Texas Instruments 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 Annual

Notice of 2013 Annual Meeting & Proxy Statement

Report

Table of contents

-

Page 1

2012 Annual Report Notice of 2013 Annual Meeting & Proxy Statement -

Page 2

... our Analog and Embedded Processing business model can deliver, even in a weak economy. We generated almost $3 billion in free cash ï¬,ow and returned 90 percent of it to shareholders through dividends and share repurchases. We raised our quarterly dividend 24 percent, our tenth increase in the last... -

Page 3

... to financial statements ...7 Description of business and significant accounting policies and practices Acquisition-related charges Restructuring charges/other Losses associated with the 2011 earthquake in Japan Stock-based compensation Profit sharing plans Income taxes Financial instruments and... -

Page 4

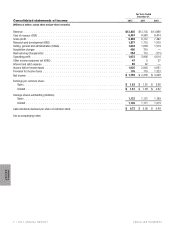

... - 4,551 1,323 $ 3,228 $ $ 2.66 2.62 1,199 1,213 $ 0.49 Earnings per common share: Basic ...Diluted ...Average shares outstanding (millions): Basic ...Diluted ...Cash dividends declared per share of common stock ...See accompanying notes. ANNUAL REPORT 2 • 2012 ANNUAL REPORT TEXAS INSTRUMENTS -

Page 5

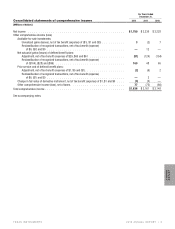

...Years Ended December 31, Consolidated statements of comprehensive income [Millions of dollars] 2012 2011 2010 Net income ...Other comprehensive income (loss): Available-for-sale investments: Unrealized gains (losses), net of tax benefit...TEXAS INSTRUMENTS 2012 ANNUAL REPORT • 3 ANNUAL REPORT -

Page 6

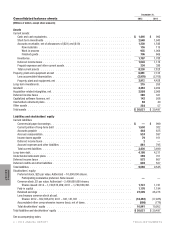

December 31, Consolidated balance sheets [Millions of dollars, except share amounts] 2012 2011 Assets Current assets: Cash and cash equivalents ...Short-term investments ...Accounts receivable, net of allowances of ($31) and ($19) Raw materials ...Work in process ...Finished goods ...Inventories... -

Page 7

...) 2,589 - - (592) (2,454) 407 13 - (2,626) ANNUAL REPORT Net change in cash and cash equivalents...Cash and cash equivalents at beginning of year ...Cash and cash equivalents at end of year ...See accompanying notes. (327) 137 1,319 1,182 $ 992 $ 1,319 TEXAS INSTRUMENTS 2012 ANNUAL REPORT • 5 -

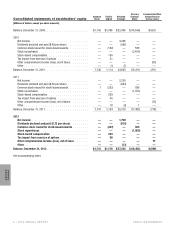

Page 8

... (loss), net of taxes Other...Balance, December 31, 2012 ...See accompanying notes. ... ... ... ... ... ... ... 1,741 - 1,759 - - (819) - (337) - 823 - - (1,800) 263 - - 56 13) - $1,176 $ 27,205 $(18,462) - - - - - - 77 - $ (699) ANNUAL REPORT 6 • 2012 ANNUAL REPORT TEXAS INSTRUMENTS -

Page 9

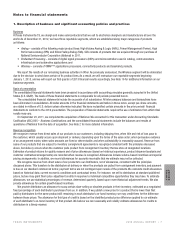

... to financial statements 1. Description of business and significant accounting policies and practices Business At Texas Instruments (TI), we design and make semiconductors that we sell to electronics designers and manufacturers all over the world. As of December 31, 2012, we have three reportable... -

Page 10

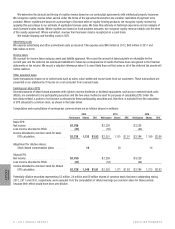

... 24 million and 66 million shares of common stock that were outstanding during 2012, 2011 and 2010, respectively, were excluded from the computation of diluted earnings per common share for these periods because their effect would have been anti-dilutive. 8 • 2012 ANNUAL REPORT TEXAS INSTRUMENTS -

Page 11

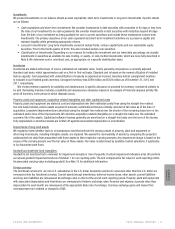

...over the shorter of the remaining lease term or the estimated useful lives of the improvements. We amortize acquisition-related intangibles on a straight-line basis over the estimated economic life of the assets. Capitalized software licenses generally are amortized on a straight-line basis over the... -

