Tesco 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 Tesco PLC

Notes to the financial statements continued

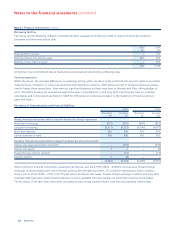

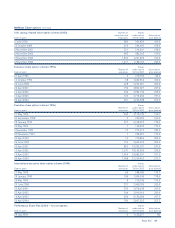

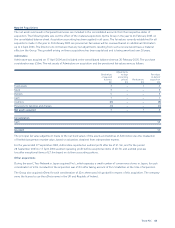

Note 32 Reconciliation of operating profit to net cash inflow from operating activities

2005 2004

£m £m

Operating profit 1,949 1,735

Depreciation and goodwill amortisation 795 752

Additional pension contribution (200) –

Increase in goods held for resale (67) (92)

Decrease in development property –15

(Increase)/decrease in debtors (48) 17

Increase in trade creditors 337 261

Increase in other creditors 238 254

Decrease in working capital (a) 460 455

Net cash inflow from operating activities (b) 3,004 2,942

(a) The decrease in working capital includes the impact of translating foreign currency working capital movements

at average exchange rates rather than year end exchange rates.

(b) The subsidiaries acquired during the year have not had a significant impact on Group operating cash flows.

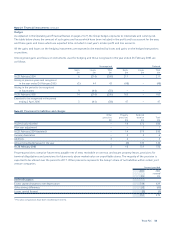

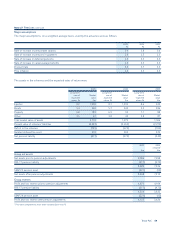

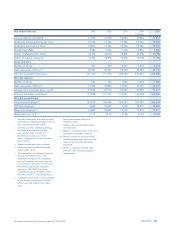

Note 33 Analysis of changes in net debt

At 28 Feb Other non- Exchange At 26 Feb

2004 Cash flow cash changes Acquisitions movements 2005

£m £m £m £m £m £m

Cash at bank and in hand 670 121 – – 9 800

Liquid resources (a) 430 (97) – – 13 346

Bank and other loans (775) 348 (14) (15) (15) (471)

Finance leases (69) 63–––(6)

Debt due within one year (844) 411 (14) (15) (15) (477)

Bank and other loans (4,180) (330) (19) (2) 45 (4,486)

Finance leases (166) 157 (16) – – (25)

Debt due after one year (4,346) (173) (35) (2) 45 (4,511)

(4,090) 262 (49) (17) 52 (3,842)

(a) Liquid resources comprises short-term deposits with banks and money-market investments which mature within 12 months of the date of inception.