Texas Instruments 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL

REPORT

TEXAS INSTRUMENTS10 • 2012 ANNUAL REPORT

Derivatives and hedging

In connection with the issuance of variable-rate long-term debt in May 2011, as more fully described in Note 12, we entered into an

interest rate swap designated as a hedge of the variability of cash flows related to interest payments. Gains and losses from changes in

the fair value of the interest rate swap are credited or charged to Accumulated other comprehensive income (loss), net of taxes (AOCI).

We also use derivative financial instruments to manage exposure to foreign exchange risk. These instruments are primarily forward

foreign currency exchange contracts that are used as economic hedges to reduce the earnings impact exchange rate fluctuations

may have on our non-U.S. dollar net balance sheet exposures. Gains and losses from changes in the fair value of these forward

foreign currency exchange contracts are credited or charged to OI&E. We do not apply hedge accounting to our foreign currency

derivative instruments.

We do not use derivatives for speculative or trading purposes.

Changes in accounting standards

As of December 31, 2012, the Financial Accounting Standards Board had issued several accounting standards that we have not yet

been required to adopt. None of these standards would have a material effect on our financial condition, results of operations or

financial disclosures.

2. Acquisition-related charges

National acquisition

On September 23, 2011, we completed the acquisition of National by acquiring all issued and outstanding common shares in exchange

for total consideration of $6.56 billion. We recognized $3.528 billion of goodwill, which was applied to the Analog segment. None of the

goodwill related to the National acquisition was deductible for tax purposes.

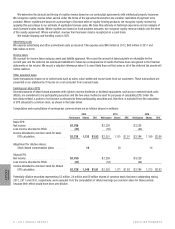

We incurred various costs as a result of the acquisition of National that are included in Other consistent with how management

measures the performance of its segments. These total acquisition-related charges are as follows:

For Years Ended

December 31,

2012 2011

Distributor contract termination . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 21 $ —

Inventory related . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —96

Property, plant and equipment related . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —15

As recorded in COR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 111

Amortization of intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 325 87

Retention bonuses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57 46

Stock-based compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 50

Severance and other benefits:

Employment reductions announced at closing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 29

Change of control . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —41

Transaction and other costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35 62

As recorded in Acquisition charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 450 315

Total acquisition-related charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $471 $426

In 2011, we discontinued using one of National’s distributors. We acquired the distributor’s inventory at fair value, resulting in an

incremental charge of $21 million to COR upon sale of the inventory in 2012.

At acquisition, we recognized costs associated with the adjustments to write up the value of acquired inventory and property, plant

and equipment to fair value. These costs are in addition to the normal expensing of the acquired assets based on their carrying or book

value prior to the acquisition. The total fair-value write-up of $96 million for the acquired inventory was expensed as that inventory

was sold. The total fair-value write-up for the acquired property, plant and equipment was $436 million. In the fourth quarter of 2011,

depreciation was $15 million. It continues at a declining rate and is no longer separately disclosed as an acquisition-related charge.