Page 12

...: For Years Ended December 31, 2012 2011 Distributor contract termination ...Inventory related ...Property, plant and equipment related ...As recorded in COR ...Amortization of intangible assets ...Retention bonuses ...Stock-based compensation ...Severance and other benefits: Employment reductions... -

Page 13

... to the seller in October 2011. In August 2010, we completed the acquisition of two wafer fabs and equipment in Aizu-Wakamatsu, Japan, for net cash of $130 million. The acquisition of the fabs and related 200-millimeter equipment was recorded as a business combination for net cash of $59 million. We... -

Page 14

... Gain on transfer of Japan substitutional pension Gain on divested product line ...Other ...Restructuring charges/other ...2012, $4 million has been paid to terminated employees for severance and benefits related to this action. ANNUAL REPORT 12 • 2 0 1 2 A N N U A L R E P O R T TEXAS INSTRUMENTS -

Page 15

... a component of Accrued expenses and other liabilities or Deferred credits and other liabilities on our Consolidated balance sheets, depending on the expected timing of payment. Other ANNUAL REPORT Gain on transfer of Japan substitutional pension During the third quarter of 2012, we transferred the... -

Page 16

... semiconductor manufacturing facilities in Japan. Our manufacturing site in Miho suffered substantial damage during the earthquake, our facility in Aizu experienced significantly less damage and our site in Hiji was undamaged. We maintain earthquake insurance policies in Japan for limited coverage... -

Page 17

... to change the dividend in the near term. The fair value per share of RSUs that we grant is determined based on the closing price of our common stock on the date of grant. Our employee stock purchase plan is a discount-purchase plan and consequently the Black-Scholes option-pricing model is not used... -

Page 18

... unissued common shares of 4,593 in 2012; 73,852 in 2011, with none in 2010. Shares available for future grant and reserved for issuance are summarized below: As of December 31, 2012 Long-term Incentive and Director Employee Stock Compensation Plans Purchase Plan ANNUAL REPORT Shares Reserved for... -

Page 19

...subsidiary or company-wide financial metrics. We pay profit sharing benefits primarily under the company-wide TI Employee Profit Sharing Plan. This plan provides for profit sharing to be paid based solely on TI's operating margin for the full calendar year. Under this plan, TI must achieve a minimum... -

Page 20

... associated with its hypothetical calculation. Cash payments made for income taxes, net of refunds, were $171 million, $902 million and $1.47 billion for the years ended December 31, 2012, 2011 and 2010, respectively. ANNUAL REPORT 18 • 2 0 1 2 A N N U A L R E P O R T TEXAS INSTRUMENTS -

Page 21

..., the years open to audit represent the years still open under the statute of limitations. With respect to major jurisdictions outside the U.S., our subsidiaries are no longer subject to income tax audits for years before 2005. TEXAS INSTRUMENTS 2012 ANNUAL REPORT • 19 ANNUAL REPORT -

Page 22

... and Write-offs, Net Balance at End of Year Accounts receivable allowances 2012 ...2011 ...2010 ... $19 18 23 $12 1 (4) $- - (1) $31 19 18 9. Valuation of debt and equity investments and certain liabilities Debt and equity investments We classify our investments as available for sale, trading... -

Page 23

... securities classified as available for sale at December 31, 2012: Due Fair Value One year or less ...$ 3,343 One to three years ...400 ANNUAL REPORT Gross realized gains and losses from sales of long-term investments were not significant for 2012, 2011 or 2010. Other-than-temporary declines and... -

Page 24

...not include cash on hand, assets held by our postretirement plans, or assets and liabilities that are measured at historical cost or any basis other than fair value. Fair Value December 31, 2012 Level 1 Level 2 Level 3 Assets Money market funds ...Corporate obligations ...U.S. Government agency and... -

Page 25

... in discounted cash flow models to calculate the fair value of each reporting unit. These unobservable inputs are considered Level 3 measurements. In November 2012, as a result of unsuccessful efforts to divest certain product lines in the Wireless business and the subsequent decision to restructure... -

Page 26

...11. Postretirement benefit plans Plan descriptions We have various employee retirement plans including defined benefit, defined contribution and retiree health care benefit plans. For qualifying employees, we offer deferred compensation arrangements. As a part of the National acquisition, we assumed... -

Page 27

...balance sheets Expense related to defined benefit and retiree health care benefit plans was as follows: U.S. Defined Benefit 2012 2011 2010 U.S. Retiree Health Care 2012 2011 2010 Non-U.S. Defined Benefit 2012 2011 2010 Service cost ...Interest cost ...Expected return on plan assets ...Amortization... -

