutional pension

During the third quarter of 2012, we transferred the obligations and assets of the substitutional portion of our Japan pension program

from the pension trust to the government of Japan, resulting in a net gain of $144 million. See Note 11 for additional details.

Gain on divested product line

In November 2010, we divested a product line previously included in Other for $148 million and recognized a gain in operating profit of

$144 million.