Texas Instruments 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL

REPORT

TEXAS INSTRUMENTS 2012 ANNUAL REPORT • 9

Investments

We present investments on our balance sheets as cash equivalents, short-term investments or long-term investments. Specific details

are as follows:

• Cash equivalents and short-term investments: We consider investments in debt securities with maturities of 90 days or less from

the date of our investment to be cash equivalents. We consider investments in debt securities with maturities beyond 90 days

from the date of our investment as being available for use in current operations and include these investments in short-term

investments. The primary objectives of our cash equivalent and short-term investment activities are to preserve capital and

maintain liquidity while generating appropriate returns.

• Long-term investments: Long-term investments consist of mutual funds, venture capital funds and non-marketable equity

securities. Prior to the fourth quarter of 2012, this also included auction-rate securities.

• Classification of investments: Depending on our reasons for holding the investment and our ownership percentage, we classify

investments in securities as available for sale, trading, or equity- or cost-method investments, which are more fully described in

Note 9. We determine cost or amortized cost, as appropriate, on a specific identification basis.

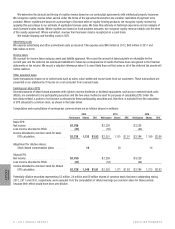

Inventories

Inventories are stated at the lower of cost or estimated net realizable value. Cost is generally computed on a currently adjusted

standard cost basis, which approximates cost on a first-in first-out basis. Standard cost is based on the normal utilization of installed

factory capacity. Cost associated with underutilization of capacity is expensed as incurred. Inventory held at consignment locations

is included in our finished goods inventory. Consigned inventory was $169 million and $129 million as of December 31, 2012 and

2011, respectively.

We review inventory quarterly for salability and obsolescence. A specific allowance is provided for inventory considered unlikely to

be sold. Remaining inventory includes a salability and obsolescence allowance based on an analysis of historical disposal activity. We

write off inventory in the period in which disposal occurs.

Property, plant and equipment; acquisition-related intangibles and other capitalized costs

Property, plant and equipment are stated at cost and depreciated over their estimated useful lives using the straight-line method.

Our cost basis includes certain assets acquired in business combinations that were initially recorded at fair value as of the date of

acquisition. Leasehold improvements are amortized using the straight-line method over the shorter of the remaining lease term or the

estimated useful lives of the improvements. We amortize acquisition-related intangibles on a straight-line basis over the estimated

economic life of the assets. Capitalized software licenses generally are amortized on a straight-line basis over the term of the license.

Fully depreciated or amortized assets are written off against accumulated depreciation or amortization.

Impairments of long-lived assets

We regularly review whether facts or circumstances exist that indicate the carrying values of property, plant and equipment or

other long-lived assets, including intangible assets, are impaired. We assess the recoverability of assets by comparing the projected

undiscounted net cash flows associated with those assets to their respective carrying amounts. Any impairment charge is based on the

excess of the carrying amount over the fair value of those assets. Fair value is determined by available market valuations, if applicable,

or by discounted cash flows.

Goodwill and indefinite-lived intangibles

Goodwill is not amortized but is reviewed for impairment annually or more frequently if certain impairment indicators arise. We perform

our annual goodwill impairment tests as of October 1 for our reporting units. The test compares the fair value for each reporting unit to

its associated carrying value including goodwill. See Note 10 for additional information.

Foreign currency

The functional currency for our non-U.S. subsidiaries is the U.S. dollar. Accounts recorded in currencies other than the U.S. dollar are

remeasured into the functional currency. Current assets (except inventories), deferred income taxes, other assets, current liabilities

and long-term liabilities are remeasured at exchange rates in effect at the end of each reporting period. Property, plant and equipment

with associated depreciation and inventories are remeasured at historic exchange rates. Revenue and expense accounts other than

depreciation for each month are remeasured at the appropriate daily rate of exchange. Currency exchange gains and losses from

remeasurement are credited or charged to OI&E.