Page 28

...on the balance sheet as of December 31, 2012, were as follows: U.S. Defined Benefit U.S. Retiree Health Care Non-U.S. Defined Benefit Total Overfunded retirement plans ...Accrued expenses and other liabilities . Underfunded retirement plans ...Funded status (FVPA - BO) at end of year ANNUAL REPORT... -

Page 29

... benefit plan Money market collective trusts ...U.S. Government agency and Treasury securities U.S. bond funds ...U.S. equity funds and option collars ...International equity funds ...Limited partnerships ...Total ...Assets of U.S. retiree health care plan Money market collective trusts ...U.S. bond... -

Page 30

... caused by discount rate volatility. For the U.S. plans, we utilize an option collar strategy to reduce the volatility of returns on investments in U.S. equity funds. The only Level 3 assets in our worldwide benefit plans are certain private equity limited partnerships in our U.S. pension plan and... -

Page 31

...U.S. Retiree Health Care 2012 2011 Non-U.S. Defined Benefit 2012 2011 Asset category Equity securities ...Fixed income securities ...Cash equivalents ... 2012 2011 31% 58% 11% 35% 63% 2% 51% 40% 9% 48% 41% 11% 36% 58% 6% 32% 66% 2% TEXAS INSTRUMENTS 2012 ANNUAL REPORT • 29 ANNUAL REPORT... -

Page 32

... allocation ranges due to cash funding late in the year. None of the plan assets related to the defined benefit pension plans and retiree health care benefit plan are directly invested in TI common stock. As of December 31, 2012, we do not expect to return any of the plans' assets to TI in the next... -

Page 33

... accounted for as operating leases. Lease agreements frequently include purchase and renewal provisions and require us to pay taxes, insurance and maintenance costs. Rental and lease expense incurred was $124 million, $109 million and $100 million in 2012, 2011 and 2010, respectively. ANNUAL REPORT... -

Page 34

.... 14. Stockholders' equity ANNUAL REPORT We are authorized to issue 10,000,000 shares of preferred stock. No preferred stock is currently outstanding. Treasury shares acquired in connection with the board-authorized stock repurchase program in 2012, 2011 and 2010 were 59,757,780 shares, 59,466,168... -

Page 35

... Unrealized losses on available-for-sale investments Postretirement benefit plans: Net actuarial loss ...Net prior service credit ...Cash flow hedge derivative ...Total ...$ 2012 2011 - $ (3) (701) 7 (5) $ (699) (780) 9 (2) $ (776) ANNUAL REPORT TEXAS INSTRUMENTS 2012 ANNUAL REPORT • 33 -

Page 36

... related to National are also recorded in Other in 2012 and 2011, as detailed in Note 2. Restructuring charges related to the 2011 announced action in Hiji, Japan, and Houston, Texas; losses and insurance proceeds associated with the 2011 earthquake in Japan; and the 2012 gain on the transfer of the... -

Page 37

... from products shipped into China (including Hong Kong) was $5.38 billion in 2012, $5.83 billion in 2011 and $5.69 billion in 2010. Major customer No customer accounts for 10 percent or more of 2012 revenue. Sales to the Nokia group of companies, including sales to indirect contract manufacturers... -

Page 38

... balance sheets of Texas Instruments Incorporated and subsidiaries (the Company) as of December 31, 2012 and 2011, and the related consolidated statements of income, comprehensive income, stockholders' equity, and cash flows for each of the three years in the period ended December 31, 2012... -

Page 39

... based on the COSO criteria. TI's independent registered public accounting firm, Ernst & Young LLP, has issued an audit report on the effectiveness of our internal control over financial reporting, which immediately follows this report. TEXAS INSTRUMENTS 2012 ANNUAL REPORT • 37 ANNUAL REPORT -

Page 40

...income, stockholders' equity, and cash flows for each of the three years in the period ended December 31, 2012, and our report dated February 22, 2013, expressed an unqualified opinion thereon. ANNUAL REPORT Dallas, Texas February 22, 2013 38 • 2 0 1 2 A N N U A L R E P O R T TEXAS INSTRUMENTS -

Page 41

... ... $3,414 495 819 1,800 $3,256 816 644 1,973 $3,820 1,199 592 2,454 $2,643 753 567 954 $3,330 763 537 2,122 ANNUAL REPORT See Notes to financial statements and Management's discussion and analysis of financial condition and results of operations. TEXAS INSTRUMENTS 2012 ANNUAL REPORT • 39 -

Page 42

... portfolio of thousands of products is marketed to many different customers who use them in manufacturing a wide range of products sold in many end markets. SVA products generally have long life cycles, often more than 10 years. 40 • 2 0 1 2 A N N U A L R E P O R T TEXAS INSTRUMENTS ANNUAL REPORT -

Page 43

... wafer form, as well as higher finished-goods inventory of low-volume products, allowing greater flexibility in periods of high demand. We also have consignment inventory programs in place for our largest customers and some distributors. TEXAS INSTRUMENTS 2012 ANNUAL REPORT • 41 ANNUAL REPORT -

Page 44

..., equipment than is needed for manufacturing advanced CMOS logic products, such as our Wireless products. We own and operate semiconductor manufacturing facilities in North America, Asia, Japan and Europe. These include both wafer fabrication and assembly/test facilities. Our facilities require... -

Page 45

... charges related to the National acquisition were $450 million in 2012 and $315 million in 2011. The increase was due to a full year of amortization of acquired intangible assets. See Notes 2 and 10 to the financial statements for details. ANNUAL REPORT TEXAS INSTRUMENTS 2012 ANNUAL REPORT • 43 -

Page 46

... Wireless segment, partially offset by a $144 million gain we recognized from the transfer of the obligations and assets of a portion of our Japan pension program from the pension trust to the government of Japan. See Note 3 to the financial statements for details. Operating profit was $1.97 billion... -

Page 47

... mix of DLP products shipped. Revenue from calculators and royalties also declined. The decrease was partially offset by business interruption insurance proceeds resulting from the 2011 Japan earthquake and increased revenue from custom ASIC products. Operating profit for 2012 from Other was... -

Page 48

... expenses. Lower gross profit was primarily due to lower factory utilization and the effect of the mix of products, which contributed about equally to the change. ANNUAL REPORT Wireless 2011 2010 Change Revenue ...Operating profit...Operating profit % of revenue Restructuring charges/other... -

Page 49

... 2011 to close certain manufacturing facilities in Texas and Japan; and the net losses associated with the Japan earthquake. Financial condition At the end of 2012, total cash (Cash and cash equivalents plus Short-term investments) was $3.96 billion, an increase of $1.03 billion from the end of 2011... -

Page 50

...in 2011, reflecting increases in the dividend rate in each year. In September 2012, we announced a 24 percent increase in our quarterly cash dividend. The quarterly dividend increased from $0.17 to $0.21 per share, resulting in an annualized dividend payment of $0.84 per share. We used $1.80 billion... -

Page 51

... customer or distributor pulls product from consignment inventory that we store at designated locations. We reduce revenue based on estimates of future credits to be granted to customers. Credits include volume-based incentives, other special pricing arrangements and product returns due to quality... -

Page 52

...goodwill. Upon the conclusion of the measurement period, any subsequent adjustments will be recorded to our Consolidated statements of income. The measurement period for the National acquisition concluded on December 31, 2011. ANNUAL REPORT 50 • 2 0 1 2 A N N U A L R E P O R T TEXAS INSTRUMENTS -

Page 53

... to be other-than-temporary are expensed in net income. Investments in the remaining venture capital funds are stated using the equity method. See Note 9 to the financial statements for details of equity and other long-term investments. TEXAS INSTRUMENTS 2012 ANNUAL REPORT • 51 ANNUAL REPORT -

Page 54

... ... ... . $ ...$ 2 - 2 - $ $ 13 - 13 - $ 154 7 147 $ - $ 256 103 153 $ 112 (a) See Note 2 to the financial statements for additional information. (b) See Note 3 to the financial statements for additional information. ANNUAL REPORT 52 • 2 0 1 2 A N N U A L R E P O R T TEXAS INSTRUMENTS -

Page 55

... stock is listed on The NASDAQ Global Select Market. The table below shows the high and low closing prices of TI common stock as reported by Bloomberg L.P. and the dividends paid per common share for each quarter during the past two years. Quarter 1st 2nd 3rd 4th Stock prices: 2012 High Low 2011... -

Page 56

...the฀locations฀in฀which฀TI,฀its฀customers฀or฀its฀suppliers฀operate Availability฀and฀cost฀of฀raw฀materials,฀utilities,฀manufacturing฀equipment,฀third-party฀manufacturing฀services฀and฀ manufacturing technology Changes฀in฀the฀tax฀rate฀applicable... -

Page 57

...'s annual report to the Securities and Exchange Commission on Form 10-K (except for exhibits) and its audited ï¬nancial statements without charge by writing to: Investor Relations P.O. Box 660199, MS 8657 Dallas, TX 75266-0199 DLP, OMAP and the platform bar are trademarks of Texas Instruments... -

Page 58

Texas Instruments Incorporated P.O. Box 660199 Dallas, TX 75266-0199 www.ti.com An equal opportunity employer © 2013 Texas Instruments Incorporated TI-30001N